简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Life After London: Covid-Era Exodus Isnt Just for the Wealthy

Abstract:When Prime Minister Boris Johnson advocates narrowing the gap between London and the rest of England -- what he calls “leveling up” -- this probably isnt what he has in mind.

When Prime Minister Boris Johnson advocates narrowing the gap between London and the rest of England -- what he calls “leveling up” -- this probably isnt what he has in mind.

A rush to escape the city is pushing rents in London and the rest of the country in opposite directions at the fastest pace in at least five years. As Covid misery lingers, rents in the capital fell 4.4% year-on-year in November, while they jumped 5.6% in the rest of the U.K., according to HomeLet, a rental-service company.

“It isnt just the rich -- what we have been seeing recently is that the less affluent areas are being snapped up and property prices rising disproportionate to what normally the prices and rents are,” said Mark Kaczmarek, a member of the Cornwall county council, a famously scenic tourist destination in the southwest. Rents in the region are rising at almost 9%, according to HomeLet.

The resulting pressure on residents and services is familiar to anyone in a major metropolitan area but not so much in more rural or suburban districts. “It is a form of gentrification,” said Yolande Barnes, a researcher at University College London. “When you‘re talking about regeneration and leveling up, it’s generally at some point seen as a good thing.” But economic gains can come at the expense of housing affordability for locals, she said.

St Ives in Cornwall.

Photographer: Matt Cardy/Getty Images

British politicians, economists and researchers have long puzzled over how to bridge the gap between the rest of the U.K. and London, where centrally located studio apartments still list for sale above $1 million and the average rent of 1,576 pounds ($2,106) is 62% higher than the national average.

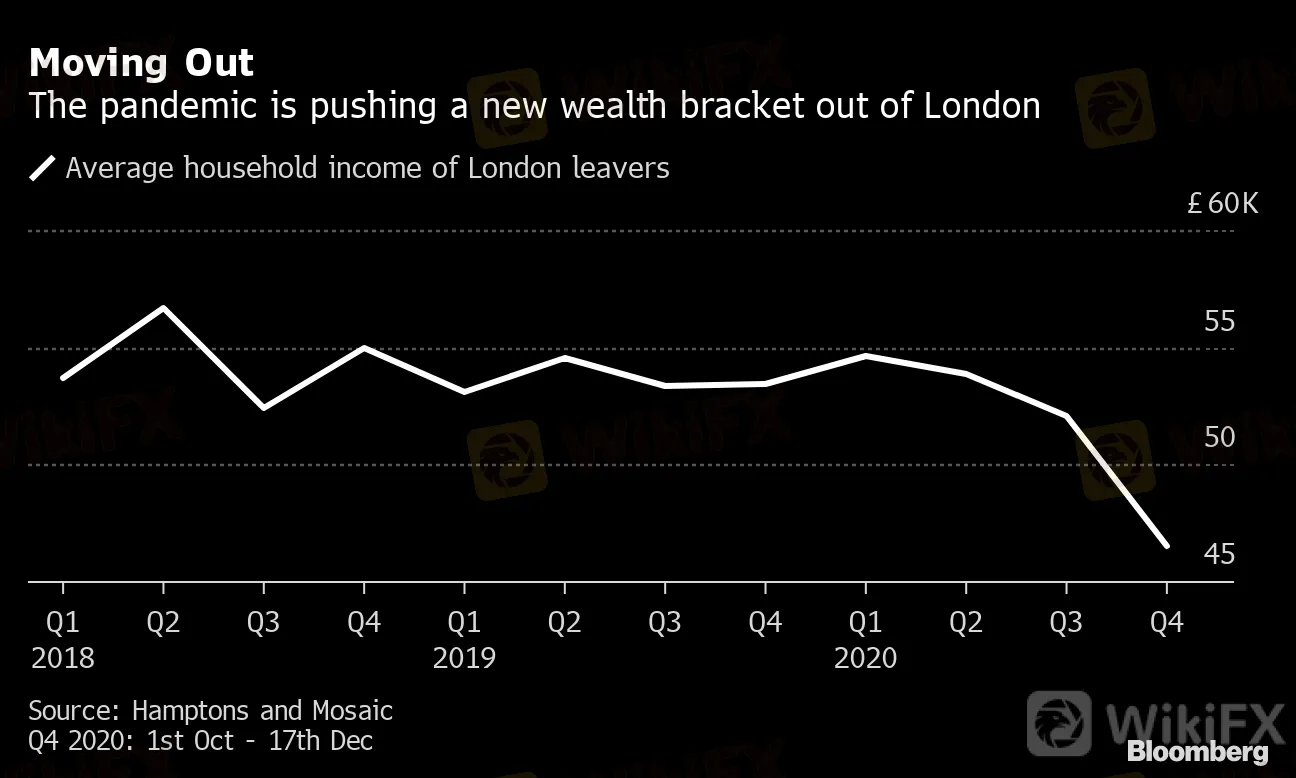

Moving Out

The pandemic is pushing a new wealth bracket out of London

Source: Hamptons and Mosaic

Q4 2020: 1st Oct - 17th Dec

Housing affordability has been a problem for Londoners for years, but especially since the boom last decade. Although a Londoners median household income is about 14% higher than the U.K. average, that gap shrinks to 1% after housing costs, according to the independant Institute for Fiscal Studies. The average income of home buyers leaving London fell below 50,000 pounds this quarter for the first time, according to realtors Hamptons International.

For Kay-Dene Petgrave, Covid-19 was the final straw. The 27-year-old trainee lawyer has moved to the suburbs: Redhill, a commuter town in Surrey.

“I don‘t think I’d ever want to move back to London,” she says. She now pays about 300 pounds less to rent a one-bedroom home than she would spend for a smaller place in London, not to mention the little things: a cupboard big enough to fit a vacuum cleaner, and a living room where she can set up a home office.

The commuter town of Redhill in Surrey.

Photographer: Steve Parsons/PA/Getty Images

“I‘m trying to convince people to move out, like let’s all just rebuild somewhere else,” she said. Her mother has decided to follow suit, selling her home in South London to move closer to her daughter, while her brother has also moved nearby.

The housing slump in the capital may prove to be more than a blip. While expectations for higher rents remain positive across most of the country, London is a “clear exception,” according to a poll from the Royal Institution of Chartered Surveyors. Across the capital, the majority of respondents think rents will decline further in the coming three months.

Miles Apart

London leavers are wreaking havoc with the nation's rental market

Source: HomeLet

The dynamic could give a boost to metro areas looking to bolster their local economies. Take Sheffield, once an industrial power that had its heyday almost 200 years ago.

Sophie Smedley, who works in marketing, fled London in March and returned to her hometown to stay in a friend‘s spare room. Nine months on, she’s renting a one-bedroom apartment a short drive from the rolling hills of the Peak District for about 120 pounds less than she paid to share a flat in London. She has no intention of returning anytime soon.

Residential property for sale in south London in November.

The move “made me more feel more calm and collected,” the 23-year-old said on the phone. “Before, I was crouched over a dining room table on a little stool in a shared dining space. Going to having a big window with a view of trees definitely helps.”

With London enduring another harsh lockdown, even a little schadenfreude is creeping into the conversation.

Petgrave went shopping in London the last Saturday before Christmas -- and the lockdown -- and “it was extremely busy, you had people walking into you, it was awful.”

“Then I came back into Redhill, and it was a completely different atmosphere,” she said. “Its just a lot more comforting.”

— With assistance by Lucy Meakin

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator