简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Saudi Go Bottom-Fishing in Buying Oil Stocks

Abstract:Saudi’s National Sovereign Wealth Fund, the Public Investment Fund (PIF), reportedly purchased US$ 1 billion shares of major European oil companies in a bottom-fishing attempt.

Saudis National Sovereign Wealth Fund, the Public Investment Fund (PIF), reportedly purchased US$ 1 billion shares of major European oil companies in a bottom-fishing attempt.

According to reliable sources, PIF has purchased shares of Equinor ASA, Royal Dutch Shell PLC, Total SA and Eni SpA on the open market in recent weeks. The fund bought about US$200 million of Equinor shares, while the specific amount purchase for the other three companies have not yet been announced.

The idea of bottom-fishing in oil market has gain wider appeal after this years oil price war and the consequent heavy slump of crude.

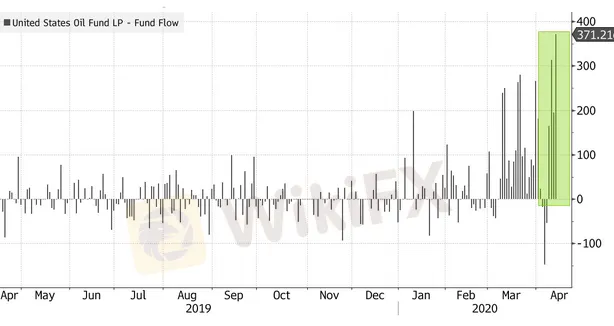

As OPEC + production reduction agreement was finally signed, markets bullish sentiment over oil market has more or less recovered. In the past month, crude oil net holdings in several of the world's largest actively managed ETFs targeting crude oil have altogether grown by more than 400%, which is a sign of capital inflows.

On Tuesday, investors increased their holdings of the United States Oil Fund LPs stock by US$371 million to the highest level since 2008.

However, so far most of the bullish bets are still losing money, and WTI fell to its lowest level since 2002 on Wednesday. However, in the long run, with the implementation of the OPEC + production cut and the adaptations of US, oil market is expected to regain balance fundamentally.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator