简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Argentina to Spend Over $880 Million to Prop Up State Airline

Abstract:SHARE THIS ARTICLE ShareTweetPostEmail Boeing Co. aircraft, operated by Aerolineas Argentina SA, st

Argentina may have to dole out at least $880 million in subsidies this year to keep its state airline afloat, further weighing on government finances after the nations ninth sovereign default.

Pablo Ceriani speaks during an interview at the companys headquarters at Aeroparque in Buenoes Aires, on May 18.

Photographer: Sarah Pabst/Bloomberg

“One of the conditions for profitability is demand, and that won‘t be normal until 2022,” Ceriani said from the airline’s headquarters in local airport Aeroparque Internacional Jorge Newbery. “We‘re planning to curb structural losses in a sustained way from then onwards. That’s the reasonable horizon in this situation.”

Like airlines worldwide, Aerolineas Argentinas‘s operations have been paralyzed by coronavirus fallout. Argentina implemented some of the earliest and harshest measures in Latin America to halt the spread of the virus, such as halting commercial flights until Sept. 1. But unlike the airline’s global peers, Aerolineas Argentinas is committed to weathering the crisis without any layoffs for its 12,000 employees, according to Ceriani.

“Its a policy aimed at keeping jobs,” he said. “Cutting incomes hurts workers already going through an economic crisis.”

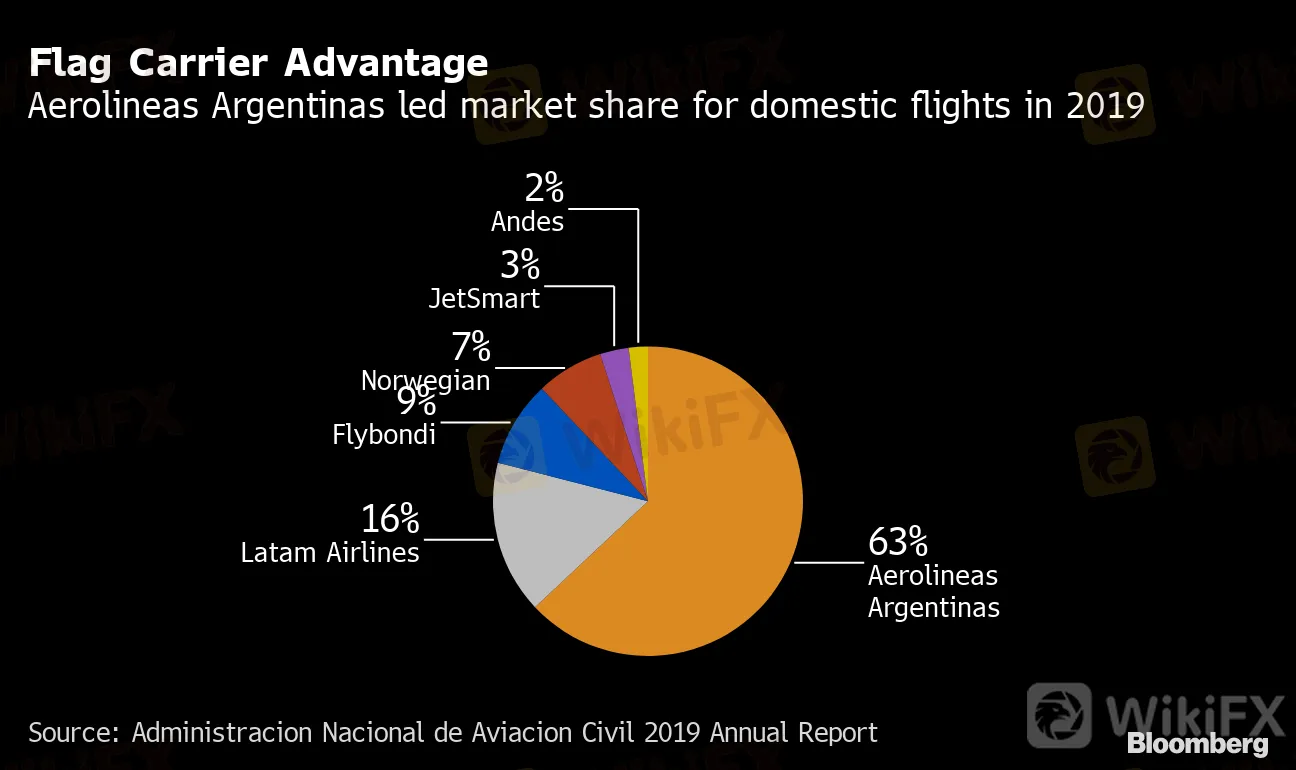

Flag Carrier Advantage

Aerolineas Argentinas led market share for domestic flights in 2019

Source: Administracion Nacional de Aviacion Civil 2019 Annual Report

Still, the company now plans to temporarily suspend about 7,500 workers in June and July, according to a person with direct knowledge of talks with labor representatives. Separately, the airline said on Sunday that it is in advanced negotiations to “reprogram” payments to Brazils Banco Nacional de Desarrollo Economico y Social (BNDES) and Banco de la Nacion Argentina.

Argentina‘s flagship carrier has depended on subsidies since being nationalized in 2008, but the gap has been exacerbated by a 50% plunge in the peso, plus a devastating recession and double-digit inflation. Airlines’ two biggest costs are fuel and planes, both of which are typically paid for in dollars. It has managed minimal savings during the pandemic, including on travel expenses.

Read More: Airline Default Risk Stalks Latin America at Twice World Average

Ceriani expects activity to start recovering in the second half of 2021 and to resume investing in growth after 2022, when it aims to boost its fleet, including by adding wide-body cargo planes that he aims will primarily fly to and from China and the U.S as part of a new focus on cargo shipping.

In the meantime, it will merge with sister airline Austral Lineas Aereas, a plan that added to the cargo shipping and a new maintenance unit, is estimated to allow $100 million in savings over three years. The carrier weighs blocking middle seats in all cabins as it strategizes for a safe return to operations, he said. Restoring flights to each of Argentina‘s provincial capitals would mean operating at 25% of usual activity in the domestic market. Foreign travel probably won’t start until after November, Ceriani said.

“This year will likely be the hardest in the history of Aerolineas Argentinas, just like it will probably be the worst year in the history of aviation,” he said.

— With assistance by Cyntia Aurora Barrera Diaz

(Adds workers suspension, talks with banks in sixth paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

WikiFX Review: Something You Need to Know About Markets4you

North Korean Hackers Steal $1.3bn in Cryptocurrency in 2024

Currency Calculator