简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Low Rates Push Risky Bond Sales by Korean Banks to a Record

Abstract:South Korean lenders are selling record amounts of risky bonds to boost capital buffers as low interest rates prompt them to expand beyond their core businesses.

South Korean lenders are selling record amounts of risky bonds to boost capital buffers as low interest rates prompt them to expand beyond their core businesses.

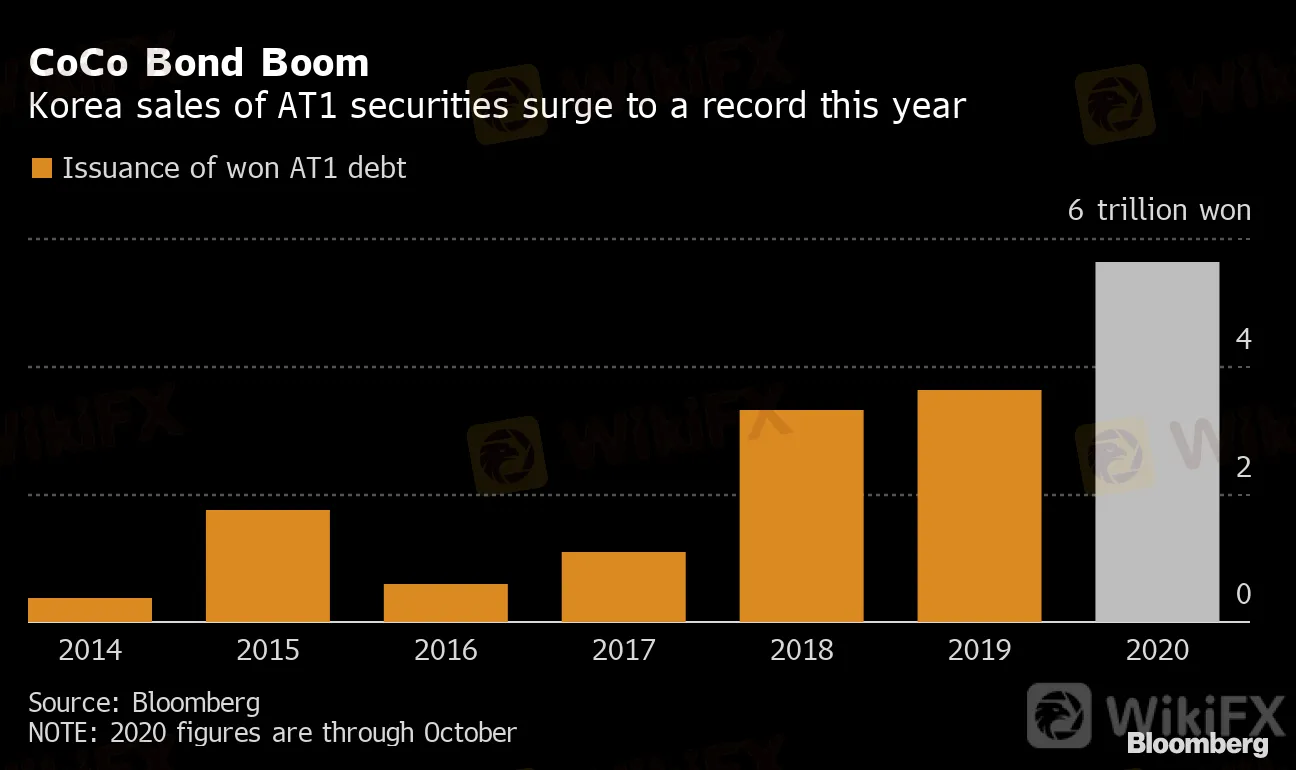

Issuance of additional Tier 1 notes by Korean banks and financial holding companies in the domestic market has surged 50% this year to an all-time high 5.3 trillion won ($4.7 billion), Bloomberg-compiled data show. That adds to a boom in such sales globally in recent months as the pandemic prompts lenders to build up reserves. A drop in Treasury yields amid the U.S. election uncertainty may fuel even more demand.

The so-called contingent convertible bonds, or CoCos, count as capital and carry the risk of being written off first by a lender should its balance sheet deteriorate to a point of non-viability.

CoCo Bond Boom

{9}

Korea sales of AT1 securities surge to a record this year

{9}

Source: Bloomberg

NOTE: 2020 figures are through October

The Bank of Korea‘s rate cuts to a record low have prompted lenders to rush to find new revenue sources that don’t rely on interest income. Woori Financial Group Inc. bought a consumer finance firm, Aju Capital, last month, while Shinhan Bank purchased investment company Neoplux Co. in September. In April, KB Financial Group Inc. acquired Prudential Financial Inc.s South Korean life insurance business in a $1.9 billion deal.

“Lenders want to secure sufficient capital to continue to acquire non-bank businesses,” like insurance, securities and leasing, said Han Gwangyeol, a Seoul-based credit analyst at NH Investment & Securities Co. “Plus, investor demand for higher-yielding debt is solid and interest rates are low. Why wouldnt they sell CoCos?”

See also: Korea Won Credit to Rally as U.S. Vote Intensifies Yield Hunt

Shinhan Bank priced AT1 bonds at 2.87% recently, about 1.4 percentage points higher than yields on similarly rated corporate debt. Faced with strong investor demand, the lender raised its issue size by 100 billion won to 300 billion won. KB Financial also increased the size of its AT1 debt deal by 200 billion won last month to 500 billion won.

(Adds link to story on the outlook for Korean credit.)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator