简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

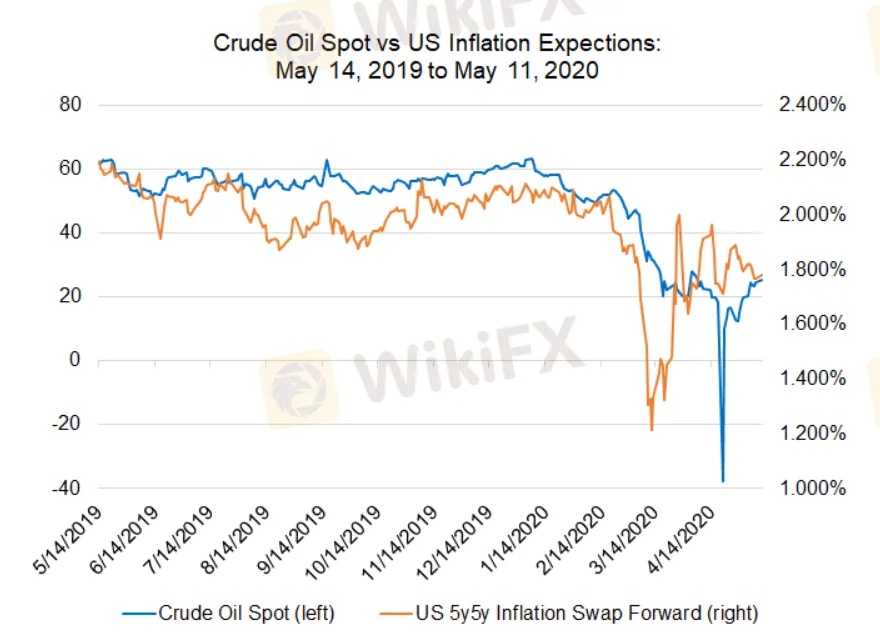

US Core CPI Experienced Historical Decline in April

Abstract:US overnight core CPI in April experienced the sharpest month-on-month decline in history, falling 0.8% after seasonal adjustment to a record low since November, 2008, while core CPI shrank 0.4% annually.

May 13th, from WikiFX news. US overnight core CPI in April experienced the sharpest month-on-month decline in history, falling 0.8% after seasonal adjustment to a record low since November, 2008, while core CPI shrank 0.4% annually.

Facing the recession caused by the pandemic, US Federal Reserve lowered benchmark interest rate to nearly zero on March 15th, while multiple Fed policymakers noted that the Fed will take all necessary measures to alleviate economic impact of the massive lockdown measures.

Fund managers and economists observe theres little chance the Fed will reduce rate to the negative range, as under negative rate, financial institutions must pay the central bank interest rate on excess reserves - the capital reserves held by the bank or financial institution in excess of what is required by regulators.

In that way, the central bank can push cash-holding institutions into increasing corporate and consumer loans.

The European Central Bank (ECB) introduced negative interest rates earlier in June, 2014, reducing the deposit interest rate to -0.1% to revive economy. The Bank of Japan (BOJ) implemented negative interest rates in January, 2016, mainly to prevent the yen ‘s unpopular appreciation from damaging the country’s export-dependent economy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator