简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUD & NZD Surges, Crude Oil Soars and Silver Skyrockets

Abstract:Among the three U.S. stock indices yesterday, Nasdaq 100 index closed lower, while other two indices ended higher. Forex market reflected an obvious risk appetite, with AUD, NZD and NOK (the petroleum-related currency) the session’s winners.

WikiFX News (22 July) - Among the three U.S. stock indices yesterday, Nasdaq 100 index closed lower, while other two indices ended higher. Forex market reflected an obvious risk appetite, with AUD, NZD and NOK (the petroleum-related currency) the sessions winners. In addition, the prices of crude oil and silver keep rising.

However, their victory came at the expense of USD and JPY, the safe haven currencies.

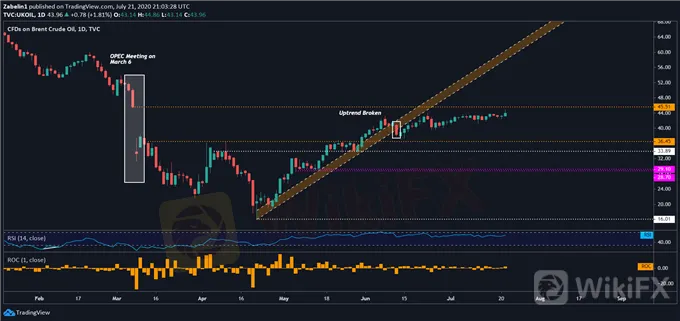

In terms of commodities, the optimistic environment pushed both Brent crude oil and copper to finish above 1.60%, with silver price jumped by 6.85%. Besides, the EU adopted the 750 billion euro stimulus agreement, swelling EUR/USD.

In view of the fundamental, once the crude oil price spikes over $45.51, there may be a moderate but notable recovery in its demands, which is a sign of economic stabilization.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

You can also find us here-

Vietnam: www.facebook.com/wikifx.vn

Thailand: www.facebook.com/wikifx.th

Indonesia: www.facebook.com/wikifx.id

South Asia: www.facebook.com/wikifxglobal

Italy: www.facebook.com/wikifx.it

Japan: www.facebook.com/wikifx.jp

India: www.facebook.com/wikifx.in

Arabian countries: www.facebook.com/wikifx.arab

Russian countries: www.facebook.com/wikifx.russian

French countries: www.facebook.com/wikifx.French

Western Pacific area: www.facebook.com/wikifx.westernpacific

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator