简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

7 Illusions That Kill Traders When Trading

Abstract:7 Illusions That Kill Traders When Trading

In reality: The more you want to get rich, the faster you lose money.

You want to get rich quick, don‘t you? Go to the nearest bank. Point the gun to the banker’s head. Collect as much money as you can. And leave as quickly as possible.

The market is not the place where the money is printed. Thats where the money goes from one hand to another. This is the rule of every market you may know including Forex, Stocks, Cryptos, Gold, etc. So if you want to make money, then surely some individuals or some organizations will lose money.

Imagine this. A lot of “wolves” are standing in the market. They are stalking you with a hungry stomach. And you, like a naive “deer” with many dreams, enter the market. The “wolves” will find a way to get closer to you. Just neglect for a moment, very quickly, you will become a hearty meal for the wolves.

The market has always been rude. It is not a place for dreamers. More precisely, it is a burial ground for all those who are greedy, lack of patience, and knowledge. So, let go of the thought of making money and getting rich. You need to learn to survive and adapt, to “survive” to make money.

In reality: You just need to overcome your feelings.

The market is still the same. Knowledge is still the same. Only your feelings are always changing. Do you know what determines success in Forex trading? I will split the ratio as follows:

· Trading strategy: 20%

· Good trading skills: 10%

· Capital management: 10%

· Emotion management: 60%.

This means, if you can win over your feelings (successfully throw emotions into the trash), you have up to 60% chance of success in trading. Candlestick charts have their own charms. It will make you quickly forget about the strategies, the skills you have learned. After the first few trading orders, you gradually lose your mind. You let your emotions make a decision. And finally, you get screwed up!

A good trading strategy alone doesnt get you anywhere. Your issue is to follow the same strategy hundreds or thousands of times. You can understand it simply as follows: If you have proven your trading strategy has a high probability of winning, then you just need to follow it and do nothing more or less.

But as I said above, after a few transactions, your emotions would change. If you win, you become greedy. You want the game to go faster. You want to make more money by trading faster. If you lose, you feel uncomfortable and impatient. You try to rush into the market to get your lost money back. Thats the real game. Emotions change and you lose it all.

So, what you need is not a strategy, but a way for you to control your own ego.

In reality: Trading is like doing an addition only.

To me, its as simple as this:

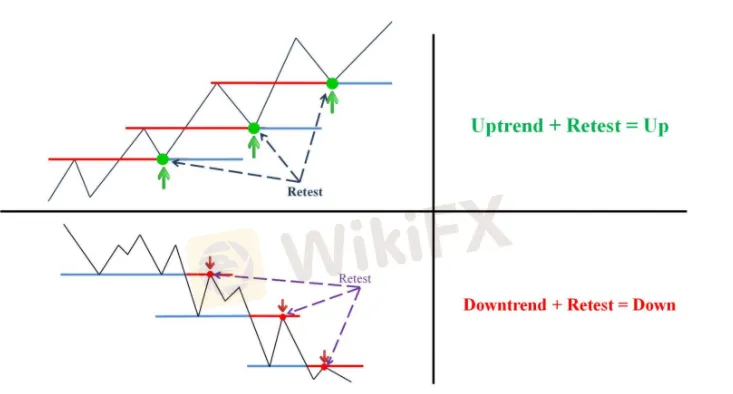

Uptrend + Retest= UP orders.

Downtrend + Retest= DOWN orders.

Trading is like an addition.

Just like that, I have made money from market. Of course, its my strategy. You need time to consult, experiment, learn from experience, and come up with a strategy for you.

Knowing too much is also a trap. More knowledge > Lots of trading signals (You will see entry points everywhere)> Open more orders> Lose more.

This is why I only focus on the trend and look for the signals (Signal, Retest) to enter a trade. The simpler it is, the more effective it becomes. The easier it is to practice and verify, the safer it brings. Therefore, dont give yourself too much knowledge. Learn to practice, learn to be patient in each transaction.

In reality: Everything will be gambling only if you allow it to.

A trader and a gambler are only one step apart called emotion. When a trader let emotion take control and “devour” his/her own reason, he/she is exactly a gambler.

Fixed Time Trade and Forex are gambling.

Do you remember the only way to make money in the market? Only trade with high winning probability which you are willing to trade with your own money.

You can understand it simply as follows: A real trader sees trading as a profession to make money. They learn how to trade, how to read the market. They practice their skills, and most importantly, learn to control emotions. And eventually, they risk their money with the best possible chance.

What if a trader puts all of the above aside? Thats right! Right now, they look like a real gambler. They hope for luck.

So, gambling or trading is up to you. Trading with a “brain”, you are a trader. On the contrary, trading and hoping for luck, you are the gambler.

In reality: The market is always right.

Trade with what you see in the market. If you see an uptrend, focus on finding the entry points for UP orders. If you see a downtrend, your job is to prepare for a DOWN order.

We have too many lessons from those trying to go against the trend, predicting the top and bottom of the market.

· That is the lesson of peaked gold in the last days of July 2020. All those who forecasted the peak of gold prices have lost.

· Looking further, we have a lesson about oil prices. Oil price dropped to 0USD, then to -5USD, and eventually stopped at -40USD. And of course, those who predicted the bottom of the oil price have lost all their money.

The market is always going further than we think. Dont try to predict the top or bottom because no one can do it. Either you respect the main trend of the market, or you stay out of the game and do nothing.

In reality: If everything is so easy, anyone can become a billionaire.

IB (Introducing Broker) is considered a broker to introduce you to the platforms. You can understand IB simply as a salesperson (looking for customers) for the trading platform. At the same time, they also advise and guide their customers to trade.

A signal room is 1 place that offers signals for you to trade. This means: You will join a certain chat room. Here, there will be a person or an organization offering signals. Your job is to follow those signals to enter a trade.

Perhaps your question would be: Why are IBs equipped with so much knowledge not making money from the platform but having to promote sales? Or the question: If the signal room is so effective, why do people sell it to you without making money and getting rich by themselves?

Answers: They cannot make money from the market. So they make money from you.

Please remember this: IBs or signal room owners are just human beings with emotions. They have nothing more than you. And if they are able to make money from the market, Forex, or Fixed Time Trade, they wont spend their time on you. Because they are busy enriching themselves.

Illusion 7: The guys who teach you about the holy grail in tradingIn reality: Their holy grail is to collect money from teaching.

You want to surely make money from Forex, Fixed Time Trade, or any other exchanges. Lets teach.

What is teaching? It is to teach the beginners or the losing traders how to make money from the market and collect their fees. Simple as that!

All those who teach trading or strategies, etc. cant make money from the market. Why? Forex is a game of emotions. Fixed Time Trade is also a game of emotions. All you know about the market is a game of emotions. Therefore, no one can teach you except for yourself. It is you who can control your emotions. It is you who decide the success or failure of this game.

One last wordEither you throw your emotions in the trash, or you die. All illusions come from your inner feelings. Use a “rational” mind to consider things and make trading decisions.

-----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience! https://bit.ly/2XhbYt5

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator