简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PPP loans more common in states with existing bank relationships: Fed - Business Insider

Abstract:Virus hotspots including New York, Michigan, and Pennsylvania are receiving fewer PPP loan approvals than less-affected states, the economists wrote.

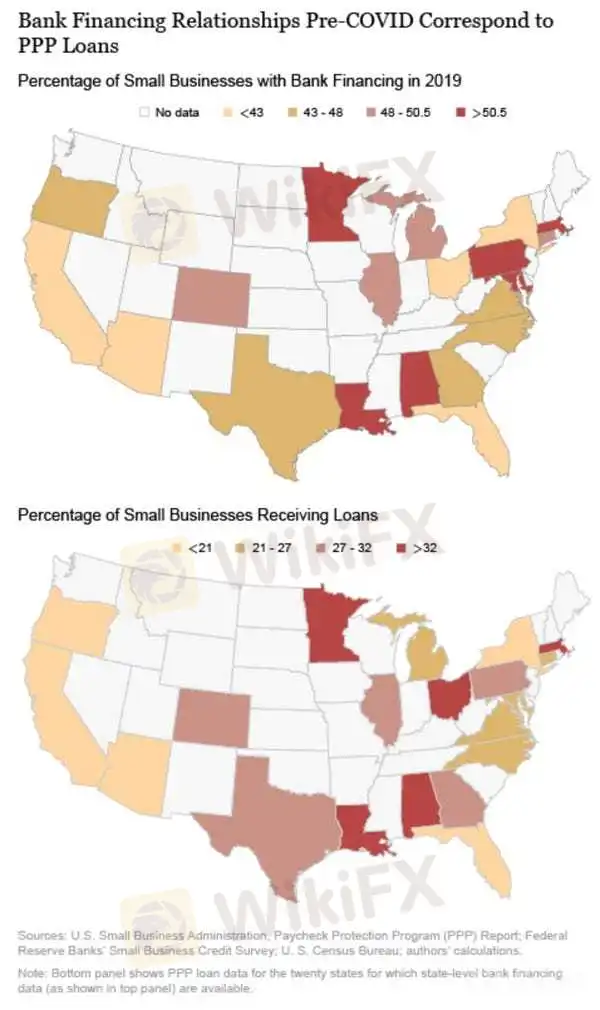

Paycheck Protection Program, or PPP, loan approvals are more concentrated in areas with existing small business-bank partnerships instead of regions hit hardest by the coronavirus, Federal Reserve Bank of New York economists wrote Wednesday. Virus hotspots including New York, New Jersey, Michigan, and Pennsylvania are receiving fewer PPP loan approvals per small business than less-affected states.The economists found “strong similarity” between states with high proportions of small business-bank financing relationships and PPP loan issuance.States with larger shares of community banks also issued a greater proportion of relief loans, the Fed found.Visit Business Insider's homepage for more stories.

Emergency loans issued by the Small Business Administration have been more concentrated in areas with pre-existing bank relationships than those most affected by the coronavirus pandemic, economists at the Federal Reserve Bank of New York said in a Wednesday blog post.Paycheck Protection Program, or PPP, loans were among the critical relief measures taken to keep the US from sliding into economic catastrophe. Eligible businesses first criticized the program's bumpy rollout and relatively small capacity, as the facility ran out of funds in less than two weeks.

Federal Reserve Bank of New York

PPP lending has since resumed, but the New York Fed's latest study suggests the emergency capital isn't being allocated efficiently. Some of the hardest-hit areas including New York, New Jersey, Michigan, and Pennsylvania are receiving fewer loans per small business than less-affected states in the Midwest and near the West Coast, the Fed found.Only about 20% of small businesses requesting PPP loans in New York have been approved, while more than 55% of eligible firms in Nebraska expect to receive emergency funding.

Loading

Something is loading.

Read more: These 22 well-known companies could get acquired as coronavirus batters their businesses, BTIG says

“The economic impact of COVID-19, both measured by the number of COVID-19 cases per capita and by the number of initial unemployment claims per capita, does not explain the geographical distribution of PPP loans,” economists Haoyang Liu and Desi Volker wrote.The team then tested whether existing financing agreements between small businesses and banks boosted the likelihood of PPP loan approval. Of the 20 states studied, those with the most small business bank financing also held the highest percentage of small firms receiving loans.The team also found that areas with a greater proportion of community banks to larger lenders were more effective in granting PPP loans. States including Wyoming, Iowa, and Kansas with nearly 50% of deposits in community banks saw a greater percentage of small businesses taking in PPP loans, the Fed said. States with less community-bank market share saw a significantly smaller proportion of small businesses approved for the funds.Read more: Award-winning fund manager Randall Dishmon says the way to win at investing is to think like a Warren Buffett-style acquirer. Here are the 3 questions he always asks before buying a stock.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fed Rate Cut Calls, Would NFP Tilt The Odds?

The latest data for the U.S. ISM Manufacturing PMI, released on August 1, 2024, shows a decline to 46.8, down from 48.5 in June. This marks the sixth consecutive month of contraction (a reading below 50) and remains well below the historical average of 52.88. On July, the Bank of Canada (BoC) announced a 25-basis-point cut in its benchmark interest rate, reducing it to 4.5%. This was the second consecutive rate cut, following a similar move in June. The latest ADP Nonfarm Employment Change for..

Fed Pressured: Will CPI Data Fuels Calls for Rate Cuts?

The U.S Producer Price Index (PPI) for June showed a month-over-month increase of 0.2%, which was slightly above market expectations of 0.1%. The Reserve Bank of New Zealand (RBNZ) recently kept its Official Cash Rate (OCR) unchanged at 5.50% during its last meeting on July 2024, which was consistent with market expectations. As of June 2024, the U.S. Consumer Price Index (CPI) showed a modest increase of 3.0% year-over-year, weaker than market expectation and previous reading of 3.1% and 3.3%..

Fed Rate Cut Locked In? All Eyes on PCE!

The latest S&P Global US Manufacturing PMI for June 2024 has been revised to 51.6, slightly lower than the expectation of 51.7 but up from 51.3 in May. In its most recent decision in June, the Bank of Canada (BoC) reduced its key interest rate by 25 basis points, lowering it from 5% to 4.75% in response to easing inflation indicators. In the first quarter of 2024, the US economy expanded at an annualized rate of 1.4%, slightly surpassing market expectations of 1.3%. This growth marked a...

Global Market Insights: Key Events and Economic Analysis Part 1

This week's major events include Powell's cautious outlook on rate cuts, TSMC's gains amid Samsung's strike, and Putin's diplomatic efforts. In China, the PBOC prepares bond interventions, while Korea's Hahn & Co. raises $3.4 billion. Deflationary pressures persist in China. US and European legal and regulatory changes impact market sentiment. Key data releases are NFIB Small Business Optimism, Core CPI, PPI, and Michigan Consumer Sentiment for the USA.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator