简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australia Lowballs Iron Price That Boosts Economy and Budget

Abstract:Australia is lowballing the price estimate of its largest export -- a key ingredient in China‘s stimulus -- setting up a buffer for the economy and the government’s books as the Covid-19 crisis clouds the broader outlook.

For a fresh perspective on the stories that matter for Australian business and politics, sign up for our new weekly newsletter.

Australia is lowballing the price estimate of its largest export -- a key ingredient in China‘s stimulus -- setting up a buffer for the economy and the government’s books as the Covid-19 crisis clouds the broader outlook.

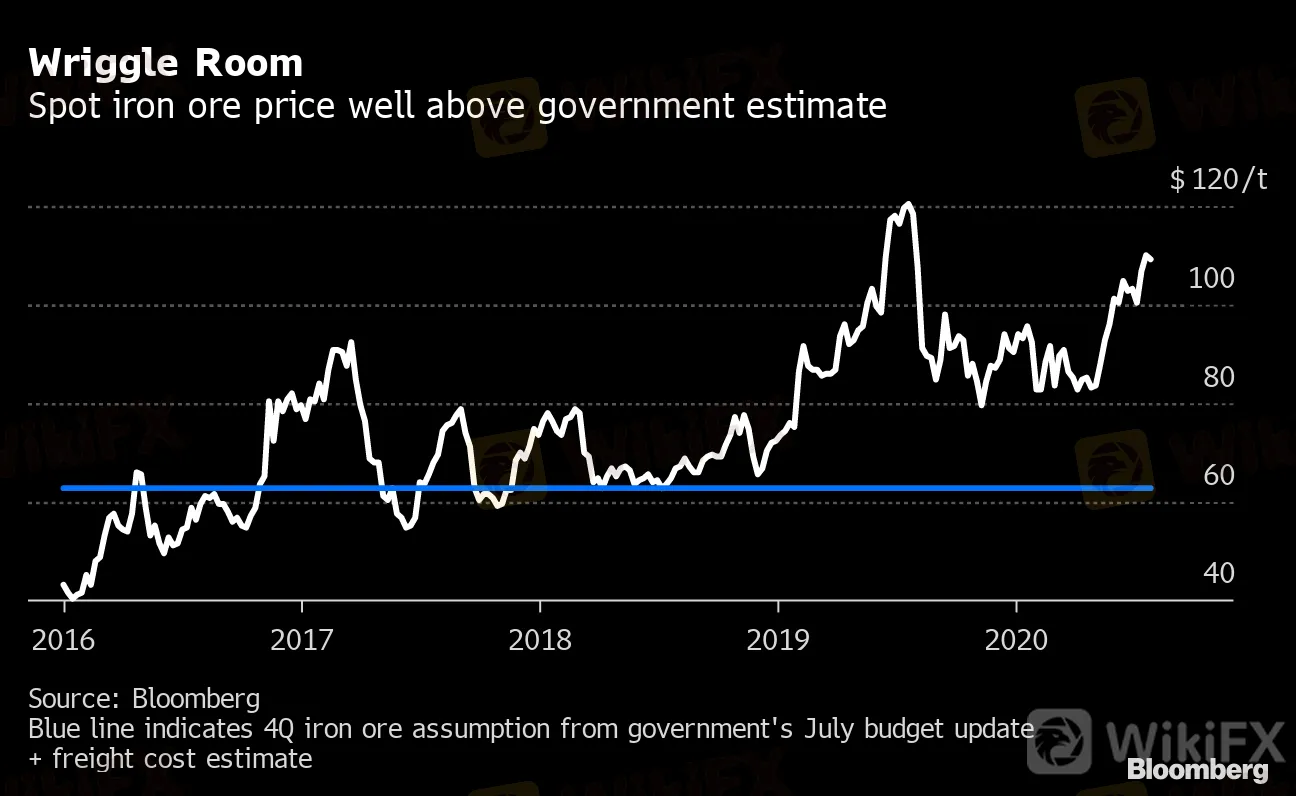

Treasurer Josh Frydenberg‘s economic and fiscal update last week was based on a $55 a ton iron ore price at a time when the market level was almost double that. Higher prices boost profits, the tax take and nominal gross domestic product. While this won’t prove decisive for Australias largest budget deficit since World War II, it does provide insurance against fiscal slippage.

Wriggle Room

Spot iron ore price well above government estimate

{11}

Source: Bloomberg

{11}

Blue line indicates 4Q iron ore assumption from government's July budget update + freight cost estimate

The “conservative commodity price assumptions effectively means that both GDP and tax receipts for the Australian government are likely higher than currently forecast,” said Vivek Dhar at Commonwealth Bank of Australia. “Chinas plan to boost infrastructure spending this year, most of which has already been allocated, is the primary driver” of steel demand.

{17}

Treasury has opted to lowball commodity forecasts in recent years after facing criticism for excessive optimism that failed to materialize. An additional A$9 billion ($6.5 billion) of nominal GDP and A$1.2 billion of tax revenue would be generated in fiscal 2021 if the iron ore remains elevated until Dec. 31 2020, a budget sensitivity analysis shows.

{17}

The strength of Chinese demand for iron ore has helped underpin the local currencys 25% rebound from a March nadir. Yet that also erodes some of the windfall profits, which is likely to be reflected in the export price index -- measured in Australian dollars -- due out Thursday.

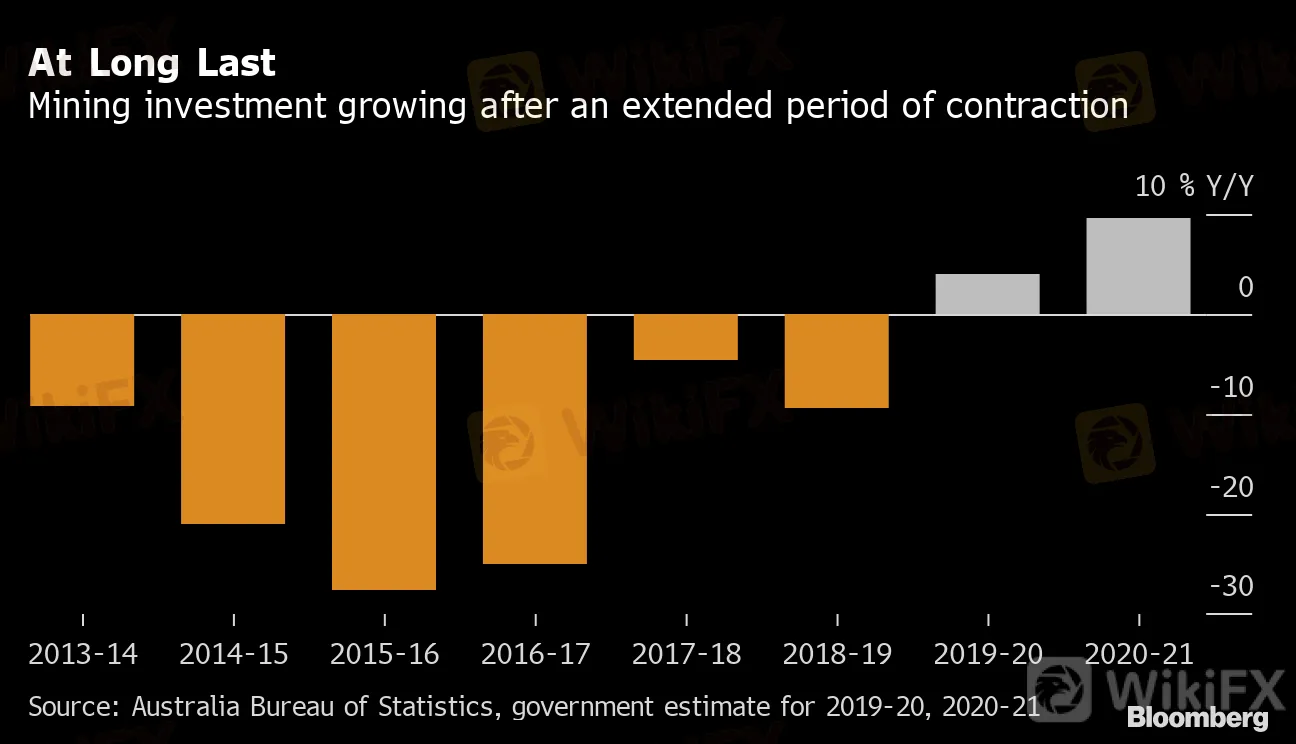

But higher prices are encouraging renewed investment following years of cost-cutting at resource companies, helping offset some of the economic damage from the collapse of industries like international tourism and education. Miners probably boosted spending in the 12 months that ended in June for the first time in seven years, and investment is expected to swell by 9.5% in fiscal 2021.

The tailwinds aren‘t just in iron ore. Increasing jitters about the global outlook have seen investors flock to gold, driving the spot price to a record high. Australia’s gold export volumes are expected to surge by 15% this fiscal year, and booming exploration reinforces the favorable investment outlook. Dhar calls gold “the brightest spot in Australias commodity mix.”

At Long Last

Mining investment growing after an extended period of contraction

{26}

Source: Australia Bureau of Statistics, government estimate for 2019-20, 2020-21

{26}

While Australia‘s status as the most China-dependent developed economy delivers major economic benefits, it also leaves it vulnerable to Chinese backlash. Prime Minister Scott Morrison’s call for an inquiry into the origins of the Covid-19 outbreak drew swift Chinese condemnation, and also tariffs and bans on some agricultural exports, which many in Australia saw as retaliation.

Read more: Australias China Ties Fray Even as Two-Way Trade Booms

However, iron ore shipments continue to expand because China needs steel for infrastructure projects that are part of its stimulus program.

{32}

Flows from Port Hedland, the gateway to Australias mineral heartland and used by top miners including BHP Group and Fortescue Metals Group Ltd., topped a record 50 million tons in June. Iron ore exports broke A$100 billion in that 12 month period, with 87% sent to China.

{32}

“This tailwind is unlikely to disappear, because Australia has a dominant position especially in the global iron ore market,” said Alicia Garcia Herrero, chief Asia Pacific economist with Natixis SA. “China would find it difficult to substitute its imports of Australian iron ore without affecting prices.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator