简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yield Curve in Japan Keeps Steepening With BOJ Holding Back

Abstract:An incessant steepening in Japan‘s yield curve is raising the stakes for the central bank’s monthly bond-buying plan due Tuesday.

An incessant steepening in Japan‘s yield curve is raising the stakes for the central bank’s monthly bond-buying plan due Tuesday.

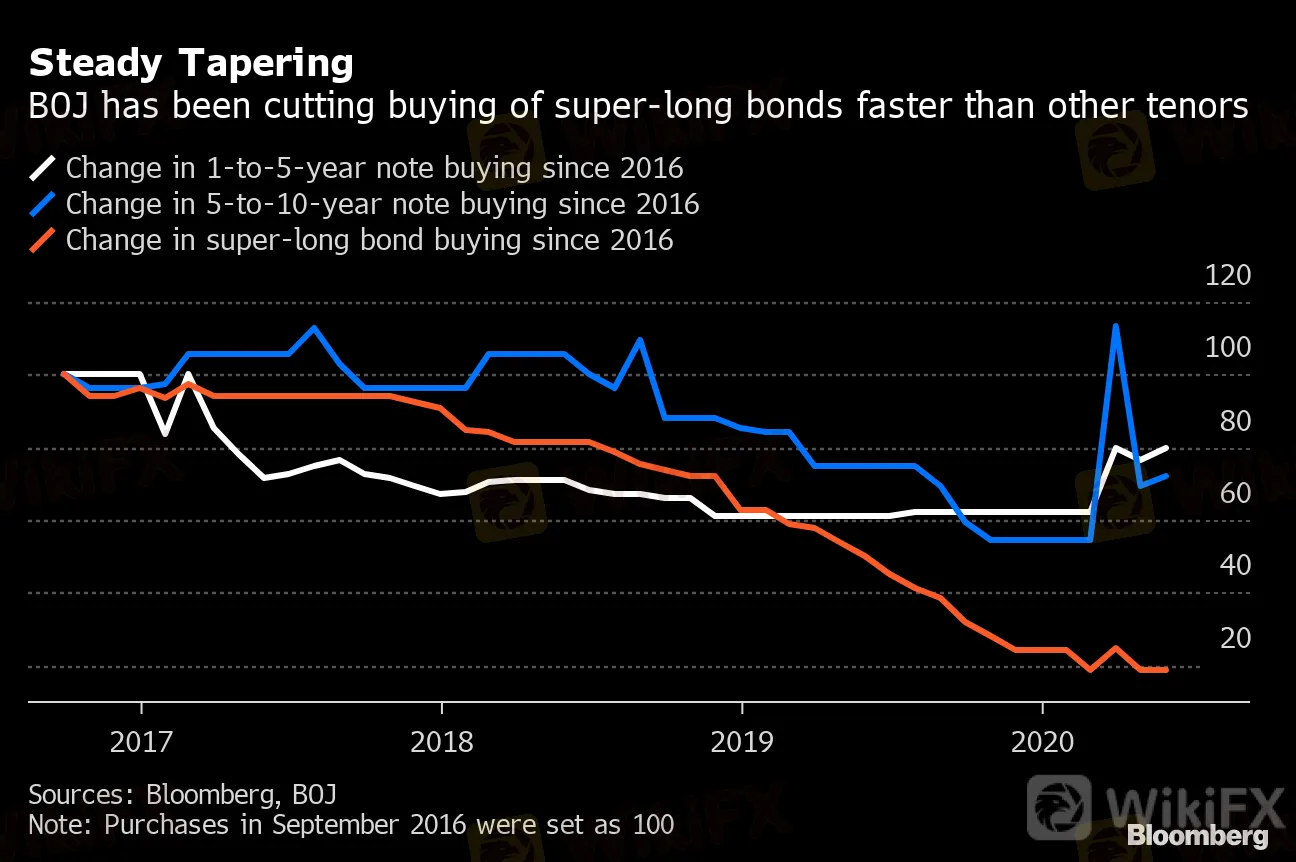

Japans bond market has come under pressure after the finance ministry increased planned issuance by 60 trillion yen ($560 billion) for the fiscal year ending March 2021 to fund stimulus spending. The impact has been compounded by reduced purchases of super longs by the central bank.

“The bond market at first calmly received the unprecedented increase in bond issuance,” Jun Ishii, chief bond strategist at Mitsubishi UFJ Morgan Stanley Securities Co., wrote in a June 25 note. “But, it has finally started to become concerned about absorbing it. Bear-steepening of the yield curve is reflecting such sentiment.”

The BOJ has gradually reduced purchases of super longs, partly to mitigate the side-effects of prolonged quantitative easing. It bought 302.4 billion yen of debt due in more than 10 years last month, compared with 1.6 trillion yen in September 2016 when it first introduced its yield-curve control policy.

Steady Tapering

BOJ has been cutting buying of super-long bonds faster than other tenors

Sources: Bloomberg, BOJ

Note: Purchases in September 2016 were set as 100

BOJ Governor Haruhiko Kuroda said on June 16 Japan‘s super-long yields weren’t high compared with that of other nations. The central bank is scheduled to release its bond-purchase plan at 5 p.m. Tokyo time on June 30.

“The BOJ doesn‘t seem to want to boost purchases of super-long maturities by a lot, as suggested by Kuroda,” said Takenobu Nakashima, senior rates strategist at Nomura Securities Co. “Markets aren’t really expecting a huge increase in these zones.”

— With assistance by Chikako Mogi

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator