简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Visit to Forex Broker Bell Potter in Australia

Abstract:According to the address listed in the regulatory information, the investigator went to Collins Street in Melbourne, one of the top ten streets in the world.

Broker profile

Full name: Bell Potter Securities Limited

Website: www.bellpotter.com.au/

Address: Lewis M Bell, Level 29, 101 Collins Street Melbourne VIC 3000

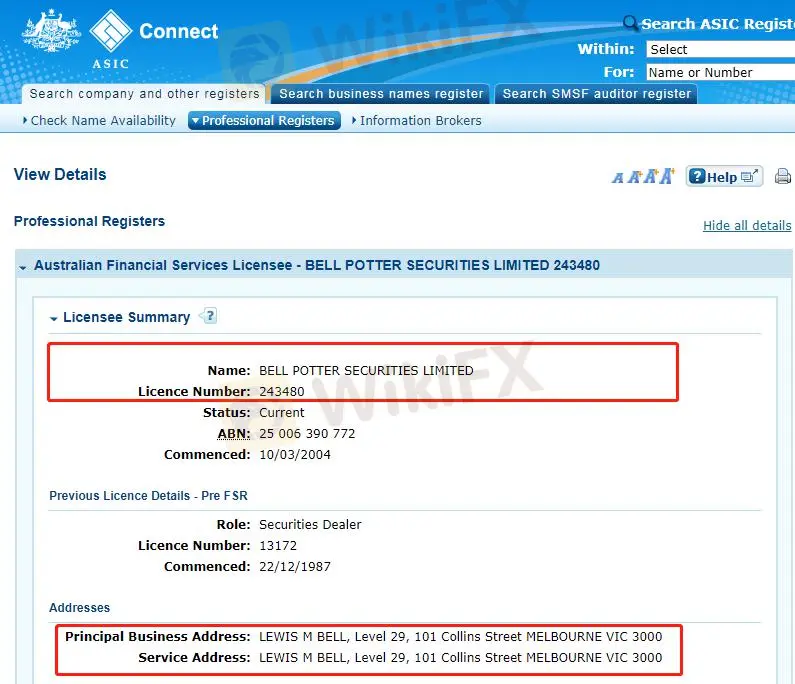

Bell Potters regulatory information on the ASIC

Survey process

According to the address listed in the regulatory information, the investigator went to Collins Street in Melbourne, one of the top ten streets in the world. Collins Street, located in the central CBD, is Melbourne's financial and business center. It is also the home to the head offices of Australia's major banks, the Australian Stock Exchange, and many financial investment companies.

Collins Street

After reaching the No. 101 Collins Street, the investigator found it a skyscraper that was 57 stories high. The building was clad in gray granite with dazzling buttresses. It was where Bell Potter, the destination of this visit, was located.

The registration of personal information was required after entering the building. While waiting, the investigator observed that the building was luxuriously decorated, which gave an upscale and welcoming impression. After completing the registration, the investigator learned from the floor directory beside the reception that Bell Potter's office was on Level 29.

The interior of the building

The investigator took the elevator to Level 29 and learned from the sign on the wall of the corridor that Bell Potter Financial Group, Bell Potter Securities, and Bell Potter Capital all had offices here.

Level 29

Sign board of Bell Potters office

Walking along the sign board, the investigator found that the entire floor belonged to the broker. Through the transparent glass door, a light spacious office area entered the sight. There were exquisite artworks displaying in the reception area. All these details showed the brokers strength and style.

The office of Bell Potter

Conclusion

It is confirmed after the site visit that the business address of the Australian licensed broker Bell Potter is in line with that on the regulatory information. Bell Potter has been rated 8.16 on the WikiFX APP and is currently under valid supervision with the MM license issued by the Australian Securities and Investments Commission (ASIC).

BP Prime has been rated 8.16 on the WikiFX App

So far, WikiFX App has included profiles of more than 23,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, and protecting investors fund safety in forex trading. For more details, please click here to download the WikiFX App: linkage

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator