简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Divergence of Britain and EU Is Weighing Down on Euro

Abstract:When it comes to the future of European capital market after Brexit, Britain and the European Union had not seen great disputes as they did over other issues. But the situation is changing now.

When it comes to the future of European capital market after Brexit, Britain and the European Union had not seen great disputes as they did over other issues. But the situation is changing now.

British Chancellor Sajid Javid and EUs chief negotiator Michel Barnier have engaged in a fierce debate, while people are expecting concrete progress of the negotiation by June this year, which is drawing near. The focus of this debate centers on the agreement known as “equivalence” that will allow British businesses to enjoy access to European single market even after Brexit, a policy that underpins the future relation between the two parties in the financial sector.

The Bank of England has also joined the debate in which Britain and EU have come to a deadlock.

Andrew Bailey, BoE‘s new governor implied on Wednesday that Britain may part ways with European Union in several key areas of regulation, while Barnier said there won’t be such an equivalence as sought by the British side. However the issue will be solved, a less efficient European capital market will hurt everyone.

Economy of the Eurozone is already fragile, with the official interest rate kept in negative rage. On the other hand, financial industry and the relevant services account for 8% of the countrys economy, and nearly 11 pounds out of every 100 pounds of revenue come from the financial sector.

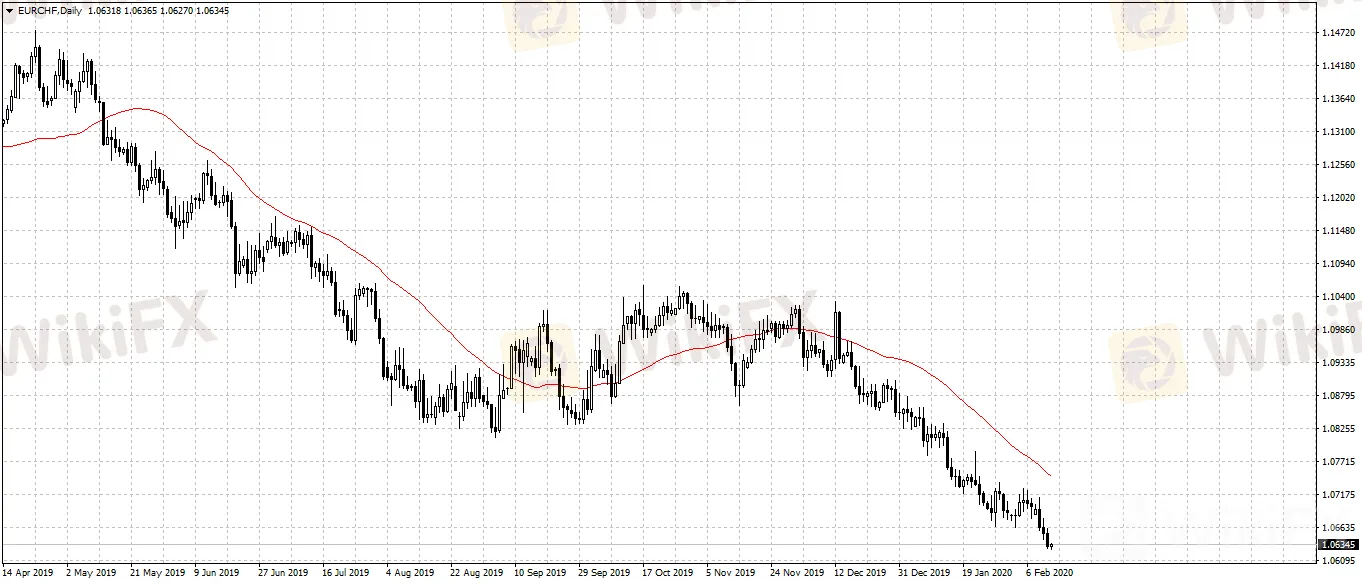

The series of events have affected the euro‘s trend on the forex market. Sellout and stop-loss in trend-following funds have driven euro’s rate against US dollar to the lowest since May, 2017, while euro against Swiss franc also dropped to the lowest since 2016.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Euro Overview

Euro Jumps to 1-Month High as ECB's Lagarde Fails to Calm Rate Hike Bets.

Euro Technical Analysis: EUR/USD, EUR/JPY Eyeing Push to Higher Highs

Euro Technical Analysis: EUR/USD, EUR/JPY Eyeing Push to Higher Highs

Opposition to EU's Budget Increases Euro's Downside Risk

Recently, EUR/USD grew to as high as 1.1869 amid the rising risk sentiment fueled by the progress in new vaccine and the signing of the Regional Comprehensive Economic Partnership (RCEP) Agreement.

EU’s Recovery Fund Will Affect Euro’s Trend

Germany and France jointly proposed on the 18th to establish an European Union recovery fund to offer financial aids to members struck by the economic fallout of the pandemic.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator