简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asian Stocks Drift; Gold Extends Slide Second Day: Markets Wrap

Abstract:Asian stocks drifted Wednesday amid doubts over the timing of a spending package from Washington and some position-trimming in high-flying sectors. The gold selloff entered a second day after it tumbled the most in seven years Tuesday.

SHARE THIS ARTICLE

Share

Tweet

Post

Photographer: Toru Hanai/Bloomberg

Photographer: Toru Hanai/Bloomberg

Asian stocks drifted Wednesday amid doubts over the timing of a spending package from Washington and some position-trimming in high-flying sectors. The gold selloff entered a second day after it tumbled the most in seven years Tuesday.

Investors are considering the possibility that a stalemate in Washington could significantly delay the U.S. virus rescue package, weighing on the nascent recovery. Meanwhile, the massive rally in gold that sent the haven metal to record highs above $2,000 an ounce reversed course Tuesday, as a rise in bond yields cut into the negative real rates that had supported the metal.

We are seeing some portfolio switching “given the constant flurry of concerns about crowded positioning and stretched valuations in growth sectors such as tech and communication services,” said Matthew Sherwood, head of investment strategy for multi-asset at Perpetual Investment. “Value and cyclicals continue to be supported by positive economic surprise momentum.”

Meanwhile, Joe Biden chose Senator Kamala Harris as his running mate, betting that her ties to the African-American community and self-branding as a “progressive prosecutor” will help propel him to the White House. On the virus front, California reported a sharp jump in cases.

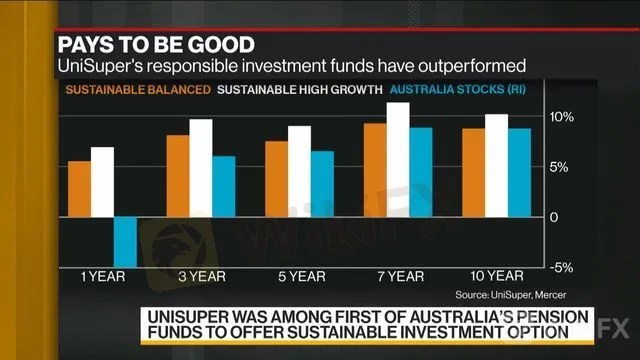

John Pearce, chief investment officer at UniSuper Management Pty Ltd., one of Australias largest pension funds, discusses finding opportunities in Tech with such high valuations, his investment in bonds and how gender equality influences assets.

Source: Bloomberg

Here are some key events coming up:

Earnings include E.ON, Deutsche Telekom, Carlsberg, Tencent and JD.com.

{21}

New Zealands central-bank policy decision is due on Wednesday.

{21}

U.S. CPI for July is scheduled for Wednesday.

China releases a slew of data for July on Friday, including industrial production and retail sales.

These are the main moves in markets:

Stocks

Futures on the S&P 500 rose 0.2% as of 9:22 a.m. in Hong Kong. The index fell 0.8% on Tuesday.

Japans Topix Index rose 0.7%.

Hong Kongs Hang Seng lost 0.1%.

{29}

Koreas Kospi Index fell 0.4%.

{29}

Australias S&P/ASX 200 Index dipped 0.3%.

New Zealands S&P/NZX 50 fell 1.2%.

Euro Stoxx 50 futures declined 0.7%.

Currencies

{34}

The yen was little changed at 106.53 per dollar.

{34}

The offshore yuan fell 0.1% to 6.9483 per dollar.

The euro was little changed at $1.1737.

The Bloomberg Dollar Spot Index was little changed.

The kiwi dropped 0.5% to 65.43 U.S. cents.

Bonds

The yield on 10-year Treasuries held at 0.64%. It rose more than six basis points Tuesday.

{41}

Australias 10-year bond yield rose more than three basis points to 0.90%.

{41}

Commodities

Gold was at $1,885.77 an ounce, down 1.4%.

West Texas Intermediate crude was 0.4% higher at $41.76 a barrel.

— With assistance by Claire Ballentine, Katherine Greifeld, and Joanna Ossinger

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator