简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USO Fund Faces Threats from Crude Short Speculators

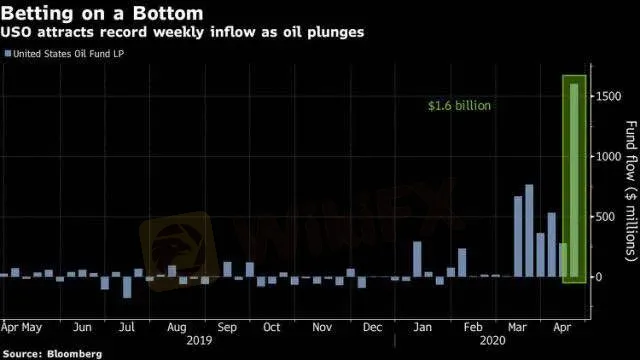

Abstract:The world’s largest crude oil ETF USO is being crushed by WTI short speculators who, by taking advantage of the US’ current storage capacity shortage, are forcing long position holders to give up all hope on oil price and surrender.

The world’s largest crude oil ETF USO is being crushed by WTI short speculators who, by taking advantage of the US’ current storage capacity shortage, are forcing long position holders to give up all hope on oil price and surrender.

As an ETF, USO is naturally one of the largest holders of near-term WTI futures contracts. On April 20th, short speculators’ maneuvers slashed WTI contracts for May delivery to the unprecedented -US$37.6, which blew up the accounts of massive investors.USO, meanwhile, didn’t suffer much loss as it has rolled most of its expiring contracts over to further-out months.

On April 21st, short speculators further turned to target contracts for June delivery which composed the largest proportion of USO’s current holdings. On the same day, WTI June contracts at New York Mercantile Exchange was down over 38% to US$13.12 in just one day.

USO swiftly reacted to the imminent threat by filing a new 8-k document to regulation authority that spelled out several major changes.The most significant one is that starting from April 21st, 2020, USO will further diversify its portfolio and deploy capital to a variety of investments, in order to cushion the impact of unusual market situations, such as contango, and avoid pooling too much capital in short-term contracts that may be easily targeted by speculators.

The document also shows that as of April 21st, 2020, USO has reduced investment in WTI and Intercontinental ICE June contracts to about 40%, and increased its investment in NYMEX and other intercontinental crude oil futures contracts to 55%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WTI Rebounds Sharply on Delayed OPEC+ Production Growth

WTI on Tuesday rebounded sharply 2% to the intraday high of $47.73.

WTI Extends Upsides on Slowed Production Growth of OPEC+

OPEC+ on Thursday agreed to slightly boost global oil output in January so as to slow down oil production growth.

WTI Rebounds amid Two Parties’ Possible Agreement

Recently, the Wall Street equity indices ended higher over 1% while the WTI closed above 1.53% as the two parties are expected to agree on a new round of fiscal stimulus bill.

WTI Finds Stability with Fed Turning Hawkish

On Thursday, WTI crude oil established a firmer footing above $39.0 and rallied again to an intraday high of $40.36 after suffering an overnight pullback.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator