简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

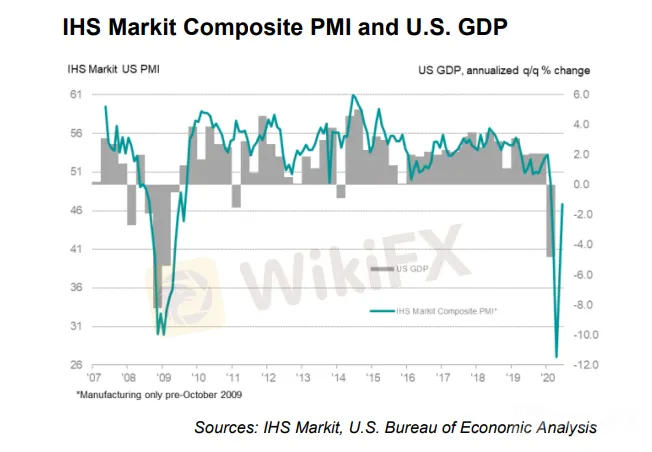

PMI Data Indicates US Economy Remains Sluggish

Abstract:According to WikiFX App, the Markit Services PMI increased to 46.7 on June 2020 from 37.5 in the previous month.

According to WikiFX App, the Markit Services PMI increased to 46.7 on June 2020 from 37.5 in the previous month; the Markit Manufacturing PMI rose to 49.6 on June 2020 from 39.8 in May. The two indicators have recorded a new high over the past four months, but below the entrepreneur confidence threshold, which indicates the US economy is still in a weak status.

From the current economic situation, it can be seen that the US business activities have still shrunk in a gradually slow manner. After the lockdown measures against the COVID-19, most enterprises reopened from mid-March, which makes a little bit better economy this month. However, some of them still kept cutting jobs due to few requests for renewal and new businesses.

Chris Williamson, Chief Business Economist at IHS Markit said: “ the downward momentum in US economy weakened obviously, which gave people great hope of US economic recovery and increase in the third quarter. But the unprecedented serious recession this time dealt a heavy blow to US economy, which appears to take more time to recovery. It is estimated that US economy will shrink over 8% in 2020.”

Sources: CNBC

Currently, the current economic data of many countries, such as PMI, and also news about US-China trade leaded to greater market volatility. Meanwhile, global risk aversion increased, and the gold approached the seven-and-a-half year high level on June 23th.

Financial calendar on WikiFX App

WikiFX is a leading forex media in forex industry and has launched WikiFX App which integrates multiple functions including forex news, forex forum, complaint and exposure, and broker info inquiry etc. Visit WikiFX official website to know the latest and recent world financial news at all times and places. https://bit.ly/wikifxIN

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator