简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

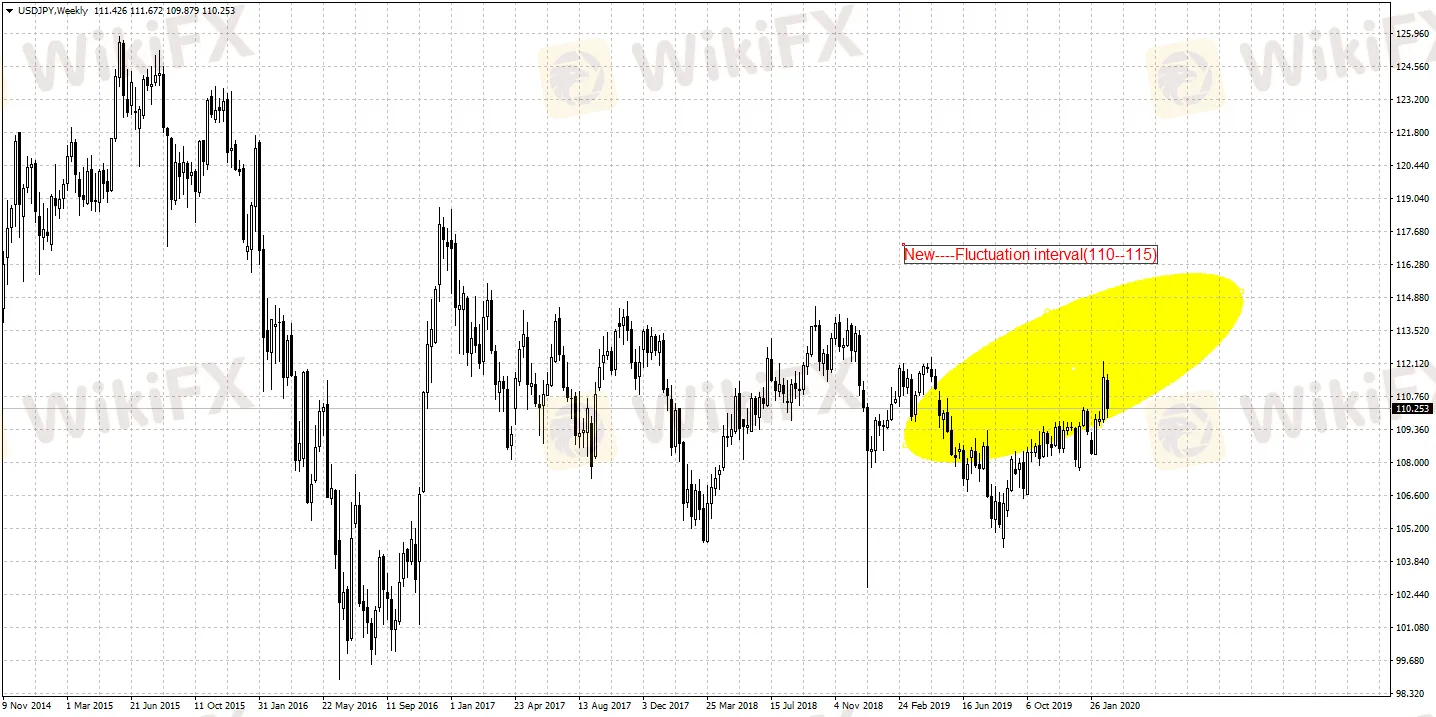

JPY Will Jitter at Low Level Due to Pandemic

Abstract:Japan’s economy is facing new risks due to the spreading new coronavirus. The yen may drop towards a relatively low range between 110 and 115, threatening to weaken its status as a safe haven.

Japans economy is facing new risks due to the spreading new coronavirus. The yen may drop towards a relatively low range between 110 and 115, threatening to weaken its status as a safe haven.

Bank of Japan‘s board pointed out that shrinking confidence of automotive and retail businesses could affect outlook of capital expenditure, while exports are unlikely to see significant rally. The outbreak may dampen private sector consumption in Japan and further harm household confidence if the situation doesn’t improve. BOJ professionals noted that strengthening the promise of monetary policy easing is among the few effective ways to boost inflation prospect.

Due to the impact of typhoon and consumer tax hike, Japan‘s GDP in Q4 shrank an annualized 6.3% and could face the first technical recession since the third quarter of 2012. It is estimated that Japan’s growth may come to a standstill after the summer Olympic in Tokyo.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator