简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OPEC+ Vows ‘Proactive’ Response to Precarious Oil Market

Abstract:The OPEC+ alliance warned of a “precarious” outlook as a resurgent pandemic hurts oil demand, dropping further hints about a potential change of policy next month.

The OPEC+ alliance warned of a “precarious” outlook as a resurgent pandemic hurts oil demand, dropping further hints about a potential change of policy next month.

Alexander Novak

Without tipping their hand, Saudi Arabia and Russia showed their unity, with their top oil officials, Prince Abdulaziz bin Salman and Alexander Novak, offering bearish views of the oil market. The Saudi minister warned of an “uncertain” outlook for oil demand and called on OPEC+ to be “proactive.”

“We know for certain its uncertain,” he said as a steering group of OPEC+ ministers gathered virtually to analyze the market before a full meeting on Nov. 30-Dec. 1. “We have to be able to take measures to head off negative trends and developments -- to nip them in the bud.”

Crucially, the panel didnt discuss if OPEC+ should press on with plans to taper output cuts next year, delegates said. It can change course if needed, something it did earlier this year when the alliance delayed an output increase by one month. Oil prices were steady below $43 a barrel in London after the officials spoke on Monday -- suggesting the market is already expecting the cartel to revise its plans.

Read: OPEC+ Faces More Pressure to Change Course as Ministers Meet

石油危机的深渊如此频繁的电话 的国家是压力,以防止价格暴跌,震撼业界耳的重复下今年IER。这种流行病在世界和OPEC构件利比亚许多地方再次涌动也提高产量。

'艰难恢复'

“我们看到的复苏是多么困难,我们看到很多在回来的全球石油需求的金融危机前的水平的方式,得到了不确定性,”诺瓦克在他在OPEC +部长级联合开场白监测委员会说。需求恢复“趋缓在一片第二冠状波,但它未完全停止。”

王子阿齐兹·萨勒曼

摄影师:西蒙道森/彭博

阿卜杜勒阿齐兹亲王上个月坚持石油输出国组织组织及其盟友将稳定市场,敢于石油投机者,以测试他的决心。他重申,确定在星期一。

通过坚持该基团应是预防,沙特部长 - 前美联储主席格林斯潘的崇拜者 - 似乎正在从中央银行,一些货币当局宁愿选择在经济衰退期间做的不是太少太多的一侧世界的提示。阿卜杜勒阿齐兹亲王似乎表明之多。

{} 28 “我不能强调足够强烈它是多么重要的是表明我们的决心的实力,”他说。 “没有人在市场上应该是有疑问,我们的承诺,我们的意图,”他补充说。 {} 28

{16}

Saudi Arabia and Russia stepped up diplomacy in the lead up to Monday‘s meeting, with President Vladimir Putin and Crown Prince Mohammed Bin Salman speaking twice by phone in a week. It was the first time the nations’ leaders have had such frequent calls since the depths of the oil crisis in April, when they were hashing out a deal to cut supply and bring the price war to an end.

{16}{17}

The countries are under pressure to prevent a repeat of the price slump that shook the industry earlier this year. The pandemic is surging again in many parts of the world and OPEC member Libya is also boosting production.

{17}{18}

‘Difficult Recovery’

{18}{19}

“We see how difficult the recovery is, we see a lot of uncertainties that get in the way of coming back to the pre-crisis levels of the global oil demand,” Novak said in his opening remarks at the OPEC+ Joint Ministerial Monitoring Committee. The demand recovery “has slowed down amid the second coronavirus wave, but it hasnt stopped altogether.”

{19}

{21}

Prince Abdulaziz bin Salman

{21}

{777}

Photographer: Simon Dawson/Bloomberg

{777}

{25}

Prince Abdulaziz last month insisted the Organization of Petroleum Exporting Countries and its allies will stabilize the market and dared oil speculators to test his resolve. He reiterated that determination on Monday.

{25}

{27}

By insisting that the group should be preventive, the Saudi minister -- an admirer of former Federal Reserve Chairman Alan Greenspan -- seemed to be taking a cue from the world of central banking, where some monetary authorities prefer to err on the side of doing too much than too little during a recession. Prince Abdulaziz appeared to suggest as much.

{27}{28}

“I cannot emphasize strongly enough how vital it is to show the strength of our resolve,” he said. “Nobody in the market should be in any doubt as to our commitment and our intent,” he added.

{28}

{30}

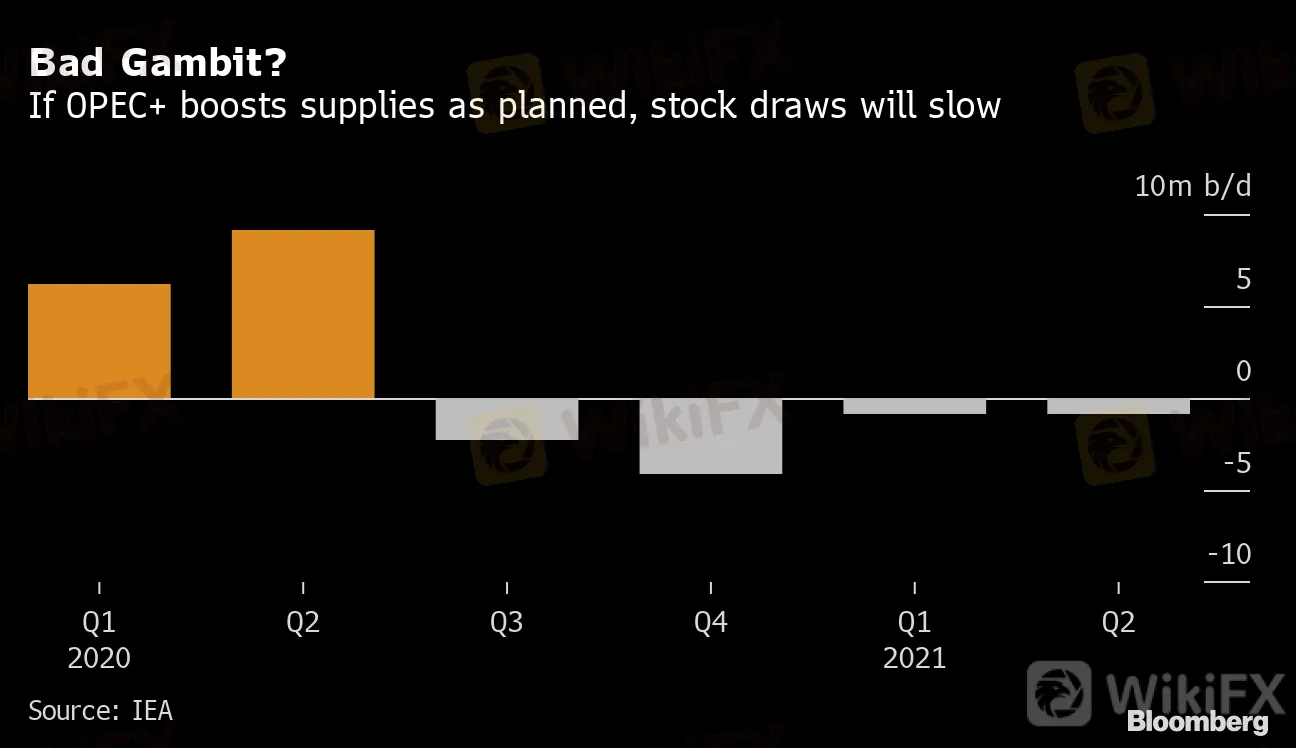

Bad Gambit?

{30}

If OPEC+ boosts supplies as planned, stock draws will slow

Source: IEA

OPEC+ is facing a slowdown in demand. Consumption isnt likely to return to prior levels for at least a couple of years, particularly for jet fuel, trading houses like Vitol Group and Trafigura Group predict. OPEC+ also needs to keep whittling away global stockpiles to avoid another glut and a plunge in prices.

If the group “adds production as scheduled in January, then we will not draw crude stocks anymore,” Torbjorn Tornqvist, chief executive officer of trading house Gunvor Group Ltd., said in an interview.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator