简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Euro‘s Ascent Won’t Knock the Dollar Off Its Perch

Abstract:Currency traders have made money betting that the euro zones pandemic response would benefit the common currency.

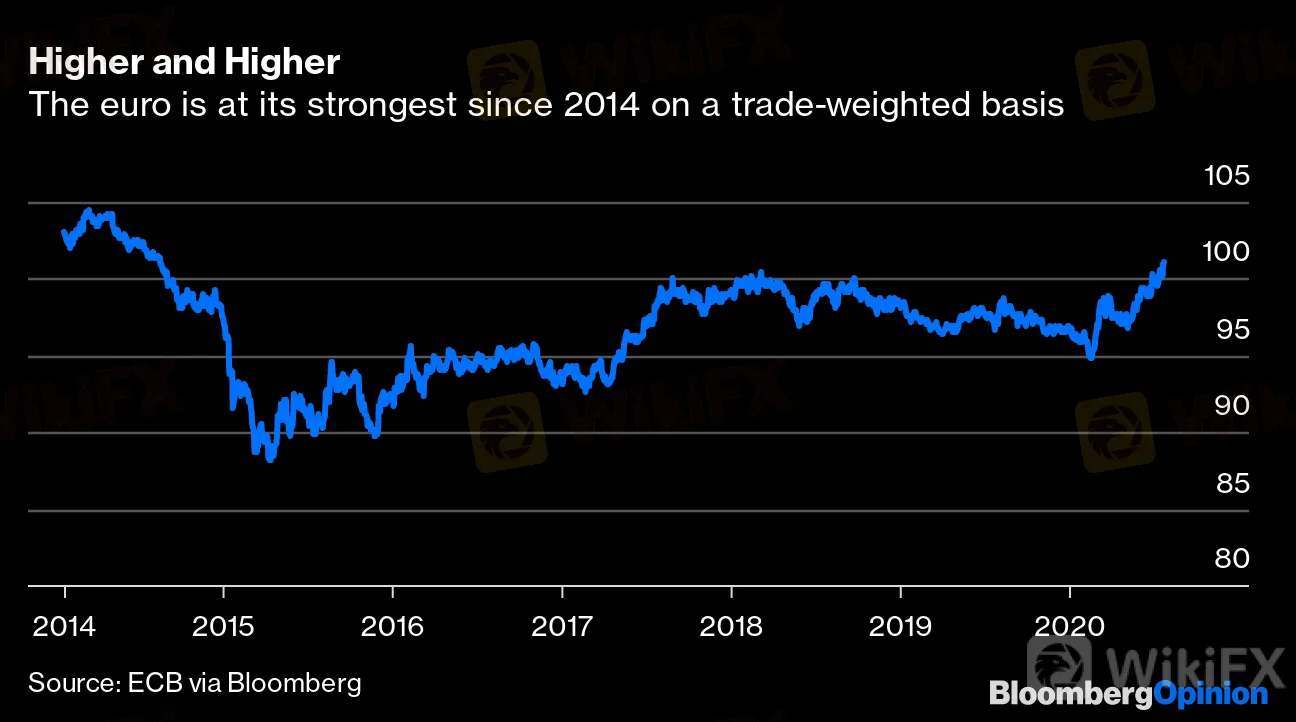

With the euro surging to its highest level for six years, based on the European Central Bank‘s trade-weighted index, the doom-mongers predicting the dollar’s demise as the worlds reserve currency of choice have started chorusing once more. As usual, they will be proved wrong.

Traders who‘ve been speculating that the common currency would benefit from the euro zone’s superior pandemic response, at least when compared with the U.S., have been rewarded for their faith. The euro is up by 4.3% against the dollar this year, and is at its strongest since 2014 versus a basket of the currencies of the blocs 19 biggest trading partners.

Higher and Higher

The euro is at its strongest since 2014 on a trade-weighted basis

Source: ECB via Bloomberg

Moreover, those bets continue to accumulate. Figures compiled by the Commodity Futures Trading Commission show net positions designed to profit from euro strength have risen steadily since flipping positive in March, and are at their most bullish since April 2018.

Euro Bulls

Bullish bets on the euro in the futures market are at their highest since April 2018

Source: CFTC via Bloomberg

On a two-way trade in the midst of a pandemic, the data on both infection rates and deaths from the coronavirus suggest it makes sense to back the euro versus the dollar, given the U.S. administration‘s woeful performance in curbing its spread. Add in the U.S.’s worsening relationship with China and the prospect of political turmoil around the November presidential election, and its easy to see why the greenback is down to its weakest position against 10 major peers since September 2018.

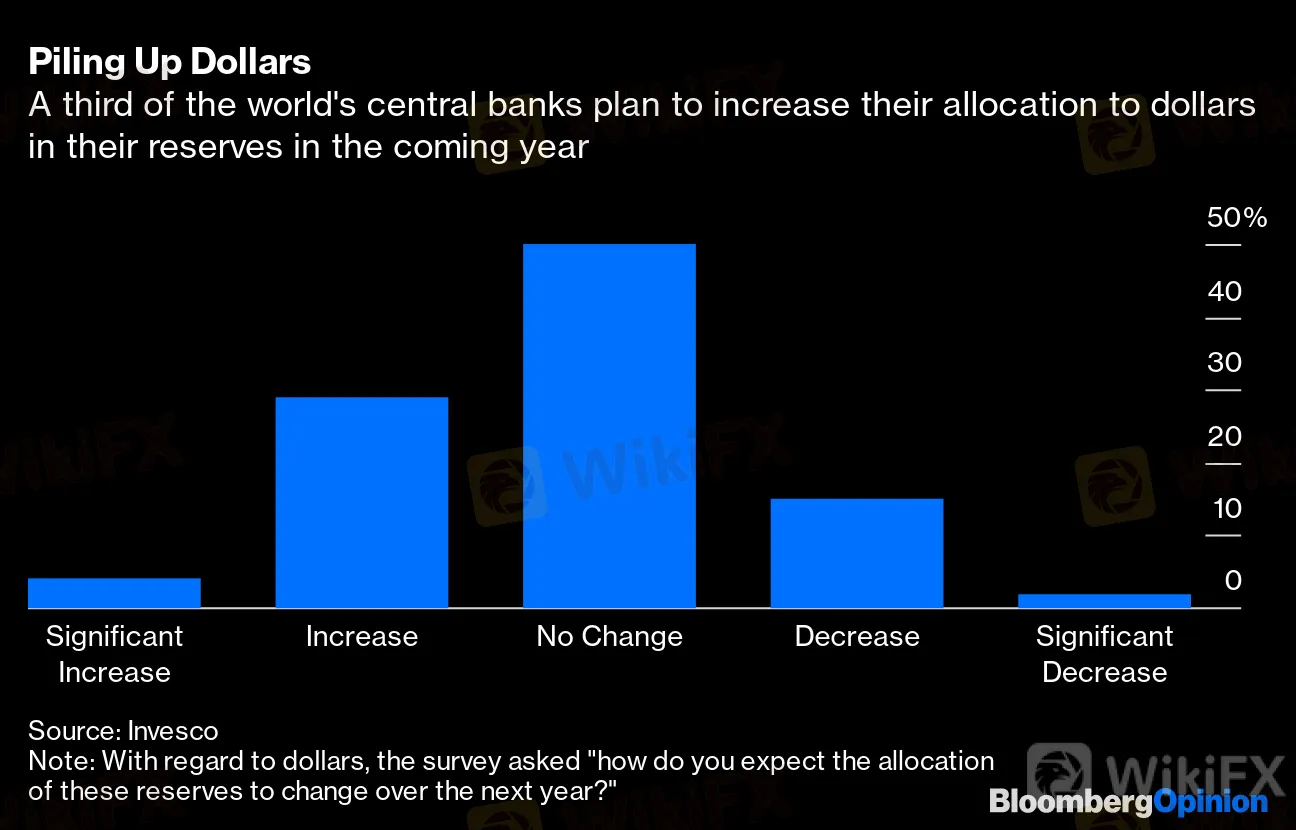

But weighing the likely speeds at which countries will emerge from lockdown and assaying the latest tit-for-tat embassy closures tells us nothing about the long-term likelihood of the dollar losing its status as the worlds preferred currency. Global central banks have about $11 trillion of reserves, according to the International Monetary Fund. More than 60% is in dollars, amounting to $6.8 trillion, compared with about 20% in euros, 6% in yen and less than 5% in pounds. Moreover, a survey of more than 50 central banks published last week by Invesco Ltd. showed increasing dollar appetite in the coming year.

Piling Up Dollars

A third of the world's central banks plan to increase their allocation to dollars in their reserves in the coming year

Source: Invesco

Note: With regard to dollars, the survey asked “how do you expect the allocation of these reserves to change over the next year?”

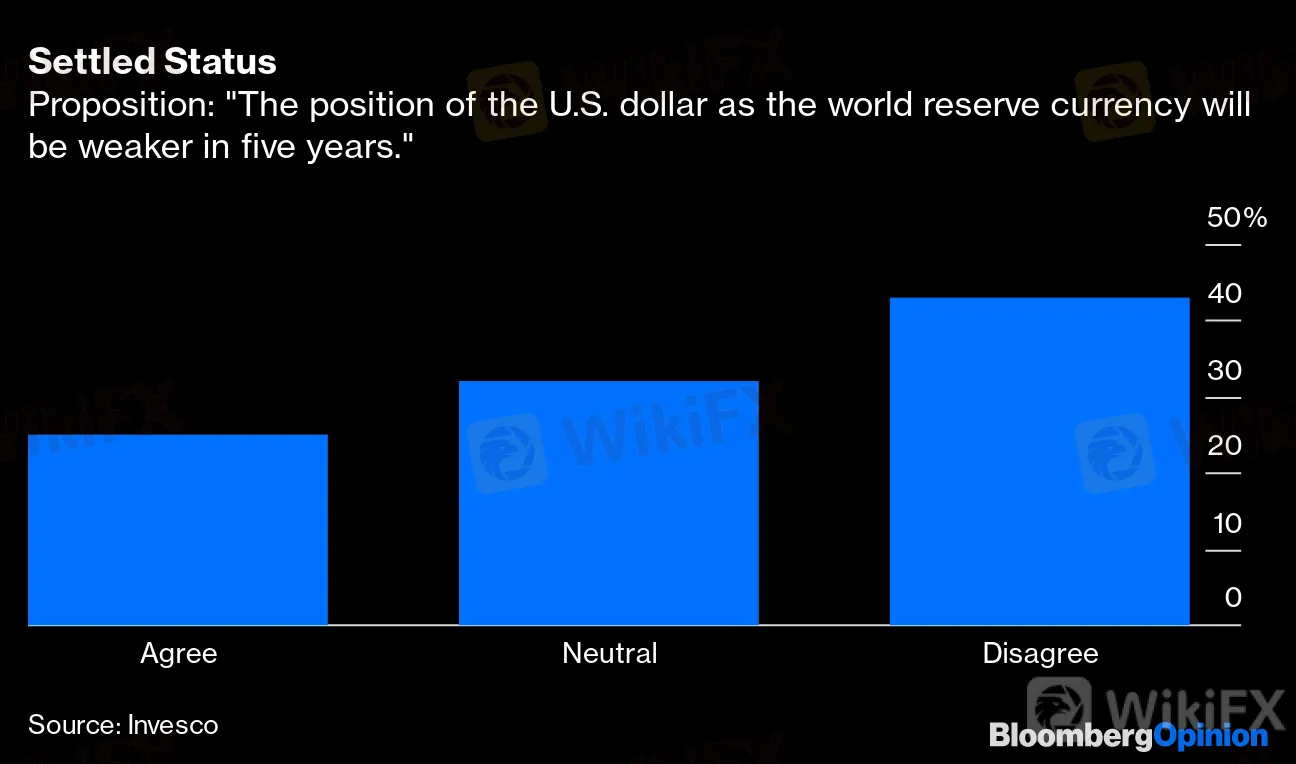

In the survey, Invesco explicitly asked whether central banks expected the dollar‘s position, as the principal store of value for the world’s foreign exchange reserves, to weaken in the next five years. The result was overwhelmingly in favor of the status quo.

Settled Status

Proposition: “The position of the U.S. dollar as the world reserve currency will be weaker in five years.”

Source: Invesco

The euro may well continue to gain while the pandemic persists, though mostly as a result of dollar weakness. But as Invesco said in its report, “it would appear that discussion of the U.S. dollar‘s demise as the world reserve currency has been greatly exaggerated.” For now, at least, the dollar’s reign will continue.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

How Long Can the Dollar Remain Strong?

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

What Every Trader Must Know in a Turbulent Market

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

“Predict and Win” Big Rewards! Join the Contest Now

Currency Calculator