简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Double Doji Strategy: Allow Profits of Hundreds of Pips

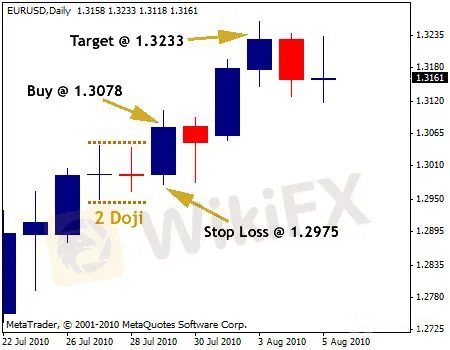

Abstract:When two dojis form one after one on the charts, traders can consider the Double Doji Forex Breakout Trading Strategy.

WikiFX Analysis (22 Dec.) -When two dojis form one after one on the charts, traders can consider the Double Doji Forex Breakout Trading Strategy. Learn more about best trading strategies on WikiFX bit.ly/wikifxIN

The doji is one of the most popular candlestick patterns, which reveals indecision in the market. It suggests that neither buyers nor sellers are in control and that price is about to break in either direction. It doesnt matter whether the market is going to go up or down at this point because a clear trend will emerge afterwards. Whichever way it goes, the thing you need to do is place pending buy stop and sell stop orders on both sides to capture the breakout.

Timeframe: 4 hours; Currency pairs: any; Candlestick pattern: doji; Forex indicators: none

Trading Rules

1. Watch until you spot 2 consecutive doji candlesticks on the charts;

2. Mark the high and low of the doji borders;

3. Wait for the third candlestick to close;

4. If the third candlestick closes above the upper border, buy at market and place your stop loss 2-3 pips below the low that you marked, or you can place it 2-3 pips below the low of the third candlestick.

5. If the third candlestick closes below the lower border, sell at market and place your stop loss 2-3 pips above the high that your marked, or you can place it 2-3 pips above the high of the third candlestick;

6. In terms of profit target, you can use previous swing highs for buy orders and swing lows for sell orders, or you can target three times what your risked.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Countertrend Strategy: Become Wealthy by Taking Risks!

Originating from market cycles, a countertrend idea refers to seizing the opportunity of entering the market before its reversal.

A Collection of Trading Strategies & Tactics

Similar to war, trading involves several tactics. Here are some of them that traders must learn.

How long experts think US economy will take to recover after reopening - Business Insider

We looked at analyst reports from major banks and government organizations for estimates of when the recovery might happen. None say this year.

Staying on task while working from home amid the coronavirus pandemic - Business Insider

Simple things like taking enough breaks and making my bed every morning have put me in a better headspace to work remotely during the pandemic.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator