简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Malaysia Bonds Blow Past Peers as Rate Cuts Power Rally

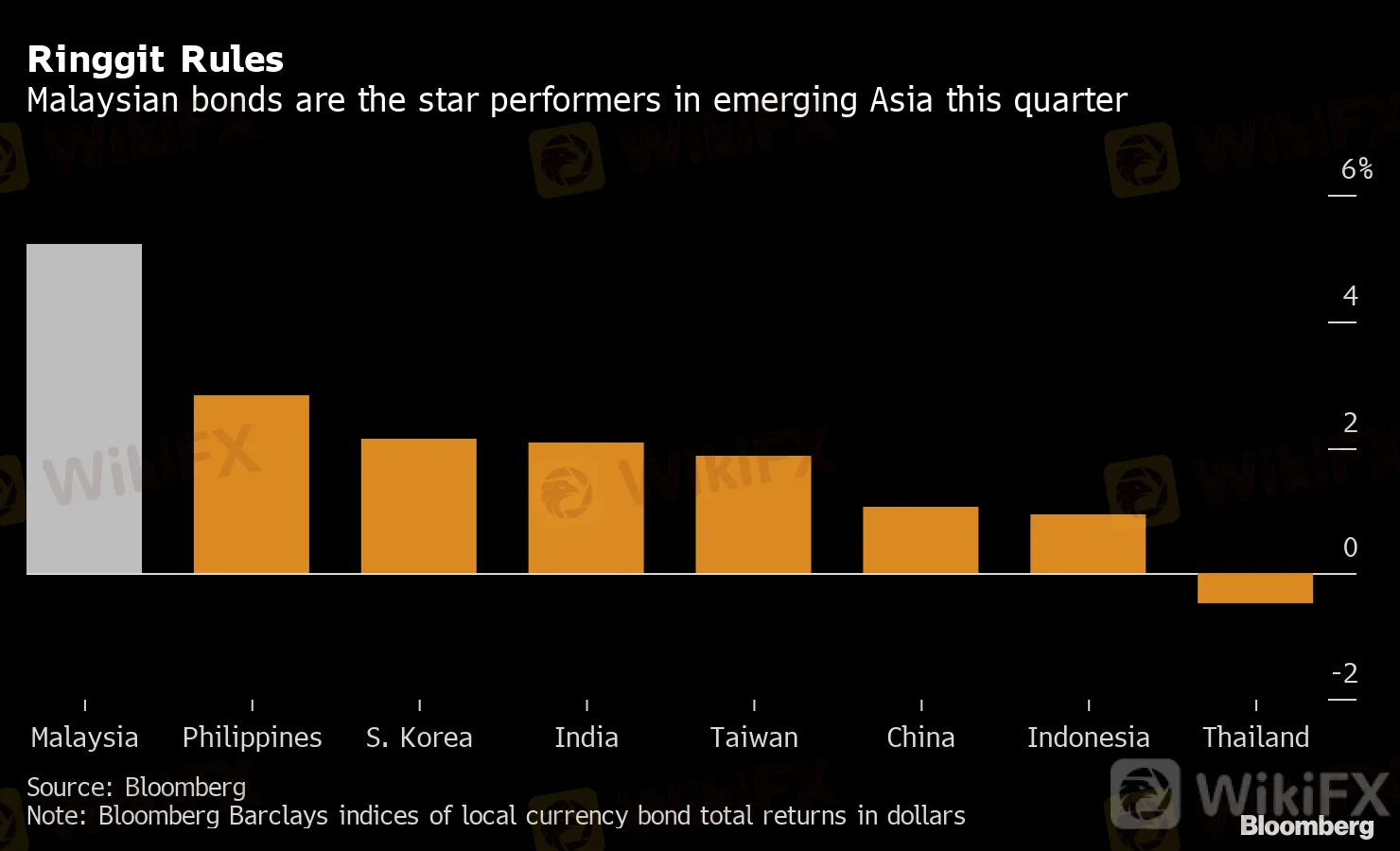

Abstract:Malaysias bonds have been the star performers in emerging Asia this quarter thanks to a succession of interest-rate cuts. Stubborn deflation means there may be more easing to come.

Malaysias bonds have been the star performers in emerging Asia this quarter thanks to a succession of interest-rate cuts. Stubborn deflation means there may be more easing to come.

Traders are betting Bank Negara Malaysia will lower borrowing costs for a fifth straight meeting in September after reducing its benchmark by a combined 125 basis points this year. Other positives powering the bond rally include a surge in foreign inflows and among the highest real yields in the region.

{13}

Ringgit Rules

{13}

Malaysian bonds are the star performers in emerging Asia this quarter

{16}

Source: Bloomberg

{16}

Note: Bloomberg Barclays indices of local currency bond total returns in dollars

{19}

“It‘s not clear that there is necessarily a hard floor for the policy rate in Malaysia,” said Brian Tan, regional economist at Barclays Bank in Singapore. “We expect second-quarter GDP to show a sharp contraction, emphasizing the need for further policy support, especially as the resurgence of Covid-19 in Malaysia’s key export markets such as the U.S. threatens to hamstring external demand.”

{19}

Ringgit government bonds have returned over 5% since the start of July, more than double that of their nearest competitors, the Philippines and South Korea. Malaysias benchmark three-year yields have fallen almost 40 basis points over the period after dropping by 75 basis points in the first half of the year.

This quarter‘s outperformance has been driven by the central bank’s July 7 meeting, when policy makers cut their benchmark by 25 basis points to a record-low 1.75% and warned of further downside risks to growth arising from the coronavirus pandemic. Three-year swap rates have fallen to around 10 basis points above the central banks benchmark, close to levels last seen ahead of policy decisions that led to a rate cut, indicating anticipation of more easing.

Read More: Malaysia Debt Limit Sparks Debate On Growth Versus Prudence

The economy is forecast to shrink 4% this year, according to a Bloomberg survey, which would be the worst result since the Asian financial crisis in 1998. Despite the bleak outlook, global funds have been pouring into Malaysias debt. Net foreign inflows totaled $4 billion in the three months through July, coming close to erasing the cumulative outflow of $4.7 billion in the previous three months that was caused by the Covid-19 outbreak.

{27}

One of the key attractions for overseas investors is the nation‘s relatively high real yields, which are being bumped up by a four-month bout of deflation. Malaysia’s 10-year bonds offer a current nominal yield of 2.49%, which translates into a real yield of 4.39% when the most recent CPI reading is taken into account.

{27}

“In a yield-starved environment, the high-yielding appeal of emerging Asia including ringgit bonds should continue to attract inflows, as long as the global risk sentiment remains conducive,” said Winson Phoon, head of fixed-income research at Maybank Kim Eng Securities in Singapore.

With the level of bond yields in many emerging markets closing in on record lows, holders of Malaysias debt can feel quite content. Expected foreign inflows and deflation are all positives, while the central bank looks set to provide the perfect backstop.

What to Watch

Thailand will release second-quarter GDP on Monday, which will give an insight into the full impact of the coronavirus lockdown

Bank Indonesia is scheduled to set its policy decision Wednesday, after cutting rates at its two previous meetings. Policy makers in the Philippines are forecast to keep rates on hold when they meet Thursday

Malaysia will publish headline inflation data on Friday, with the nation having experienced deflation every month since March

Note: Marcus Wong is an EM macro strategist who writes for Bloomberg. The observations he makes are his own and not intended as investment advice.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator