简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ECB Must Limit Emergency Powers to Temporary Crises, Mersch Says

Abstract:SHARE THIS ARTICLE ShareTweetPostEmail Yves Mersch Photographer: Alessia Pierdomenico/Bloomberg Ph

The European Central Bank risks legal trouble if it tries to extend the “emergency powers” of its pandemic bond-buying plan to its other asset-purchase program, according to Executive Board member Yves Mersch.

The 1.35 trillion-euro ($1.6 trillion) measure “has been created first and foremost to be a backstop,” Mersch, the ECB‘s longest-serving policy maker, said in an interview at the institution’s Frankfurt headquarters on Monday.

“We have always said it is linked to the assessment of the Governing Council on how long this pandemic is affecting us,” he said. “So we cannot say the pandemic is over but we continue with the pandemic program, or we transfer the pandemic program features into the asset-purchase program. To my humble understanding of what the law means, this would be very curious.”

The comments offer a glimpse into potentially contentious arguments ahead. Mersch, a lawyer by training, is responsible for the ECB‘s legal services. He has also been at the center of decisions since the single currency’s birth, as head of Luxembourg‘s central bank from 1998 and then on the ECB’s six-member board from 2012. Hell step down in December.

Policy makers already had a legal scare this year when Germanys top court criticized the way they deployed their 2015 asset-purchase program, which is still running.

The pandemic tool, launched in March, is even more powerful. It can skew asset purchases toward stressed economies such as Italy because it is exempt from limits that aim to prevent monetary financing -- the funding of governments by the central bank -- which would be illegal.

Read More: Race to Join Lagardes Team at Top of ECB Officially Kicks Off

The Financial Times reported this week that a review of the emergency measure has started, and that some Governing Council members want to consider extending such flexibility to the older program.

Mersch, 70, said he was “not aware of such a development” and it could be problematic.

“Its always easier to govern if you have emergency powers and you prolong the emergency powers forever,” he added. “We have disenfranchised ourselves from a certain number of self-imposed constraints in view of the pandemic and in view of its exceptional nature and threat -- and that means it must be temporary.”

Economic Outlook

{18}

Most economists and investors expect the pandemic program to be expanded again at Decembers policy meeting, as economic growth slows and virus infections mount. Mersch -- long seen as a relatively hawkish policy maker -- said that decision will depend on the data, but so far the outlook is steady.

{18}

“Looking also at new incoming information, I think nothing is pointing to a further deterioration,” he said. “This is based on an assumption that things continue as they are right now, that there is no major deterioration on the health front.”

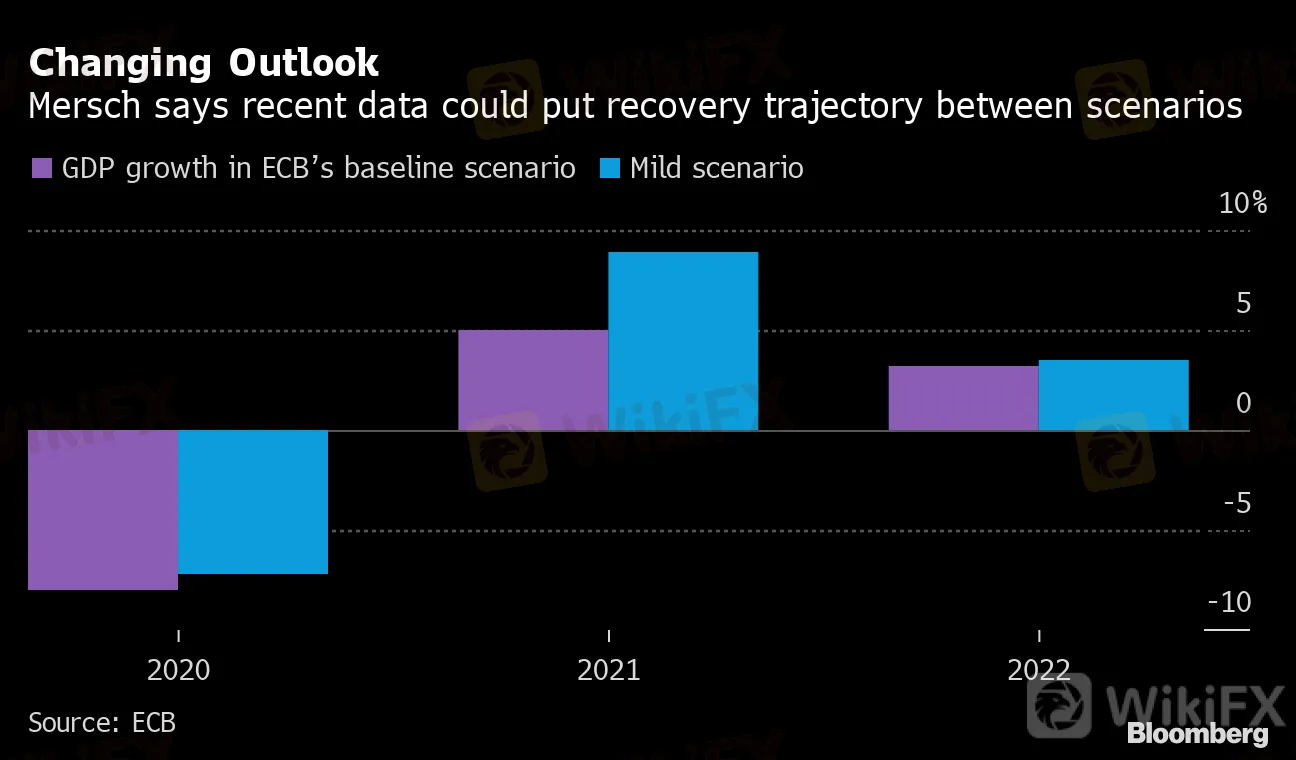

Changing Outlook

Mersch says recent data could put recovery trajectory between scenarios

Source: ECB

Mersch said the recovery‘s trajectory might lie somewhere in between the ECB’s baseline scenario for only a partial pickup next year and its milder scenario, which shows a full rebound in 2021, “maybe with chances to come out a bit closer” to the better outcome.

{28}

He also noted that while the ECB has largely described its bond-buying program and long-term bank loans as the most effective stimulus measures right now, “we have never said that the interest rate is no more at our disposal.”

{28}

A rate cut has been floated by some economists as a way to rein in the euro, which has jumped more than 10% against the dollar since March and weighed on inflation by lowering import costs.

What Bloombergs Economists Say

“With Covid-19 the biggest shock the union has faced, it should be a catalyst for change. Will a more resilient euro area come out the other side? Perhaps, but there are still big reasons to worry.”

-Jamie Rush, Maeva Cousin, David Powell. Read their EURO-AREA INSIGHT

Mersch stressed that the ECB doesnt target the exchange rate, but acknowledged it is “obvious” that it affects the measurement of inflation and must be monitored.

The euro‘s rise has been partly attributed to dollar weakness as a consequence of the Federal Reserve now targeting an average inflation rate of 2%, meaning it’ll probably keep U.S monetary policy lower for longer.

The ECB is reassessing its own goal of “below, but close to 2%” as part of a wide-ranging strategic review that should conclude around the middle of next year.

That will also include topics such as climate change that central bankers of Mersch‘s vintage have never had to grapple with. On Tuesday the ECB announced that it’ll accept bonds linked to environmental targets in its refinancing and purchase programs.

{38}

Mersch welcomed involvement in green initiatives, though again with a word of warning.

{38}

“It‘s a question of transition and a transition needs to be financed. It’s not all in the hands of central banks,” he said. “If we are pushing awareness thats already a big contribution. If in the end central bankers are perceived as politicians, that would not be helpful in my opinion.”

| Read more... |

|

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator