简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Egypt‘s Central Bank Extends Pause to Keep World’s Top Real Rate

Abstract:SHARE THIS ARTICLE ShareTweetPostEmailEgypt extended its interest-rate pause for a fifth month as t

SHARE THIS ARTICLE

Share

Tweet

Post

Egypt extended its interest-rate pause for a fifth month as the central bank waits to resume easing while capital inflows stabilize.

The Monetary Policy Committee held the deposit rate at 9.25% and the lending rate at 10.25% on Thursday, according to a statement. All but one of 12 economists surveyed by Bloomberg predicted the decision.

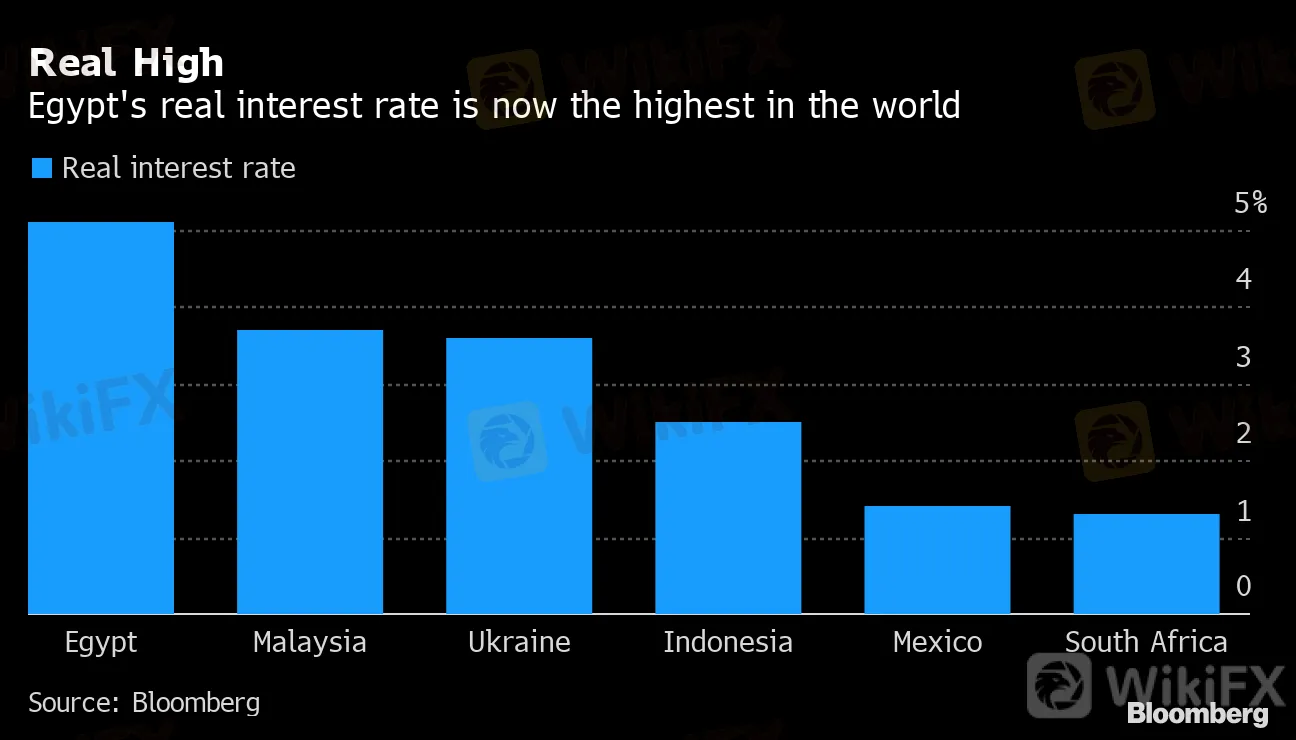

The central bank is treading carefully even after a slowdown in inflation to an eight-month low made Egypts key rate the highest among more than 50 major economies tracked by Bloomberg when adjusted for prices. It lowered borrowing costs a combined 450 basis points last year and delivered a record cut of 300 basis points at an emergency meeting in March.

Real High

Egypt's real interest rate is now the highest in the world

Source: Bloomberg

“While inflows have resumed back into the local Egyptian market in recent weeks, the international exogenous outlook remains uncertain,” said Paul Greer, a money manager in London at Fidelity International, which oversees $566 billion. “The central bank focus will remain on keeping the currency stable and maintaining a healthy and positive real policy rate.”

In its statement, the regulator said that “a number of leading indicators started showing signs of recovery in June and July” in tandem with “the easing of the containment measures.”

The central bank is also finding other ways to pump more money into the economy. In December, it introduced a 100-billion pound ($6.3 billion) initiative to enable industrial companies to borrow at a below-market rate of 8%. The program has grown to include other sectors and firms in the months after the coronavirus flared.

Egypts main sources of foreign currency-- tourism, remittances and Suez Canal receipts -- are under pressure from the disruptions caused by the coronavirus pandemic. Meanwhile the country also saw its biggest-ever capital outflows between March and May amid a global selloff.

Foreign investors began to come back in June after Egypt secured financing from the International Monetary Fund. Foreign holdings of local Treasury bills and bonds climbed to around $14 billion by the end of July from $10.6 billion a month earlier.

{22}

Egypts foreign-currency and local debt has outperformed most other emerging-market peers this year.

{22}

{24}

Read More: Egypts Carry Trade Bounces Back as Foreigners Buy Up Debt Again

{24}

Citigroup Inc. favors Egypts local-currency bonds, saying that its fiscal strength will likely improve in 2021.

The economy will probably grow 2% this year and the governments stand-by arrangement with the IMF is set to keep reserves sufficient to meet obligations and compensate for the drag on remittances, tourism and Suez revenues, strategists including Luis Costa said in a report to clients.

— With assistance by Harumi Ichikura, Netty Idayu Ismail, and Abeer Abu Omar

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator