简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Prices Rebound on Weaker USD, Crude Oil Holds Breath for OPEC+ Meeting

Abstract:Gold Prices Rebound on Weaker USD, Crude Oil Holds Breath for OPEC+ Meeting

Gold prices extended higher after President Joe Biden announced a smaller-than-expected infrastructure plan

Crude oil prices awaited fresh catalysts from the OPEC+ policy meeting after falling 3.8% over the past two sessions

Fridays US nonfarm payrolls data will be closely watched by traders for clues about the direction of the US Dollar

Gold prices traded modestly higher during Thursday‘s APAC morning session after rebounding 1.32% a day ago. Prices returned to above a psychological level at $1,700 as the DXY US Dollar index retreated from a four-month high. This could be attributed to a smaller-than-expected infrastructure plan announced by President Joe Biden, who aims to revamp America’s infrastructure facilities, create millions of jobs and tackle climate changes with the proposal. Yet the $2.25 trillion spending package came below market expectation of $3-4 trillion, resulting in some unwinding activity.

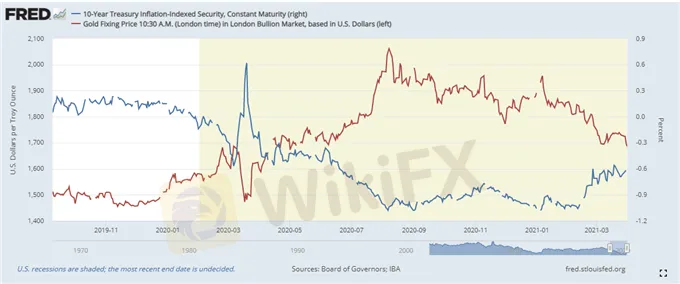

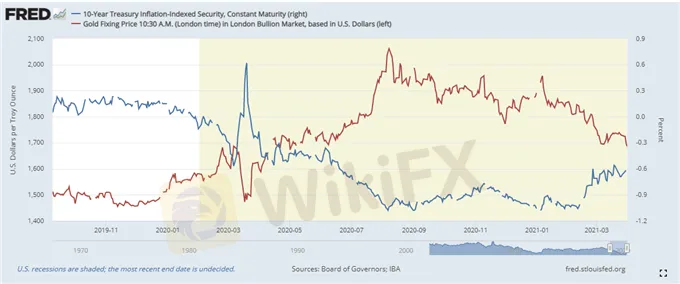

A weaker US Dollar provided bullion with some temporary relief, but this may not change its medium-term bearish trajectory as the longer-term Treasury yields continues to march higher on reflation optimism. The heavily watched 10-year rate hovered near its 14-month high of 1.744%, exerting downward pressure on precious metal prices. The real yield, as represented by the 10-year Treasury inflation-indexed security, climbed to -0.63% from -0.70% a week ago. A rising real yield may weigh on gold prices despite a temporary retreat in the Greenback.

Gold Prices vs. 10-year Treasury Inflation-indexed Security

Source: FRED

Friday‘s US nonfarm payrolls report will be closely watched by traders for clues about the health of the labor market and its ramification for the Fed’s interest rate path. Volatility could be exacerbated by thinner trading volume as many markets are shut for the Good Friday holiday. Prior to this, ADP private payrolls added 517k new jobs in March, the most seen since September 2020, but still fell below the consensus forecast of 550k. If the nonfarm payrolls number fails to meet an estimation of 647k, this could lead to a deeper pullback in the US Dollar and buoy bullion prices. The opposite may happen if the actual number beats.

Crude oil prices were little-changed during Thursday‘s APAC trading session after falling over 3.8% over the prior two sessions. Prices were facing a couple of headwinds, including a larger-than-expected build in API crude inventories, a revision down of this year’s oil demand outlook by OPEC+, and the lingering impact of a third viral wave in Europe. Against this backdrop, market participants are expecting OPEC+ to roll over its current production cut through May to stabilize prices.

The energy demand outlook appears to be tarnished by renewed wave of lockdowns in Europe and rising Covid-19 infections in India and Brazil. The Canadian province of Ontario will be put under lockdown restrictions for 28 days, marking the latest restrictive measure carried out by a major economy to curb the spread of coronavirus.

Gold Price Technical Analysis

Gold prices rebounded from a key support level at US$ 1,676 and extended slightly higher. The primary trend remains bearish-biased however, as suggested by the downward-sloped 50- and 100-day SMA lines, although the 20-day SMA seems to be flattening. Gold prices have also broken the minor “Ascending Channel” earlier this week, suggesting that bears are still in control. The MACD indicator is probably going to form a bearish crossover beneath the neutral midpoint, underpinning downward momentum.

Gold Price – Daily Chart

Crude Oil Price Technical Analysis

WTI retreated from the 200% Fibonacci extension level of 66.50 and entered a technical correction. Prices appeared to be hesitant to decide a near-term direction as traders await policy guidance from OPEC+. A daily close below the 50-day SMA (59.67) would likely intensify near-term selling pressure and carve a path for price to test a key support level at 58.29 (the 127.2% Fibonacci extension). The MACD indicator has formed a bearish cross over and trended lower since, underscoring bearish momentum.

Crude Oil Price – Daily Chart

Chart by TradingView

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

North Korean Hackers Steal $1.3bn in Cryptocurrency in 2024

Currency Calculator