简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Holds Gloomy Outlook amid Price Crash

Abstract:On Monday, gold prices continued retreating in Asian markets while trimming early losses below $1,900 to $1,882 in U.S. markets.

WikiFX News (22 Sept.) - On Monday, gold prices continued retreating in Asian markets while trimming early losses below $1,900 to $1,882 in U.S. markets. The yellow metal may be hampered by the massive selling for its price is recently more sensitive to bad news than good news.

The University of Michigan said its U.S. consumer sentiment index in September rose to 78.9, the best level since March. The data indicates that consumers hold positive expectations about the country's economic prospects.

Kaplan, president of the Dallas Fed, predicted the U.S. will see an economic recovery next year and the unemployment will likely approach 3.5% by 2023. These hawkish words catalyzed the DXY up above $93.50.

Pressed by the strengthening greenback, the intraday price of gold kept declining after a rally to $1,955. Moreover, the Trump administration has softened its stance on Tiktok, which also weakened the markets' safe-haven demand for gold.

The Fed Chair Powell will testify before Congress this Wednesday and Thursday. He is generally considered to reiterate the views that economic prospects will rally and fiscal policy is of vital importance, which could further strengthen the U.S. dollar and send gold prices lower.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

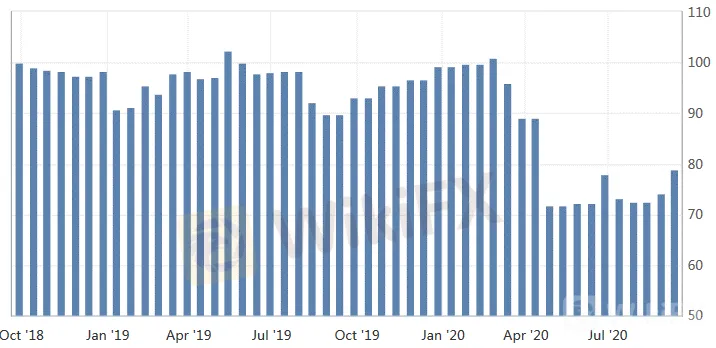

Chart: Consumer Sentiment Index

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Quadcode Markets: Trustworthy or Risky?

5 Questions to Ask Yourself Before Taking a Trade

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator