简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Pound Plunges into a Seesaw Battle

Abstract:Recently the pound plunges into a seesaw battle, with increasingly improved economic data and people’s concern that the terms about future relationship between the pound and the EU would harm the British’s prospect.

Recently the pound plunges into a seesaw battle, with increasingly improved economic data and people‘s concern that the terms about future relationship between the pound and the EU would harm the British’s prospect.

The pound‘s rebound trend in 2020 could be hindered by the BOE(Bank of England)’s forced stimulus measures in Economy.

Now GBP/USD hovers below 1.30, close to the lowest level this year. However, GBP/USD has limited downside, as the exchange rate is undervalued according to the level implied by the actual two-year swap spread between GBP and USD. If GBP/USD can support at 1.2800, the markets upside would be back again.

According to CFTCs latest report, speculative net longs of pound decreased by 7,233 to 17,689 contracts. Meanwhile, speculative longs reduced by 2,369 to 61,887 contracts, while speculative shorts increased by 4,864 to 44,198 contracts.

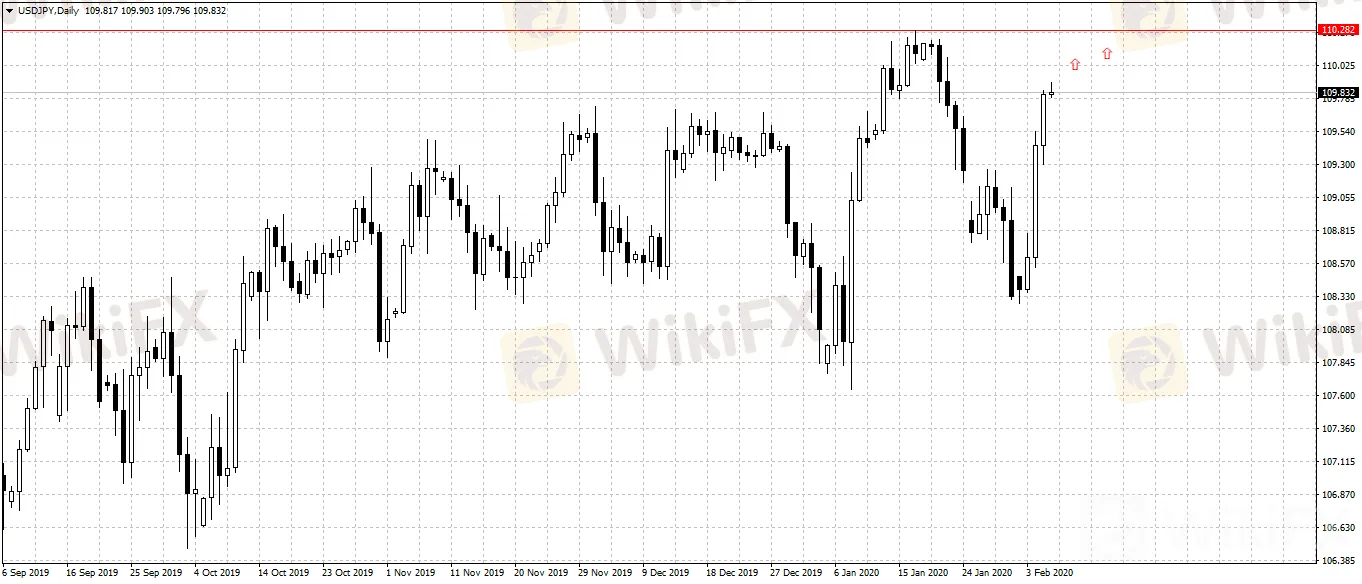

GBP/USD Daily Pivot Points: 1.2940-1.2960

S1: 1.2900 R1: 1.2980

S2: 1.2880 R2: 1.3020

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator