简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trump Urged the Fed to Cut Rate, Signaling a Global Wave of Rate Slash

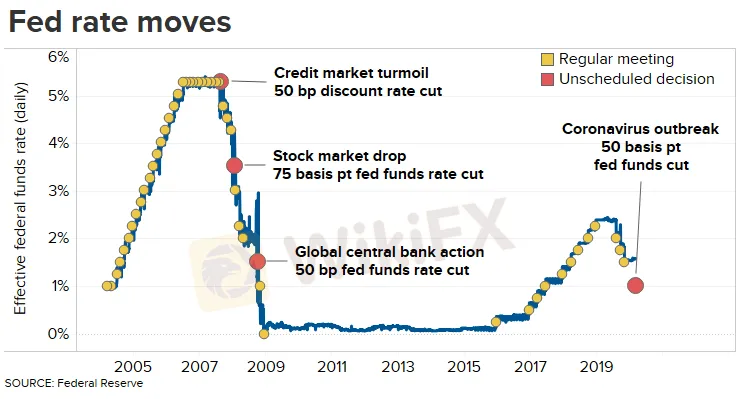

Abstract:As the coronavirus spreads across the world, the US Federal Reserve announced an emergency rate cut on Tuesday, lowering the target range of Fed’s fund rate by 50bp to 1-1.5%. It is the first time that Federal Reserve have cut rate over 25bp since 2008, in order to tackle the impact of the coronavirus pandemic on economy.

As the coronavirus spreads across the world, the US Federal Reserve announced an emergency rate cut on Tuesday, lowering the target range of Feds fund rate by 50bp to 1-1.5%. It is the first time that Federal Reserve have cut rate over 25bp since 2008, in order to tackle the impact of the coronavirus pandemic on economy.

Data: Federal Reserve

Federal Reserves Chairman Jerome Powell said during the press conference after the policy decision meeting that the Fed understands the risks facing US economy and decides to take actions.

Feds Chairman Jerome Powell

The Fed acted much faster than expected, and it has been the sharpest rate cut since the financial crisis 2008, but the move wasn‘t much of a surprise. Before the Fed’s announcement, Reserve Bank of Australia already cut interest rate to a historical low of 0.25% and became the first among global central banks to slash rates for saving economy from the shock of coronavirus pandemic. Next, Central Bank of Malaysia also announced a 25bp rate cut. President Trump quickly responded to the news and urged the Federal Reserve to cut rate in his mid-night Twitter post.

Trump called for the Fed to lower rate on Twitter

The Fed‘s emergency rate slash marked a start of a rate cut wave by global central banks. On March 4th , local time, Saudi Arabian Monetary Authority and Central Bank of the UAE both cut rates by 50bp; Monetary Authorities in Hong Kong and Macau also announced on the 4th they’ll reduce benchmark interest rate. Meanwhile, Bank of Korea‘s Chairman noted that the Fed’s emergency rate cut will be taken into account in future decision-mak ing. Investors also expect Bank of Canada, Bank of England and European Central Bank to lower rates this month.

Hong Kong Monetary Authority lowered the benchmark interest rate

Conclusion:

On the fast-changing forex market, many factors such as national economic policy changes, inflation or political factors can directly affect fluctuation of forex rates. On WikiFX App, You can easily check the latest forex updates and market trends for free.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator