简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Election Years See Weak U.S. Stocks in October| Influencer Forex Analysis•Jasper Lo

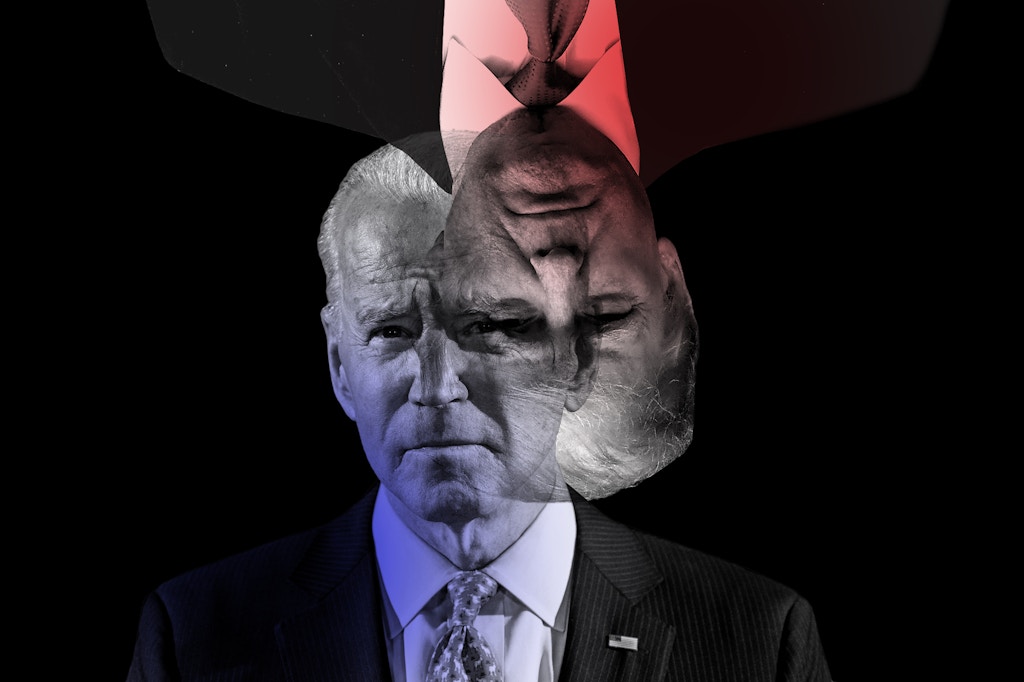

Abstract:Since the Democratic candidate Biden was reported to be involved in a scandal, he has not yet given a press conference to clarify what happened. Implicated by the scandal, Biden’s approval rating has lost large ground in the latest polls, with his lead over Trump narrowing by just seven percentage points.

Since the Democratic candidate Biden was reported to be involved in a scandal, he has not yet given a press conference to clarify what happened. Implicated by the scandal, Biden‘s approval rating has lost large ground in the latest polls, with his lead over Trump narrowing by just seven percentage points. With only two weeks left before election day, it is possible for Biden to see a defeat in the election and even be prosecuted unless he can take the situation under control and dispel voters’ doubts. This situation will send additional uncertainty to the presidential election and unsettle investors, drastically shocking U.S. stocks.

The analysis that U.S. stocks will gain more if Trump turns the table is prevailing financial markets, which is mainly based on the speculation that Biden has a good chance of significantly raising capital gains tax rates after coming to power. According to Biden's platform, he will increase the tax rate on capital gains to 39.6% from 20% for taxpayers earning more than $1 million annually. As a result, investors tend to be bearish on U.S. stocks if Biden wins out, considering Trump has been playing a positive role in stimulating the stock market. The concerns of financial markets come not only the presidential election but also the full control of Congress. Before the scandal revealed, polls had been showing that the Democrats could both regain power in the White House and take control of Congress. Now that Biden has been involved in the scandal, it is estimated that Trump will win the re-election, but the Democrats will take charge of the House and Senate. In this case, Trump will find the next four years extremely difficult.

Since the situation now is complicated and possible results are various, investors may either exit the market temporarily, waiting for more details, or deploy hedging strategies in advance. Previous statistics show that U.S. stocks see rise more often than fall in election years, but the past four election years (2016, 2012, 2008, and 2004) all witnessed an overall drop in U.S. stocks in October. Specifically, the stocks dwindled widely even in the second half of October, indicating investors of these years did not deploy their trades until the election results came in. Looking ahead, if the U.S. stocks continue to retreat in the next two weeks, the DXY and the Japanese yen will embrace gains, but gold will struggle in playing the role of a safe haven, considering the market performance since March that gold prices keep mirroring stock prices.

Notably, the negotiations between the EU and the UK are teetering on the brink, which may hamper the prices of GBP and EUR and put a premium on the greenback. This week, Trump and Biden will face off again on the morning of October 23 (Friday, GMT+8), and all eyes will be on whether Trump can make use of the scandal to turn the tide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

22 things you need to know as a Beginner in the Forex Market| Influencer Forex Analysis•Bola Akinya

Forex trading has caused large losses to many inexperienced and undisciplined traders over the years. You need not be one of the losers. Here are twenty forex trading tips that you can use to avoid disasters and maximize your potential in the currency exchange market.

Two Concerns Non-Negligible After Thanksgiving| Influencer Forex Analysis•Jasper Lo

It is reported that the US Food and Drug Administration has scheduled a meeting of its Vaccines and Related Biological Products Advisory Committee on Dec. 10 to discuss the request for emergency use authorization of a Covid-19 vaccine from Pfizer. If nothing else, an approval would immediately allow the first Americans to get a vaccine on Dec. 11.

Inevitable Flaws Hidden in Demo Account

There are some disadvantages of virtual accounts during forex trading. If these drawbacks are ignored by traders, they may experience unexpected losses even in real trading.

Trading at the Right Time

The most obvious difference between the forex market and other trading markets is the constant trading hours and the unconstrained trading places. Trading at the right time helps generate a great profit.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator