简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Market Trend in Correction Amid Raging COVID-19

Abstract:On January 30th, 2020, local time World Health Organization Director General Dr Tedros Adhanom Ghebreyesus held press conference in Geneva and announced the Novel Coronavirus(COVID-19) outbreak to be an public health emergency of international concern(PHEIC). The economic cost of this raging epidemic is growing in China as well as other parts of the world.

On January 30th, 2020, local time World Health Organization Director General Dr Tedros Adhanom Ghebreyesus held press conference in Geneva and announced the Novel Coronavirus(COVID-19) outbreak to be an public health emergency of international concern(PHEIC). The economic cost of this raging epidemic is growing in China as well as other parts of the world.

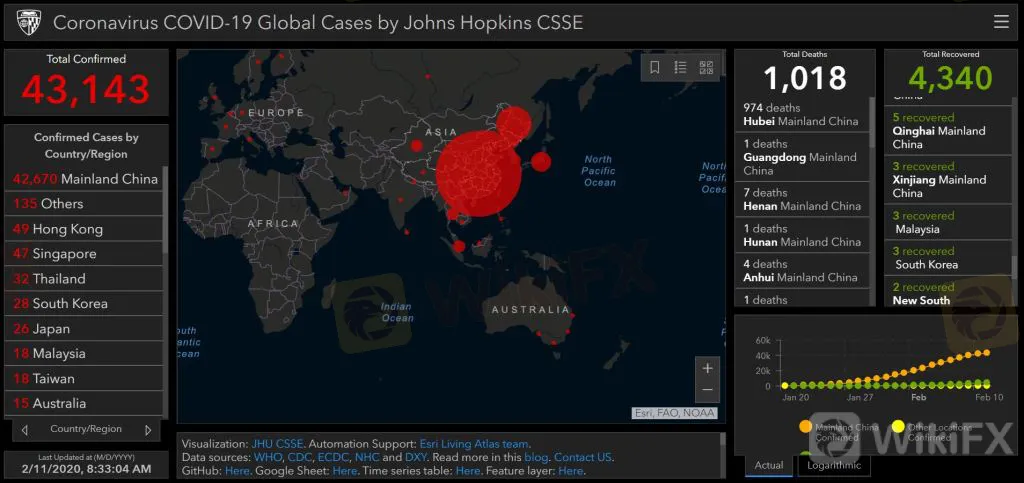

Global distribution of COVID-19 cases on February 11th

2020 has started with the “black swan” of COVID-19 outbreak, and the fast spreading virus further stirred up concerns of global investors, bringing people's concern about how the epidemic will affect global forex market.

Frank Cholly, Senior Market Strategist from RJO Futures, mentioned that were seeing market sentiment of risk-aversion. Worrying about the impact of this outbreak on global economy, pessimistic investors are selling RMB assets and turning to safe-havens such as gold, Japanese yen and Swiss Franc.

Meanwhile, an IMF senior official observed during an interview with CGTV that “it may be too early to decide the real impact of the epidemic on major global economies”. IMF believes that China has the resources and resolution needed to tackle the COVID-19 outbreak.

Also, according to Goldman Sachs, their estimation on the impact of COVID-19 outbreak suggests the rate of newly infected cases will peak in the first quarter, pulling the global economic growth down by 0.1%-0.2%.

Jeffrey Siu, the Chief Operating Officer of Forex company ATFX, also noted that the company‘s business hasn’t seen substantial changes so far since the coronavirus outbreak.He outlined on behalf of the company during an interview with Finance Magnates that “We have not seen any material changes in the number of new clients signing up for our services across the world.”

How will the trend of RMB change amid the raging epidemic, and how should investors adjust their strategies accordingly? Stay tuned as WikiFX analysts bring you more comprehensive insights.

Click the link below to download WikiFX App and check out the latest forex updates

https://www.wikifx.com/cn_en/

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Designer handbags from Chanel will now cost more as it hikes prices - Business Insider

French luxury house Chanel is raising prices across the globe on its iconic handbags and some small leather goods.

Why stock market is higher despite unemployment, coronavirus job loss - Business Insider

Investors think that, even though the unemployment numbers look bad, the US economy has hit bottom already and will get better from here

Why airlines don't refund customers after canceled flights - Business Insider

Expecting a refund to appear automatically after a flight cancellation? It's not that easy with most airlines as they lose millions each day.

10 major news events you may have missed this past week - Business Insider

The coronavirus pandemic has been dominating headlines for months. Here are 10 major world events that you may have missed out on in the past week.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator