简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Most Dangerous Time to Trade

Abstract:The Most Dangerous Time to Trade

Have you ever noticed that after a solid winning trade you often lose money on the next one? Well, it may be something you can prevent, at least sometimes. You see, after a winner, there is emotion that can cause traders to want to jump back into the market without a signal being present.

False-confidence and even addiction to the euphoria and the ‘high’ you get from winning are things that can end your trading career just as its starting to take off. After winners, we may literally invent or see patterns on the charts that are not even there; we convince ourselves into jumping back in the market, subconsciously.

Before we proceed, let me be clear, you cannot avoid all losing trades, sometimes they are just normal statistical occurrences of your trading edge. What we are talking about here are the losers that you can prevent; the ones born of emotion, fueled by brain chemistry that you are probably unaware of and that you need a planned-out course of action to deal with…

Why we tend to lose after winning

Right after a winning trade is indeed the most dangerous time to trade. Whilst that may seem surprising to some of you, it has a scientific basis that we need to understand…

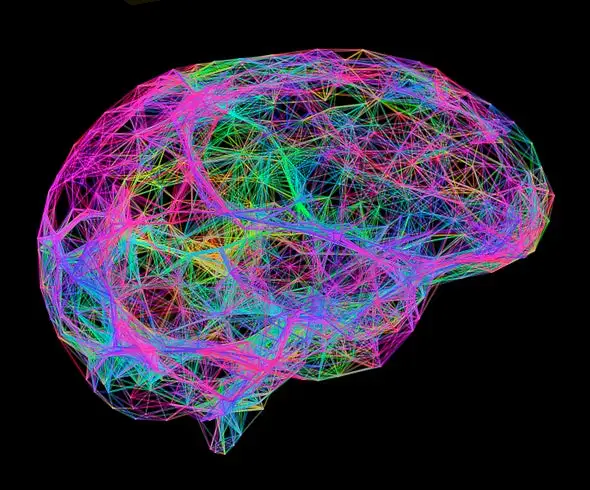

After a winning trade, we feel good, there is no denying that and you cannot stop it, and why would you want to, right? However, this euphoric feeling can lead to disaster of you are not aware of it and how to deal with how it makes you feel. Dopamine is the feel-good chemical released in your brain (learn about dopamine here) when something happens that makes you happy, like a winning trade. The danger comes in the form of addiction. You can become addicted to the feeling you get from dopamine.

For a trader, this means after a winner we are more likely to over-trade and do something stupid with our trading platform because our brains are subconsciously looking to keep the dopamine high going. When riding a dopamine high after a winning trade, our brains naturally perceive less risk in the market and that can cause us to deviate from our trading strategy.

Our brains will do anything to keep feeling that happy feeling from fading. Ironically, as with any other form of addiction, like drugs, gambling, etc., dopamine gets released whether or not what you‘re doing is good for you or your body. The very act of entering a trade, an event that previously made you money and made you happy, will release more dopamine in your brain, thus keeping the ’high going. I hope you can see how dangerous this is and how it can cause losing streaks that lead to account blow-outs.

So, the brain will get what it wants, whether you win or lose, and as traders, we need to be aware of this genetic ‘flaw’. Dopamine is truly a double-edged sword that can either reinforce good habits or reinforce bad habits. It is up to you to understand this and make sure you are only reinforcing the good ones. You must understand your own mind and control it so that it does not control you in negative ways.

Solutions

So, now that you know why it‘s so easy to lose money shortly after winning, it’s time to figure out how you will avoid this major pitfall in the future. The trick is to have some type of filter in place to catch yourself from making an emotion-fueled / dopamine-fueled trade. Whilst it may sound cliché to once again talk about trading plans, their importance in this matter cannot be over-stated.

The solution to this mistake is to ensure youre only subjecting yourself to your edge, which needs to be a well-defined trading edge (for example price action trading is my edge). You need to build and follow a trading plan so that you are not simply entering on random whims of confidence or because you think a chart is about to do something. In essence, we just need to understand our brain chemistry and learn that by filtering and following our plan we can hopefully be in a scenario where these releases of feel-good chemicals, like dopamine, are not causing us to become addicted to the feeling of simply being in a trade.

Summary of solutions to battle the tendency to over-trade after winners:

You have an actual trading strategy / trading edge that you fully understand and can define.

You have a trading plan built around the above strategy.

Make sure you only subject yourself to your edge, which should be well-defined and in your plan.

Your trading plan should act as a ‘filter’ of sorts – something you always run any trade through so that you can separate those trades that are dopamine-fueled ‘mistakes’ from the ones that are legitimate occurrences of your edge.

Conclusion

The best way to avoid giving back trading profits is by making sure you have no doubt about what youre looking for as you scan the charts each day. When you reach a point of having mastered your trading strategy, you only need to build a trading plan around it and stick to it, to filter out the emotion-based trades that traders often make.

------------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience! https://bit.ly/2XhbYt5

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator