简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Port Logjam in Brazil Marks Chinas Return to Sugar Market

Abstract:Chinese demand for sugar is finally showing signs of life after Beijing ended massive import tariffs.

SHARE THIS ARTICLE

Share

Tweet

Post

Chinese demand for sugar is finally showing signs of life after Beijing ended massive import tariffs.

Brazil, the largest exporter of the sweetener, has scheduled the shipment of 816,823 metric tons to the Asian nation in the coming weeks, according to port lineup data from consulting firm Datagro dated Aug. 10.

That‘s 31% of all sugar Brazilian ports are expected to ship in that period. If exports continue at the same pace, China would resume its place as Brazil’s top sugar buyer.

The number of China-bound vessels awaiting loading in Brazil has increased every day and recent new orders suggest the lineup will remain at high levels, according to Paulo Roberto de Souza, head of top sugar trader Alvean.

Chinese purchases and expectations of more to come have helped raw sugar futures in New York to rebound about 35% from a late-April low. Authorities in China may allow an additional 2.1 million tons of imports in the coming months, said Datagro President Plinio Nastari.

{12}

“The rise in corn prices internally to their highest level in five years might impact consumption of alternative sweeteners as well, pushing more consumption to sugar as a result,” McDougall said.

{12}{13}

Alvean expects China to import from all destinations above 5 million tons of raw and white sugar this year. Only considering the raw sugar, it is a 50% jump from last year. About 80% of the raw product may come from Brazil, de Souza said.

{13}

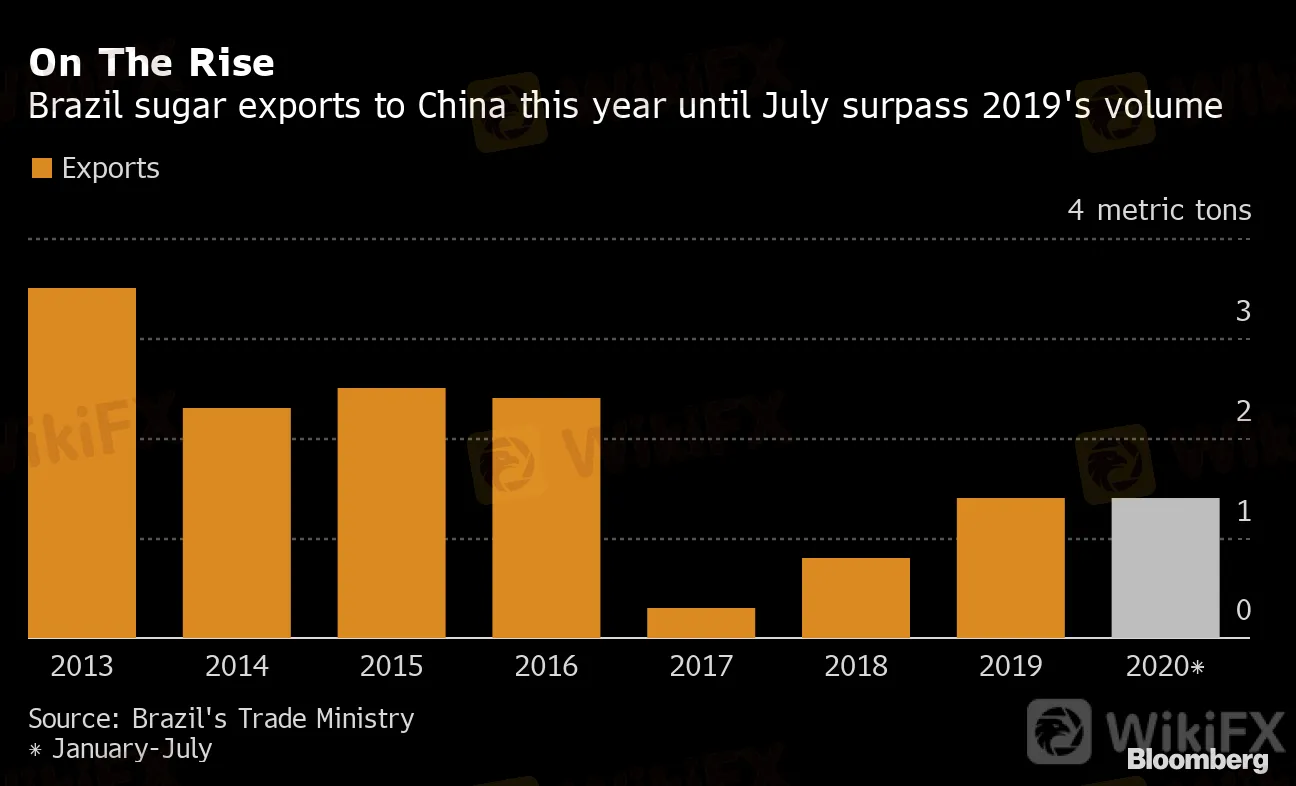

This year through July, Brazil exported 1.43 million tons to the Asian nation, surpassing the volume shipped in all of 2019, according to data from Brazilian Trade Ministry.

{17}

On The Rise

{17}{18}

Brazil sugar exports to China this year until July surpass 2019's volume

{18}

Source: Brazil's Trade Ministry

* January-July

(Adds comment from Datagro president in sixth paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Currency Calculator