简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Rs 70,986 cr: Nov registers highest-ever FPI flows

Abstract:The domestic equity markets have seen an unprecedented liquidity gush, underpinned by the weakening of the dollar and aggressive monetary and fiscal stimulus undertaken by global authorities.

The domestic equity markets have seen an unprecedented liquidity gush, underpinned by the weakening of the dollar and aggressive monetary and fiscal stimulus undertaken by global authorities.

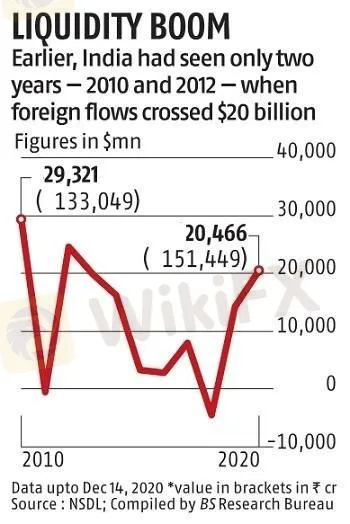

Investments by foreign portfolio investors (FPIs) have topped the $20 billion mark -- the most since 2012 in dollar terms.

Previously, India has had only two years -- 2010 and 2012 -- when foreign inflows have been greater than $20 billion.

In local currency terms, at Rs 1.5 trillion, overseas investment into equities has surpassed the previous high of Rs 1.33 trillion in 2010.

Interestingly, over $14 billion has flown into domestic stocks since November, propelling the markets by 18 per cent.

The increase in the pace of foreign inflows has coincided with the US election results and talks among US congressional leaders for another stimulus deal.

Also, the rapid progress on the COVID-19 vaccine froraised hopes of the economy returning to normalcy by the middle of next year.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator