简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Brokers' Trading Volume Drop as Market Volatility Subsides

Abstract:The coronavirus pandemic stirred up the entire financial market, creating greater volatility which can benefit brokers.

The coronavirus pandemic stirred up the entire financial market, creating greater volatility which can benefit brokers. We mentioned in previous articles that most forex brokers saw their trading volume rose sharply in March. Now that the epidemic gradually got under control, volatility in both financial market and forex market are subsiding, which also significantly reduced transaction volume of several brokers.

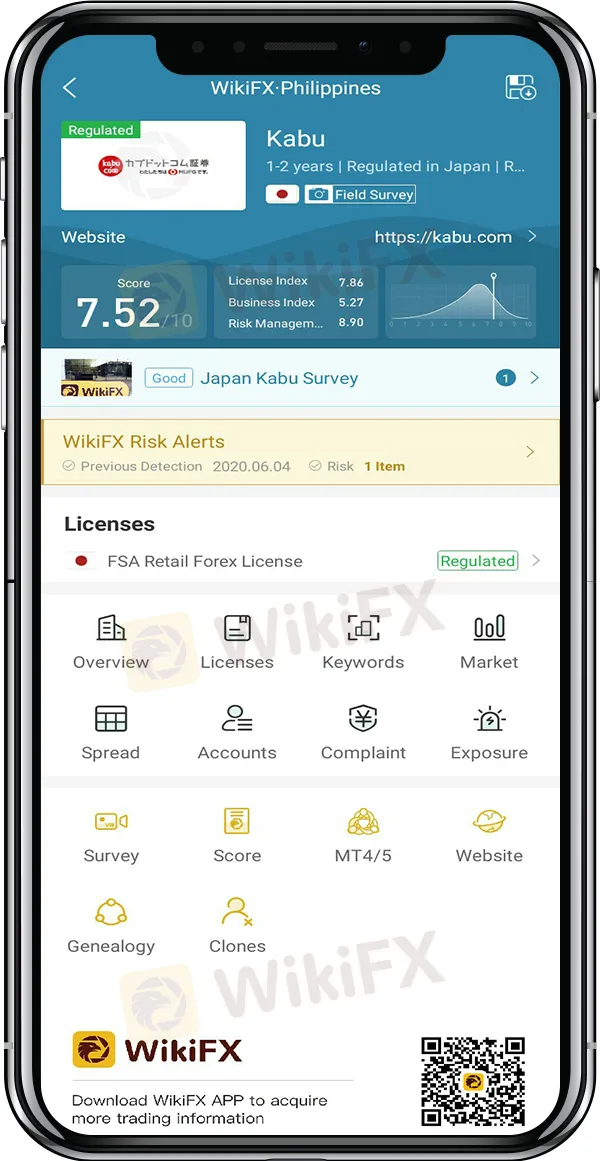

The May operating data recently released by online broker Kabu shows that the trader's performance fell for the second straight month in May after peaking in March. In May, Kabus online forex trading volume was 2.07 trillion yen, a month-on-month decrease of 8.1% from the previous month; the stock trading volume was 2.44 trillion yen, a decrease of 13.1% from April, and futures trading volume dropped 23.1% from April's 3.49 trillion to 2.68 trillion yen.

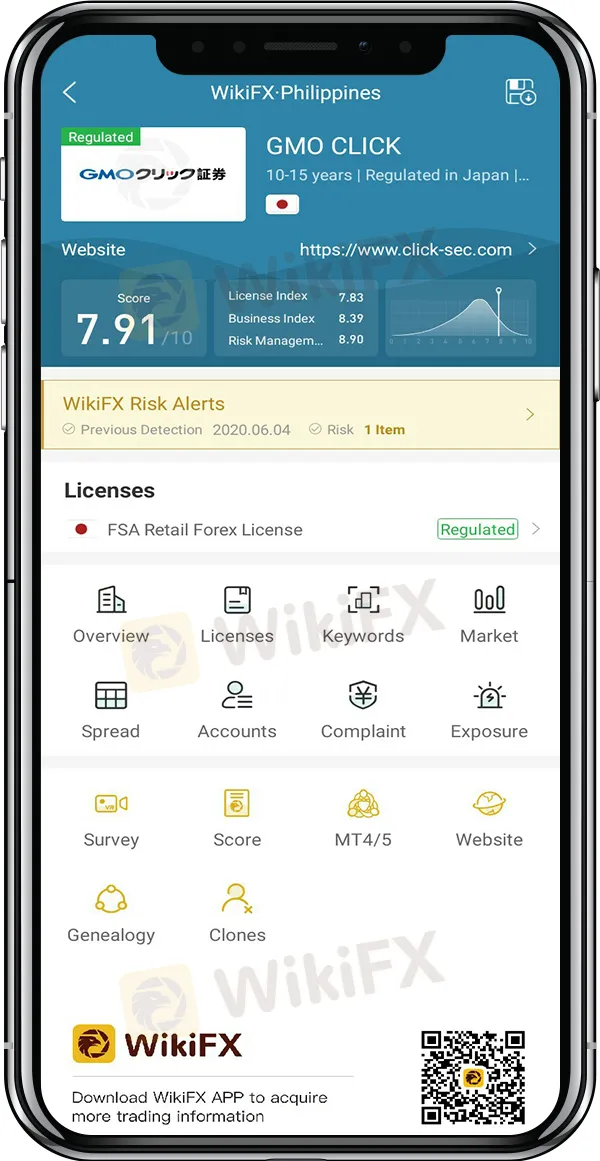

GMO Click also released its May transaction data on June 3rd. Data suggests the broker's May trading volume continued to decline after a drop in April. Specifically, GMO Click's total on-site trading volume in May was US$2.8 billion, a 9.7% decrease from the US$3.1 billion of April and significantly lower than the US$8.5 billion trading volume in March.

With the pandemic under control after measures were effectively implemented in China and some European countries, The once-soaring transaction volume began to fall as early as in mid and late April. According to the April data report of well-known broker Forex.com, the company's retail transactions in April totaled US$188 billion, a 51% decrease from Marchs US$388 billion; the average daily trading volume (ADV) also halved from US$17.7 billion to US$ 8.6 billion; futures recorded 567,189 transactions, down 20% month-on-month.

For more financial information and forex market updates, please visit WikiFX official website or download WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

These Are How Millionaire Forex Traders Think and Act

It's no secret that in the world of trading, the most difficult thing is realization. Everyone can expect to be a successful trader, a trader who wins a lot of money, to a millionaire trader. But all this could be a dream if they didn't try to chase it.

How to Register Forex Trading, 5 Easy Steps to Follow

Foreign exchange has been developed and turned into something big in all of society. Not just office employees, but also students, kids in school, housewives, and even the unemployed.

Pip In Forex Trading, The Relation to Profitability

Pip or price interest point or percentage in point is a measurement tool associated with the smallest price movement any exchange rate makes. Usually, there is four decimal places used to quote currencies.

Euro Drops to 2-Decade Low on Recession Fears

Worries about how the European Central Bank will react also undermined sentiment after Germany's Bundesbank chairman Joachim Nagel lashed out at the ECB's plans to try and protect heavily indebted countries from sharp increases in lending rates.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Currency Calculator