简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Eurozone Faces Grim Economic Situation

Abstract:Although European countries have taken measures to deal with the epidemic, the market outlook remains grim.

Although European countries have taken measures to deal with the epidemic, the market outlook remains grim.

The European Central Bank pledged to purchase more than 1 trillion euros of assets this year to alleviate the impact of the epidemic, and governments have proposed hundreds of billions of dollars in spending plans to support businesses and workers.Yet despite all these initiatives, Eurozone remains in a severe recession. A survey conducted on April 14-22 showed that the economy of Eurozone shrank by 3.1% in the first quarter and is projected to shrink 9.6% in the second quarter.

The industry believes that the European Central Bank's easing policy is not over, and it will have to start buying ETFs like the Bank of Japan. The European Central Bank's balance sheet indicates that the central banks debt level currently sits at about 5.3 trillion euros; while expected to reach 6.2 trillion euros by the end of 2020 and further expand to 6.7 trillion euros by the end of 2021.

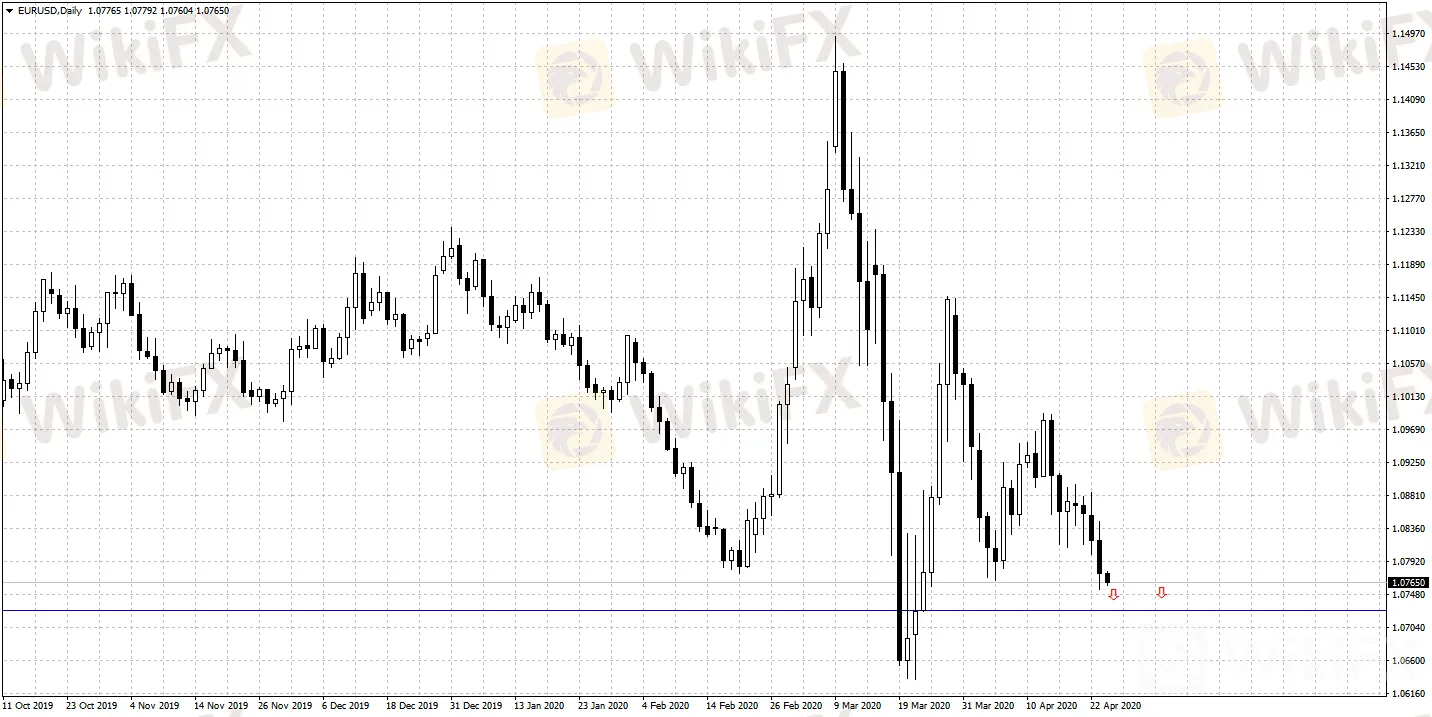

EUR/USD daily pivot points: 1.0785-1.0801

S1 1.0740 R1 1.0831

S2 1.0702 R2 1.0884

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

OFX: Is It Good to Go? Broker Review

Financial Educator “Spark Liang” Involved in an Investment Scam?!

Currency Calculator