简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Why Indian Market Is Becoming Bullish?

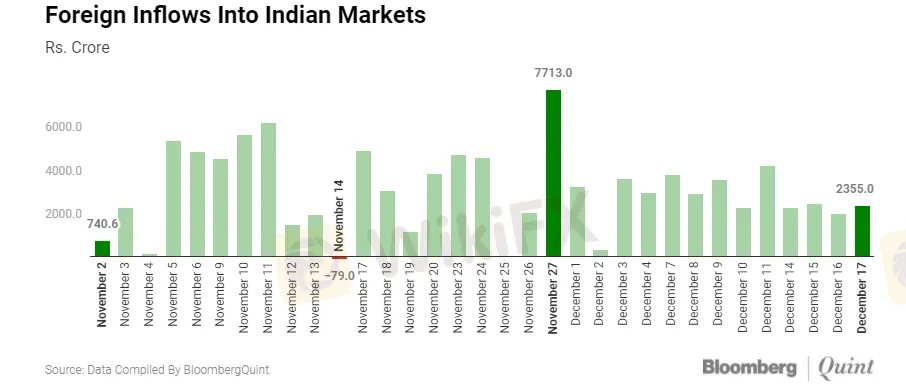

Abstract:According to the data from NSE, foreign investors have poured over Rs 1.01 lakh crore into the Indian equity markets since the beginning of November.

According to the data from NSE, foreign investors have poured over Rs 1.01 lakh crore into the Indian equity markets since the beginning of November.

Foreign investors are driving the Indian equity markets to new heights

A combination of low interest rates in the US and the weak dollar has led to inflows into emerging markets like India.

Low-interest rates mean the returns on US Treasurys are subdued and hence foreign investors prefer Indian markets, where the return could be relatively higher. Driven by the inflow from foreign players, the Indian equity markets have continued to hit new heights.

What else is contributing to the bullish market in India?

Besides the foreign investor inflows, the rally is also attributed to the good corporate earnings season and trends from the festive season.

Even the big global firms like Morgan Stanley and Goldman Sachs have turned bullish on India, citing factors such as accommodative monetary policy, government spending, and peaking out of Covid-19 infections.

Pay attention to potential risks

But there are also a lot of factors that could prick the pricey bubble of Indian markets. Inflation is still a bone of contention and could hurt the Indian central banks attempts to keep the rates low. At the same time, the recovery in demand has been slow with the imports and credit growth showing signs of weakness.

As a leading media in the forex industry, WikiFX offers overall information of global forex brokers, and provides educational content to help people become profitable traders. Download and review more than 23,800 brokers on the WikiFX App: https://bit.ly/wikifxIN

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Column: The time of Mutable Madness

Weekly Column: The time of Mutable Madness

The Philippines Closes Financial Market Due to the Pandemic

March 16th at night, the Philippine Securities Exchange made an announcement to temporarily halt trading of stocks, securities and currencies starting from March 17th until further notice, making the Philippines the first country to shut financial market under the impact of the global coronavirus outbreak.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator