简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stock market crash: Goldman warns crisis valuations 'still too high' - Business Insider

Abstract:Goldman expects a bigger collapse in corporate profits than the rest of Wall Street is forecasting due to the coronavirus pandemic.

The market turmoil caused by the coronavirus has featured historic single-day sell-offs and rallies. On balance, global stock levels are “still too high” according to Peter Oppenheimer, the chief global equity strategist of Goldman Sachs. He listed collapsing corporate earnings and uncertainty about the timing of the economy's recovery as some of the reasons for his view.Click here for more BI Prime stories.

Bear markets often feature days when investors buck the trend and send stocks flying higher.This downturn caused by the coronavirus pandemic has been no different; in fact, the superlatives have been historic in both directions. US stocks plunged by the most since 1987 on March 16. Then on March 24, they staged their biggest one-day gain since 1933.The rollercoaster reflects uncertainties about the end date of social-distancing restrictions and the economy's subsequent recovery when business activity comes back to life. Markets are juggling dire news about the coronavirus with massive government stimulus that could dampen the recession.But it is premature to conclude that the worst of the market sell-off has occurred, according to Peter Oppenheimer, the chief global equity strategist and head of European macro research at Goldman Sachs.“Despite the scale of the policy support, which we agree is a necessary condition for markets to rebound, we think it is too early and the level and valuation of equity markets still too high,” Oppenheimer said in a recent note.

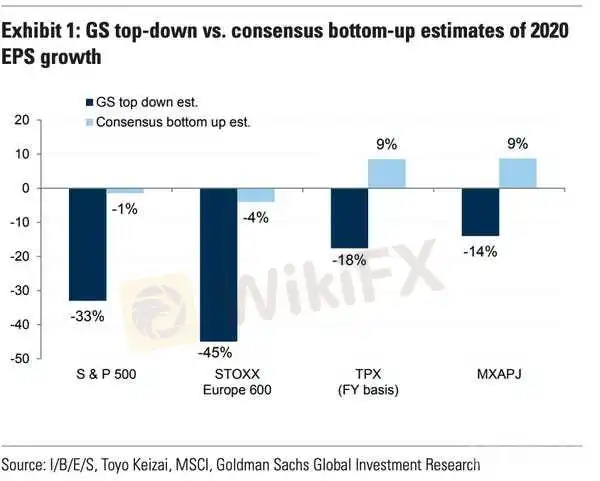

His three reasons for this view are listed below:1. Current stock prices do not reflect the scale of potential earnings declines. Company earnings constitute the single-biggest driver of stock-market returns in the long run. And investors have rightly dumped stocks over the last few weeks because they know that company profits are shrinking. Even Goldman recently cut its full-year S&P 500 earnings-per-share forecast to $110, representing a 33% decline from 2019.However, consensus forecasts for EPS growth around the world are still higher than what the investment bank expects. The chart below shows why Oppenheimer says stocks are still too expensive.

Goldman Sachs

2. Many valuation metrics are not near crisis-level lows.

Important data on jobs and unemployment have suddenly reached or surpassed levels that were seen during recent economic crises. But many gauges of stock-market valuation are not near any of these milestones. Oppenheimer flagged the European price-to-earnings ratio as an example. It hit a low of 7 times forward 12-month earnings during the Great Recession. As of last week, it was near 12 times.

Goldman Sachs

3. The timing of any economic recovery is unclear. Goldman Sachs economists are assuming that the number of new infections will peak within the next couple of months and the recovery will start in May or June. Morgan Stanley economists have a similar forecast.

However, Oppenheimer says this view may be too optimistic. He also notes that the spikes in unemployment may slow the recovery. 4. Bear-market rallies are very commonLook no further than the Great Recession, the tech bubble, and the 1980s recession for evidence that market downturns always include big advances that are followed by deeper losses.Oppenheimer cited two reasons why investors frequently jump the gun: policy measures kick in, and longer-term growth expectations for growth improve even if things are still ugly in the short term. Bond investors also tend to take these optimistic cues and sell, leading to a rise in yields. “That said, we found that in general our activity indicators are still falling during these rallies and often still fall in the months after they finish — in other words, they are not associated with near-term growth improvement,” Oppenheimer concluded.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

February 23, 2024- US Stocks Hit Record Highs, Tech Sector Fuels Rally

Nvidia Soars, European Markets Gain, and Key Forex Trends

Market Resurgence: Stocks Rally, Cryptos Surge, and Forex Fluctuations - February 15, 2024 Update

Key Insights into Today's Market Dynamics and Profitable Trading Strategies

EBC Research Institute Hotspot Analysis | China Unleashes Major Moves, Stock Market Brews a Violent Reversal

The Chinese government has taken measures to boost the stock market, yet the market still faces challenges, and investors should proceed with caution.

Market Wrap: Stocks, Bonds, Commodities

U.S. Stocks Rebound, Yen Surges on BoJ Policy Hints

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator