简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dose the Internationalization of RMB Move a Step Further?

Abstract:According to the latest data from the Society for Worldwide Interbank Financial Telecommunications(SWIFT), the share of RMB international payments has risen to 1.79% in May 2020. The internationalization of RMB is continuously deepening.

According to the latest data from the Society for Worldwide Interbank Financial Telecommunications(SWIFT), the share of RMB international payments has risen to 1.79% in May 2020. The internationalization of RMB is continuously deepening.

On June 18, Shanghai Lujiazui Financial Forum, Yi Gang, the Governor of the People's Bank of China, delivered speeches that indicated the future policy attitudes and trends in financial sector of China.

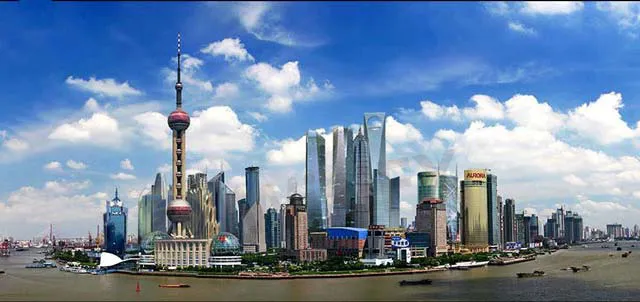

Shanghai has been paving its way to become an international financial center, which will contribute to the internationalization of RMB. In early 2015 when the exchange rate reform was conducted, China formed a floating exchange rate mechanism to some extent, and continued to develop towards a complete exchange rate marketization. The reform has made Hong Kong less important in international capital investment in China. At present, China has not fully marketized the exchange rate, but adopts only floating exchange rate mechanism. Even so, no one would doubt that Shanghai, as China's financial center, has gradually developed into an international financial center.

(Source: internet)

The current epidemic is totally a test for world economies and the policy makers. Judging from the series of policies of the People's Bank of China this year, China has not completely followed the loose monetary policy of the Fed and global industries, and even has monetized its debt. This shows that China's monetary policy is becoming increasingly independent.

(Source: internet)

According to the “Mundell-Krugman's Impossible Triangle Law” in economics: the three ones (sovereign monetary policy, fixed exchange rates, and free capital flow) cannot be satisfied at the same time but only two at most. For example, Hong Kong has chosen a fixed exchange rate and free capital flow, so it doesnt satisfy the sovereign monetary policy. While the United States prefers to a sovereign monetary policy and free capital flow, and fails to have a fixed exchange rate. However, as a world currency, the US dollar actually possesses the advantage of a fixed exchange rate to some extent. As a result, it allows the US dollar to completely choose the sovereign monetary policy and free capital flow, regardless of the problems that floating exchange rates may cause.

Recently, to deal with the impact caused by the epidemic, the US Fed has released unlimited easing policy, which may lead to damage to US dollar credit. A research showed that as of June 22, the amount of US Treasury bonds has reached 26.24 trillion US dollars. Some analysts pointed out that the rapid growth of US Treasury bonds will have an impact on the fiscal budget, thereby exacerbating the financial crisis. Whether the United States can correctly deal with the negative impact of these factors on the economy will determine whether the dollar can pass the test.

(Source: internet)

With the advantage of the US dollar, the risk of USD exchange rate is very low, and it is also possible to purchase cheap goods from other countries by printing money. However, former US Treasury Secretary Henry Paulson pointed out recently that the status of the US dollar is now being tested.

Paulson stated that considering that the US economy has fallen into a relative decline and emerging market countries such as China are on the rise, it currently appears that “RMB will be the currency most likely to replace the US dollar.”

Technically, investors may see the US dollar index continue to fluctuate in the coming weeks and months. Any move below 94.61 and 93.395 would be a technical breakdown in the index. As the world's reserve currency, the path of the lowest resistance of the US dollar may affect all asset class markets throughout 2020, including RMB.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

Quadcode Markets: Trustworthy or Risky?

5 Questions to Ask Yourself Before Taking a Trade

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator