简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a Forex Spread in Trading (Part 1)

Abstract:Spread is one of the basic terms of forex trading and investing.

Spread is one of the basic terms of forex trading and investing. It should not be an unknown term for you if you want to trade currencies and generally make an investment in the stock market.

In this article we will see :

- What is the Spread in Trading ?

- How to measure the spread on Forex ?

- The best indicator : MetaTrader Spread

- Why the Spread is important for your Trade profitability

Forex spread - Definition

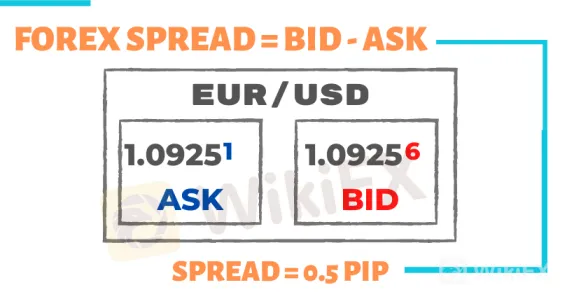

On the stock and the forex market, spread is the difference between purchase and sale price. It is the difference between the bid and ask price.

Once the position is opened, the spread no longer varies because it is already paid.

From an online broker's perspective, spread is one of its main sources of income, along with the commissions and swap fees. A spread can be fixed or variable, most online brokers provide variable spreads.

Example : Spreads at the Broker Admiral Markets

- CAC40 : 0.8 pips

- DAX30 : 0.8 pips

- EUR/USD : 0.8 pips

- SP500 : 0.4 pips

- NQ100 : 0.8 pips

- GOLD : 20 pips

How we can measure the spread in Finance

The difference between the buy and sell price is measured in pips or points. In the currency market, the period is the fourth digit after the decimal point in an exchange rate. Consider our example : the Euro/Dollar (EUR/USD) rate at 1.1234 / 1.1235. The difference between supply and demand is 0.0001. This is the equivalent of saying the spread is one point one to one pip.

The stock market spread is also the difference between the bid and ask price of a security.

The amount of the spread varies for each broker and depending on the volatility and volumes traded on an instrument. The most traded currency pair is the Euro/Dollar (EUR/USD) and generally the lowest spread is found on this pair. The spread can be fixed or variable and it is proportional to the volume placed on the market.

At first, brokers will often collect the spread when the position is opened. Thats why your position is initially negative on the trading platform. This is a very easy way to see how much the brokerage fees are.

Each online broker publishes the typical spreads provided on the Contract Specifications page.

(To be continued...)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Can someone earn $1 million at once on forex trading? If yes, how can this be done?

In conclusion, while it is theoretically possible to make $1 million at once in forex trading, achieving such a remarkable feat requires exceptional expertise, meticulous risk management, and a deep understanding of the complexities of the market. Aspiring traders should approach forex trading with rational expectations, a focus on continuous improvement, and an emphasis on preserving capital as the foundation for long-term success in this dynamic and challenging market.

Type of Accounts Offered by Giraffe Markets

Each type of account is tailored to meet the diverse needs and preferences of traders, ensuring that there's an option suitable for every level of expertise and trading style with Giraffe Markets.

Commodity Trading for Beginners: A Comprehensive Guide

At Giraffe Markets, we provide the tools and resources to help you confidently navigate the commodity markets. Whether you're interested in trading gold, oil, or agricultural products, our platform offers a seamless experience for new and experienced traders.

Giraffe Markets Introducing Broker (IB) Program Feature List

The Giraffe Markets Introducing Broker (IB) Program offers a rewarding and supportive partnership opportunity for individuals and organizations looking to grow their business in the financial markets. With competitive commissions, advanced tools, and dedicated support, Giraffe Markets is committed to empowering its IB partners for success.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

Currency Calculator