简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Negative Interest Rate Is a Potent Yet Dangerous Drug

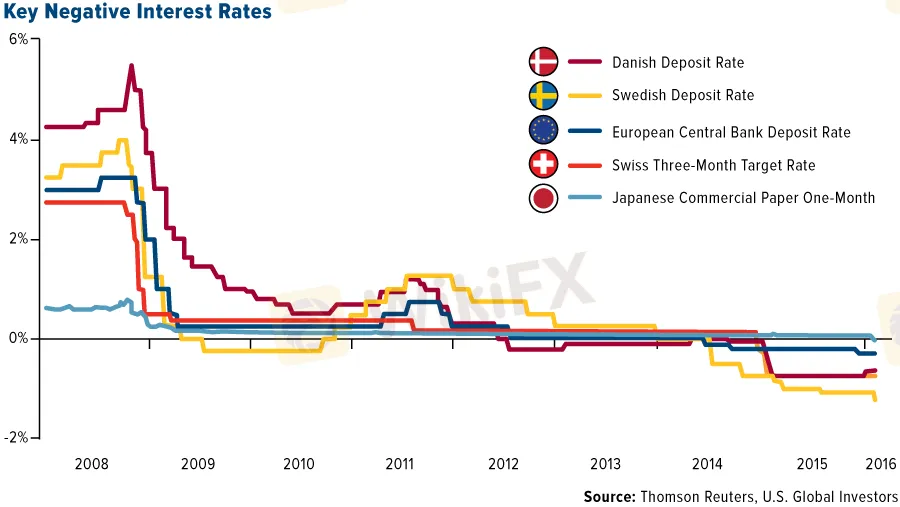

Abstract:The epidemic is raging all over the world and the economies of various countries are deeply affected. As a result, central banks of many countries have slashed interest rates to stimulate the economy, making negative rates a global phenomenon.

WikiFX News (25 June)-The epidemic is raging all over the world and the economies of various countries are deeply affected. As a result, central banks of many countries have slashed interest rates to stimulate the economy, making negative rates a global phenomenon. However, negative interest rate is a potent yet dangerous drug.

As an unconventional tool, negative interest rate, if improperly applied, can easily throw the entire economic and financial system into a new slump hard to escape from.

In July 2009, the Central Bank of Sweden announced that it would lower the deposit rate to -0.25%, and it wasn't until the end of 2019 that the rate return from negative to zero. However, as of 2018, Sweden's GDP growth rate never exceeded 0.8%.

In addition, negative interest rates will stimulate some risky behavior in economic activities. For example, the debt of market entities may expand in an unsustainable manner, which in turn may lead to overestimation of asset values, distortions in market risk pricing, and a decline in resource efficiency.

To make matters worse, a negative deposit rate can rapidly boost people's demand for cash, which will virtually increase transaction costs for the entire society and reduce economic efficiency. In particular, under the condition of negative saving rate, the size of bank deposits will inevitably be impaired, which will directly restrict the lending capacity of banks.

One thing clear is that negative interest rates will bring side effects that cannot be ignored. However, negative interest rates are not without their virtues. When the economic recession reaches a certain level and there is no other way, whether to use negative interest rates is a delicate decision left to policymakers. And when introducing negative rate, policymakers also need to consider accompanying measures to cushion the side affects.

From WikiFX, a world-renowned forex trading inquiry service provider. Download and check broker's compliance with an easy click. bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator