简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly USD Outlook: Powell’s Message Is Worth Noting

Abstract:S&P 500’s steep fall of 6% within one day last week gave the market risk warnings. Such a swift and sudden fluctuation usually benefits dollar as a global reserve currency, but on the other hand, demand for dollar may reduce if market volatility further declines.

WikiFX News (15 June) - S&P 500s steep fall of 6% within one day last week gave the market risk warnings. Such a swift and sudden fluctuation usually benefits dollar as a global reserve currency, but on the other hand, demand for dollar may reduce if market volatility further declines.

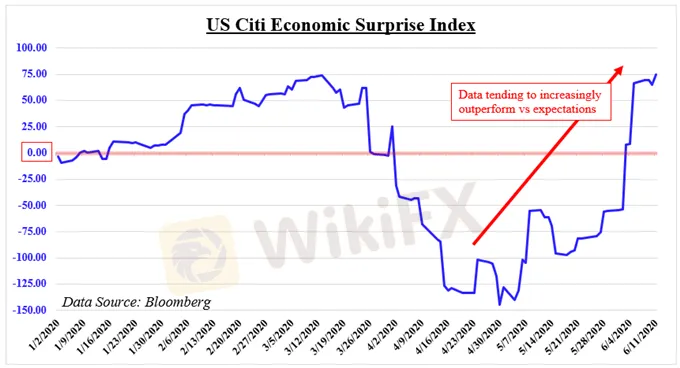

As for the fundamentals, US Retail Sales data will be released on Tuesday. Market expects a 7.4% Retail Sales Monthly Rate in May, and the improvement of consumption can boost Dow Jones and S&P 500. These factors will weigh on greenback, leading to inferior performance of USD against growth-related currencies such as AUD and NZD.

Meanwhile, investors also need to pay close attention to the speeches of Fed‘s policy makers, including Fed’s Chair Jerome Powell. He is expected to reiterate his concerns over economic prospect which he already mentioned last week.

The Fed‘s balance sheet saw little changes last week, which can increase the market’s demand for greater liquidity. If the present economic situation is not substantially improved, the US dollar will have less room to decline further.

From WikiFX, a renowned global forex broker inquiry platform where you can easily check brokers compliance and avoid being scammed. Download WikiFX App here bit.ly/WIKIFX.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oversold USD Puts a Rally on Track

Covid-19 kept raging the US, amid which the latest spate of economic data signaled a turn for the worse.

Fed's Upbeat Statements May Push USD Higher

The Federal Reserve Vice Chair Randal K. Quarles said in a recent speech that he was optimistic about the country's economic outlook, which could push the dollar higher in the short term and keep the dollar dominating non-USD currencies.

Unveil Reasons of USD Bounced up After Releasing Federal Reserve Board Minute

The US Dollar Index bounced up by around 1% after releasing the minute of Federal Reserve Board on 19 Aug, breaking the record high since this March.

A Tendency for Strong USD and Volatile Markets

Recently, markets seem to calm down as the U.S. stocks settled higher above early low and the VIX largely shrank 5 percentage points.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator