简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

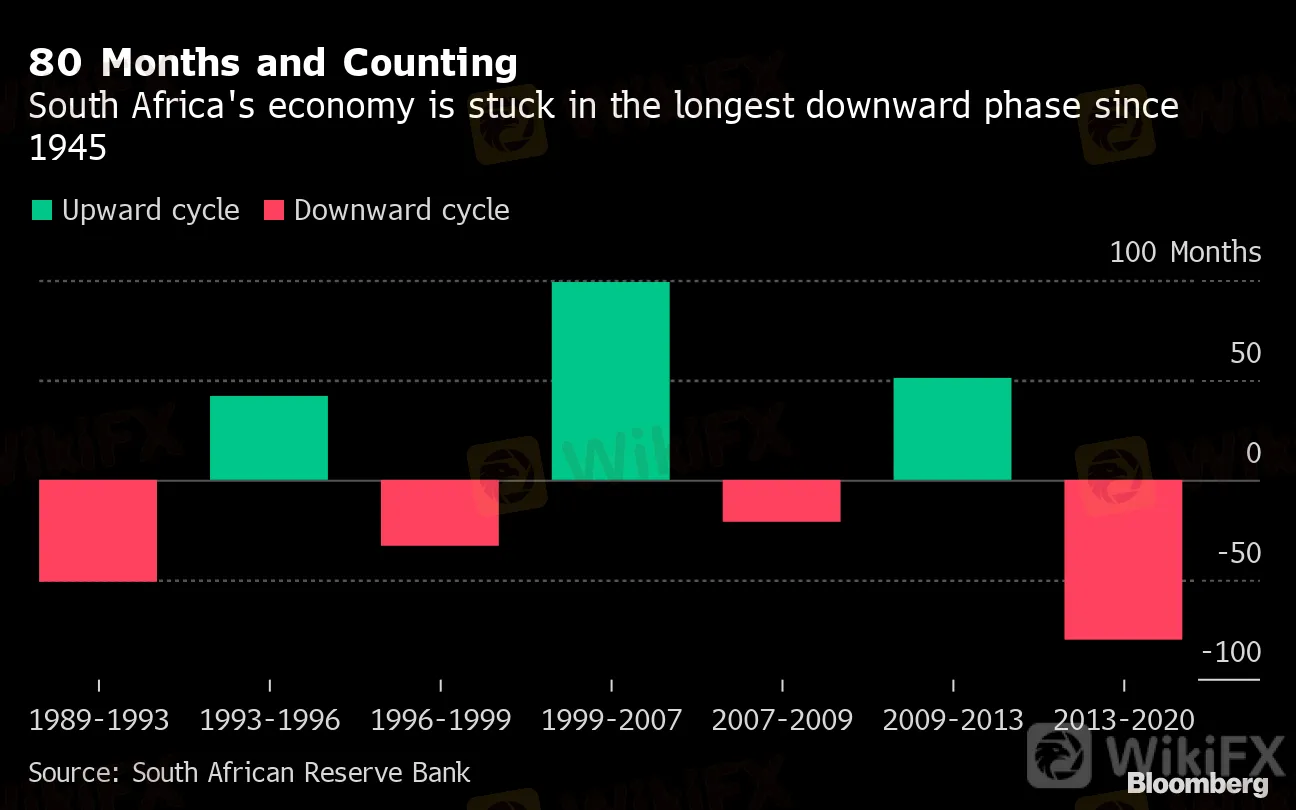

South Africa Extends Its Longest Slump Since 1945

Abstract:The South African economy extended its longest downward cycle since 1945 as restrictions to curb the spread of the coronavirus weighed on output and are set to hurt household finances even more.

The South African economy extended its longest downward cycle since 1945 as restrictions to curb the spread of the coronavirus weighed on output and are set to hurt household finances even more.

The economy entered the 80th month of a weakening cycle in July, according to data in the Reserve Bank‘s Quarterly Bulletin released Thursday. That’s after a nationwide lockdown that started on March 27 shuttered most activity and weighed on output. Business and consumer confidence languish at multi-year lows, with many firms having closed permanently and thousands of jobs lost.

80 Months and Counting

South Africa's economy is stuck in the longest downward phase since 1945

Source: South African Reserve Bank

Household finances that deteriorated in the first quarter are likely to get much worse. Net wealth fell to 330% of nominal disposable income, compared with 360% in the three months through December, according to the report. That‘s as a sharp drop in share prices due to virus-related panic trading weighed on the value of assets held by households, the central bank said. South Africa’s main stock index declined by 22% during the period, the largest decline since the third quarter of 1998.

Portfolio outflows surged to 97.56 billion rand ($5.85 billion), the highest level on record. Thats due to the net sales of debt and equity securities by non-residents, as well as the redemption of a $1.6 billion international government bond, the central bank said.

No Pay

About 3 million fewer people were employed in April, according to a National Income Dynamics Study-Coronavirus Rapid Mobile Survey published Wednesday. A third of all income earners in February werent paid in April because they lost their jobs or were furloughed, the study showed.

Growth in nominal remuneration per worker slowed to 4.1% in 2019 compared with 4.9% a year earlier, central bank data showed. That the lowest since 1970. Public sector nominal wage growth per worker more than halved to 6.6% in 2019 from a recent peak of 13.7% in 2010.

“Household finances ought to be affected by both an increase in unemployment and a loss of income as the salaries of some employees, in particular in the non-essential industries, were reduced during the lockdown with knock-on effects such as debt repayments,” the Reserve Bank said in an emailed response to questions. “The effect on household income will likely impact overall demand in the economy.”

(Updates with portfolio outflows in fourth paragraph, central bank comments in seventh)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator