Score

BOURSE DIRECT

France|5-10 years|

France|5-10 years| https://www.boursedirect.fr/fr/actualites

Website

Rating Index

Influence

Influence

AA

Influence index NO.1

France 9.52

France 9.52Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

France

FranceUsers who viewed BOURSE DIRECT also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

France

boursedirect.fr

Server Location

France

Most visited countries/areas

France

Website Domain Name

boursedirect.fr

Website

WHOIS.NIC.FR

Company

GANDI

Domain Effective Date

1997-12-30

Server IP

212.157.203.181

Company Summary

| BOURSE DIRECT Review Summary | |

| Registered Country/Region | France |

| Regulation | No Regulation |

| Market Instruments | Stocks, UCITS, Warrants, CFD, Forex |

| Demo Account | Unavailable |

| Trading Platforms | Web Platform, Mobile Platform |

| Minimum Deposit | €0 |

| Customer Support | Phone Number: +33 01 56 88 40 40 |

| Address: 374 rue Saint-Honoré, 75001 Paris | |

|

|

| Contact form (24/7 support) | |

What is BOURSE DIRECT?

BOURSE DIRECT is an unregulated brokerage firm based in France that offers access to a wide variety of trading instruments across different asset classes. These include stocks, UCITS, warrants, CFDs, and forex. The company provides fee-free accounts with no minimum deposit requirement, making it accessible to traders of all levels. It also offers convenient trading platforms via the web and mobile app, allowing traders to execute trades and monitor market movements from anywhere.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

No Minimum Deposit Requirement: Unlike some other brokerage firms that may require a minimum deposit to open an account, BOURSE DIRECT has no minimum deposit requirement. This makes it accessible to traders of all levels, including those with limited capital.

Fee-Free Accounts: BOURSE DIRECT does not charge any custody, subscription, or account maintenance fees. This means that traders can enjoy trading without worrying about incurring additional costs for holding or managing their accounts.

Multiple Customer Support Channels: BOURSE DIRECT provides various customer support channels including phone, email, address, social media, and contact form (24/7 support), enhancing accessibility and assistance for clients.

Cons:

No Regulation: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency. There are also reports of being unable to withdraw and scams, adding to the cons of the platform.

Unavailability of Demo Account: BOURSE DIRECT does not offer a demo account, which can be a disadvantage for new traders looking to practice trading strategies and familiarize themselves with the platform risk-free.

Is BOURSE DIRECT Safe or Scam?

BOURSE DIRECT's lack of valid regulation raises concerns regarding its safety and legitimacy. Regulatory oversight is essential to ensure adherence to established standards, protecting investors and clients from fraudulent activities and inadequate consumer protection measures. Without proper regulation, there is an increased risk of fraudulent activities, scams, and inadequate consumer protection.

Market Instruments

Stocks: BOURSE DIRECT provides access to a wide range of stocks, allowing investors to trade shares of publicly listed companies on various stock exchanges. This includes stocks from major global markets as well as regional exchanges.

UCITS (Undertakings for Collective Investment in Transferable Securities): BOURSE DIRECT offers UCITS, which are investment funds regulated at the European Union level, providing investors with opportunities to diversify their portfolios through professionally managed funds.

Warrants: Investors can trade warrants through BOURSE DIRECT, which are derivative financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price before a predetermined expiration date.

CFD (Contracts for Difference): BOURSE DIRECT allows trading of CFDs, which are derivative products that enable traders to speculate on the price movements of various financial instruments without owning the underlying asset. CFD trading provides opportunities to profit from both rising and falling markets.

Forex (Foreign Exchange): BOURSE DIRECT offers access to the forex market, where traders can buy and sell currency pairs. Forex trading involves the exchange of one currency for another at an agreed-upon price, allowing investors to capitalize on fluctuations in exchange rates between different currencies.

Accounts

BOURSE DIRECT provides various types of accounts with user-friendly features and benefits. Opening a stock exchange account is free of charge and can be conveniently completed online for securities, PEA (Plan d'Épargne en Actions), and PEA-PME accounts. For company and investment club accounts, an opening file needs to be filled out. Moreover, in case of an account transfer, Bourse Direct covers 100% of your costs, up to €200 per account.

All accounts offered by BOURSE DIRECT come with the following advantages:

No minimum deposit requirement.

No custody fee.

No subscription fee.

No account maintenance fee.

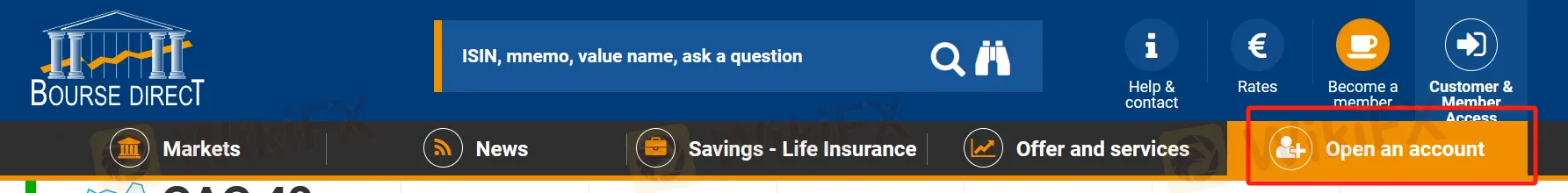

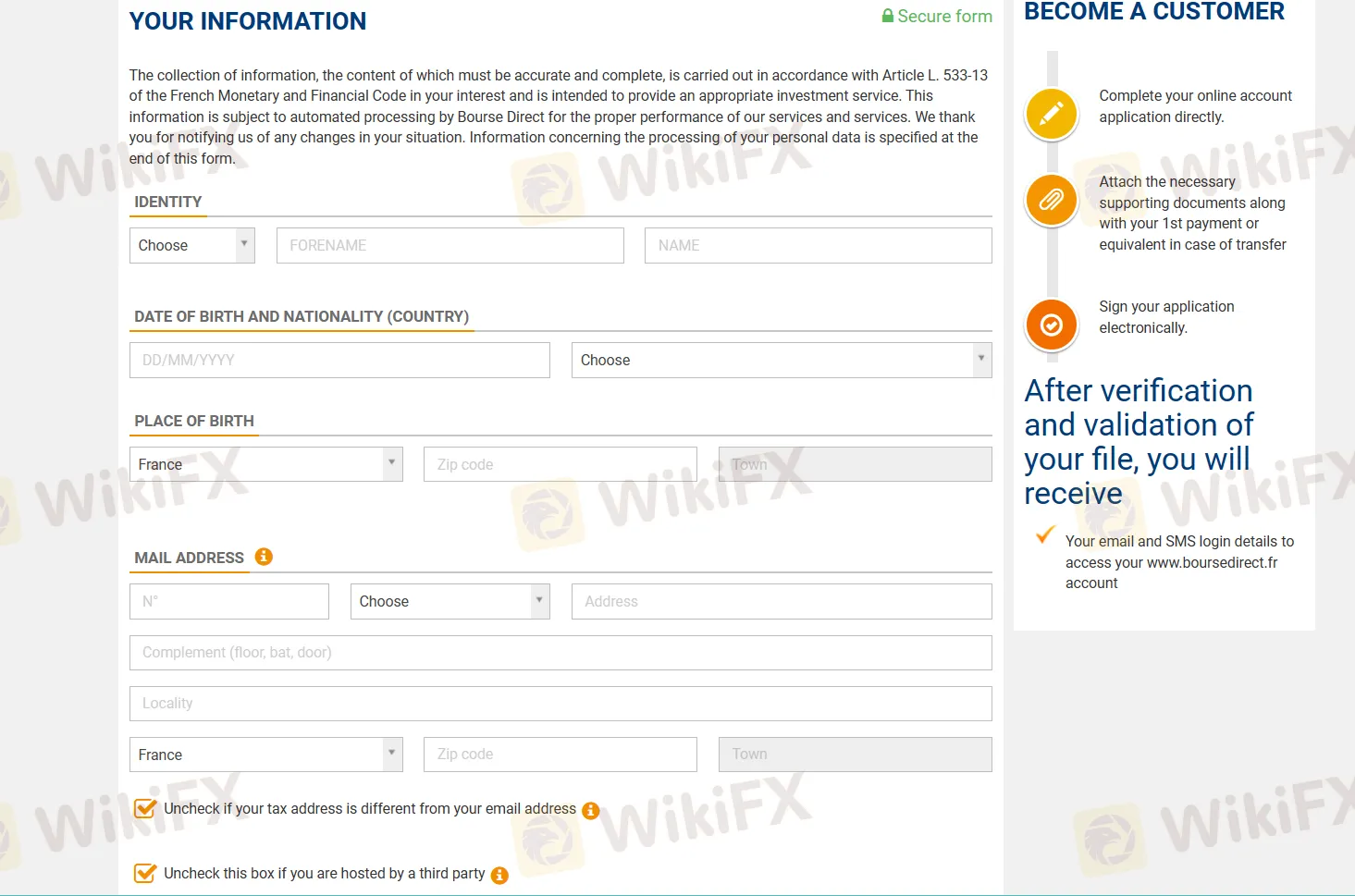

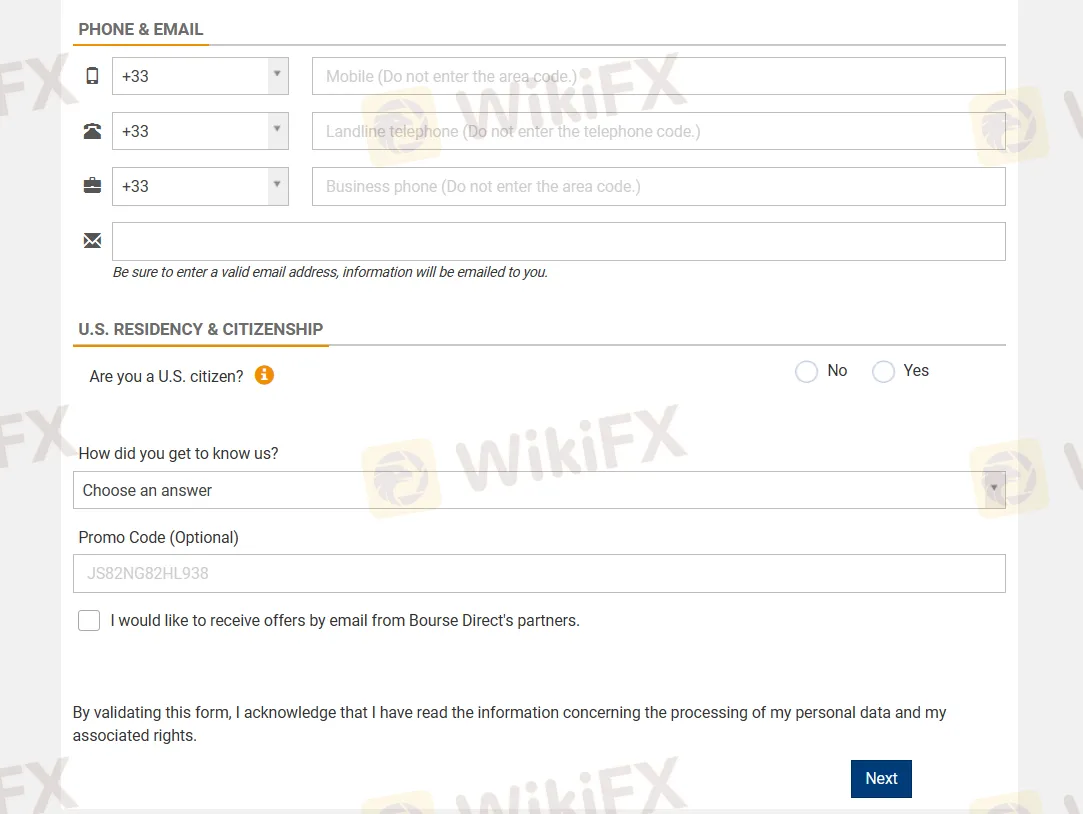

How to Open an Account?

Steps:

Click the button ''Open an account'' on the homepage.

Follow the on-screen instructions to input your information.

Click on the ''Next'' option to finalize the creation of your account.

An email will typically be sent to your registered email address to verify your account. Ensure to check your inbox and spam folders.

Click on the link received in the verification email to activate your account.

Trading Platforms

BOURSE DIRECT provides a seamless trading experience through its Web Platform and Mobile Platform (APP) for clients. You can easily access the trading platform by downloading the app from the Google Play Store for Android devices or the Apple App Store for iPhones and iPads. This ensures convenient access to your trading account anytime, anywhere, allowing you to stay connected to the markets and manage your investments on the go.

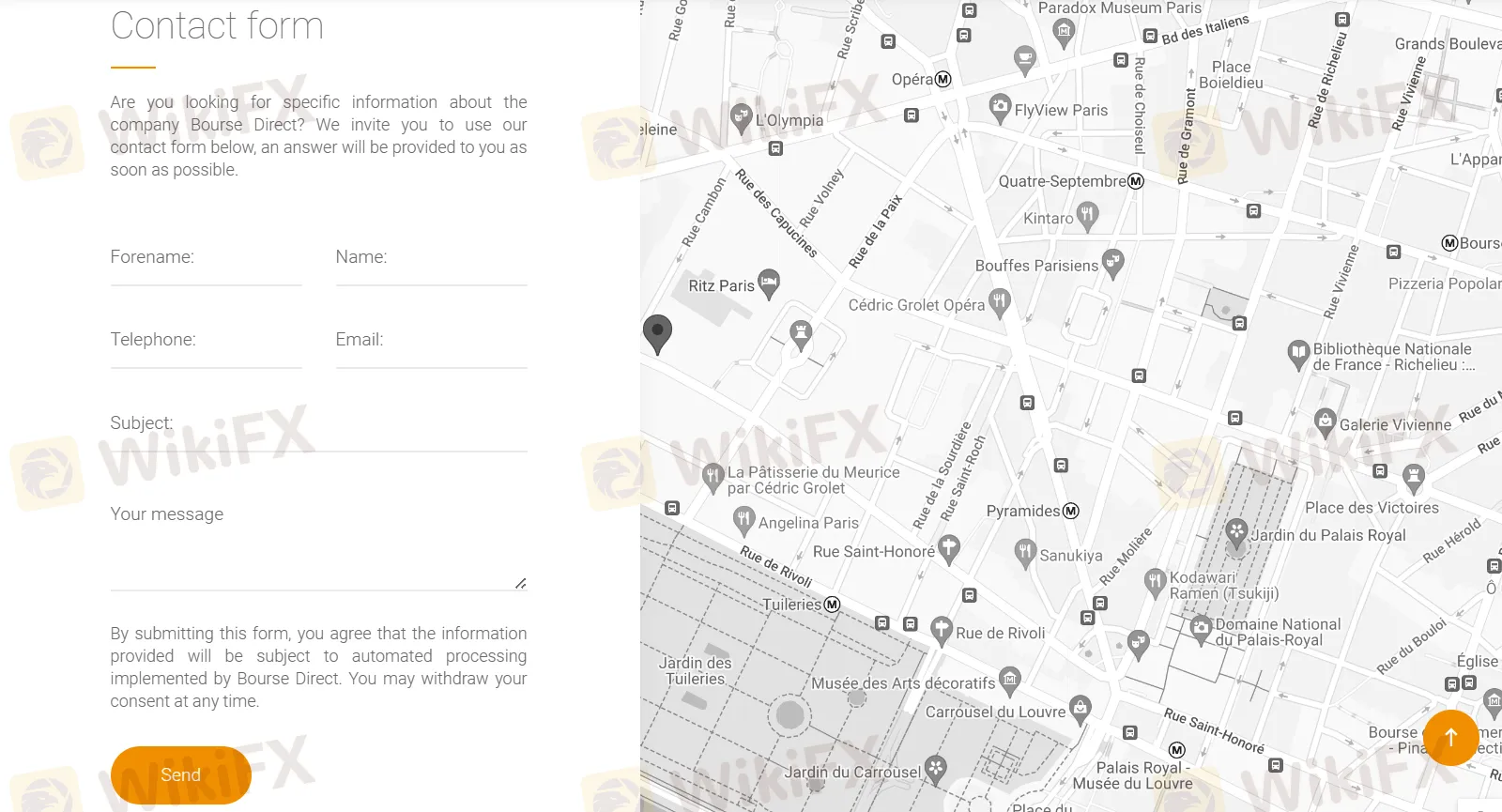

Customer Service

BOURSE DIRECT provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone Number: +33 01 56 88 40 40

Email:support@btmarkets.com;

Address: 374 rue Saint-Honoré, 75001 Paris

Social media:

Twitter: https://twitter.com/boursedirect

Facebook: https://www.facebook.com/Boursedirect

Instagram: https://www.instagram.com/boursedirect.fr/?hl=fr

YouTube: https://www.youtube.com/c/boursedirect

Linkedin: https://fr.linkedin.com/company/bourse-direct

Contact form (24/7 support)

Conclusion

In conclusion, BOURSE DIRECT offers an extensive range of trading instruments, various account types, multiple trading platforms, and multiple customer support channels, making it an advantageous platform for various investors with varying investment styles and goals. However, the lack of valid regulation raises significant concerns about the safety and trustworthiness of the platform.

Frequently Asked Questions (FAQs)

| Q 1: | Is BOURSE DIRECT regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does BOURSE DIRECT offer demo accounts? |

| A 2: | No. |

| Q 3: | What is the minimum deposit for BOURSE DIRECT? |

| A 3: | There is no minimum deposit requirement. |

| Q 4: | What trading platforms does BOURSE DIRECT provide? |

| A 4: | It provides a web platform and a mobile platform (APP) for traders. The mobile app is available for both Android and iOS devices. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Global Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now