简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Chase Q1 earnings reflect crisis preparation - Business Insider - Business Insider

Abstract:Chase has reported earnings for Q1 2020, and its results are already beginning to show the profound effects of the ongoing coronavirus crisis.

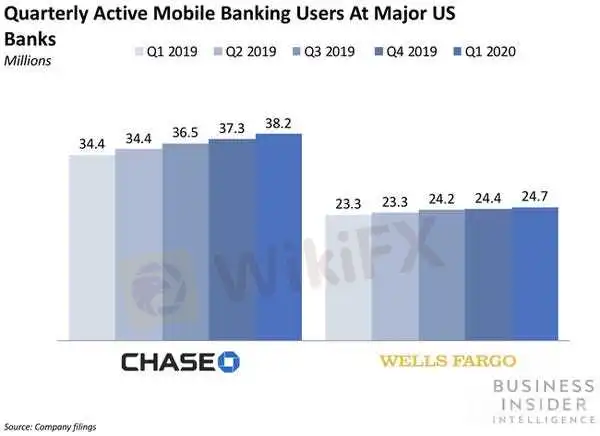

This story was delivered to Business Insider Intelligence Banking Briefing subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Stay up-to-date with our latest coverage on the impacts of coronavirus on technology, marketing, and the digital economy here.Chase has reported earnings for Q1 2020, and its results are already beginning to show the profound effects of the ongoing coronavirus crisis. The bank's net income of $2.9 billion was down a staggering 69% year-over-year (YoY) from $9.2 billion in Q1 2019, and profits in its consumer unit dove 95% YoY from $4 billion in Q1 2019 to $191 million in Q1 2020, per The Wall Street Journal. On a more positive note, the bank saw its mobile active customers grow 11% YoY to 38.2 million, a rate similar to the 12% YoY growth it saw in Q4 2019.

Business Insider Intelligence

The bank's income was largely affected by an increase in credit costs as Chase builds up its reserve in preparation for the effects of the coronavirus on clients. The pandemic hit the US economy hardest only at the very end of Q1, but Chase's credit costs in the period still totaled $8.3 billion, comprising $1.5 billion in charge-offs and a whopping $6.8 billion in buildup to its credit reserves.The latter is being set aside because the bank is preparing for the effects of a recession and the accompanying possible losses on loans made to consumers and companies working to weather the coronavirus crisis, per the Journal. And the bank may not stop there, saying it might set aside even more of its profits in the future to cover loan losses if its dire expectations for Q2 prove true, such as a catastrophic expected unemployment rate of 20% (twice as high as the 10% peak rate during the 2007-2009 financial crisis, per Newsweek).While Chase is clearly bracing for serious loan losses, its customer-focused approach to the coronavirus could yield it favor with clients in exchange. Even though losses from lending will be damaging to Chase's bottom line, it is taking care to put helping customers first, noting in its earnings presentation that it is waiving and refunding some fees, not reporting payment deferrals to credit bureaus, and continuing to extend credit to qualified consumers and businesses to help them weather the storm.These measures to continue helping customers through the crisis even in the face of major losses could help the bank curry favor with clients and give it a human touch despite its monolithic size.Want to read more stories like this one? Here's how to get access:Business Insider Intelligence analyzes the banking industry and provides in-depth analyst reports, proprietary forecasts, customizable charts, and more. /> /> Check if your company has BII Enterprise membership access.Sign up for the Banking Briefing, Business Insider Intelligence's expert email newsletter tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator