简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Next stock market crash: Shrinking profit growth spells doom for rally - Business Insider

Abstract:Stock market investors are confronting an "incredible valuation problem" that can stop the rally in its tracks, according to SocGen's quant experts.

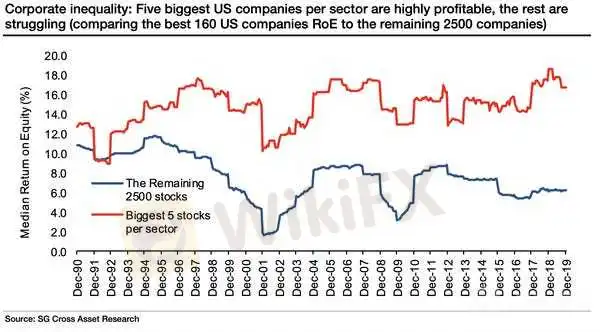

The gap in profitability between the largest and smallest public companies is at its widest in at least 30 years, according to Andrew Lapthorne, Societe Generale's quant chief. In a recent note, he explained why this gap is part of a bigger “valuation problem” for investors, and shared his recommendation for avoiding its fallout.Click here for more BI Prime stories. The stock market's ongoing rally is still missing a good amount of its most important ingredient: earnings growth.Investors are willing to pay ever-increasing prices for stocks despite the decline in profits growth over the past year. This so-called multiple expansion has subsequently lifted various gauges of the market's valuation to unnerving levels.Investors have an “incredible valuation problem,” Andrew Lapthorne, the head of quantitative equity research at Societe Generale, said in a recent note.He quantified the problem as follows: price-to-earnings ratios for stocks with the greatest expectations for earnings growth have reached levels only seen during eight months of a three-decade span.Additionally, a composite of 34 valuation metrics compiled by RBC Capital Markets broke through its highest level of this bull market late last year.While valuations on their own do not determine the stock market's direction, the underlying deterioration in profit growth is where the risks of a pullback lie. One way Lapthorne unearths what is happening is by stacking the profitability of the largest companies (by sales) in each sector against their smallest counterparts. He found that the gap, which he refers to as corporate inequality, is at its widest since at least 1990.

Societe Generale

More evidence of a profit crunchIn addition to Lapthorne's observation above, two plain vanilla measures of profitability — EBIT growth and margins — show a deteriorating trend.First, earnings before interest and taxes grew at a slower pace last year for the nearly 90% of US market capitalization captured by the S&P 1500.

Societe Generale

“The high percentage of loss-mak ing firms in the US is impacting these numbers, but still seeing so many loss-mak ing firms at the top of the cycle is a risk,” Lapthorne said. He continued: “And lower down the capitalization band, profits are falling fast even once loss-mak ing firms are excluded.” And secondly, profit margins are under pressure due to a combination of higher costs and slower sales growth.Sales growth for non-financial companies has fallen from around 10% at its peak about a year ago to roughly 4% now, Lapthorne pointed out. These are trends that the private-equity giant KKR also flagged in a recent outlook note.“From what we can observe, there are still too many companies with high fixed costs and less marginal revenue dollar per purchase that are being funded,” KKR's Henry McVey said in relation to profitless companies.He further opined that investors will be more wary of these companies in 2020, particularly in the venture capital realm.But even in the public market, there's the nagging question of how much longer investors will continue bidding up prices in the absence of an earnings growth rebound. “Either sales growth must pick up or costs need to be cut to avoid negative profits growth in 2020, and given the rise in equity prices a profits growth recovery is very much priced in,” Lapthorne said.He added: “If Q4 reporting fails to deliver a better profit growth outcome, equities could struggle.”If the trend in profits does not improve, investors are likely to punish small-cap under performers more than their large-cap peers — consistent with the wide corporate inequality gap. Lapthorne therefore recommends buying the strongest small-cap companies on offer. He flagged the MSCI USA Select Strong Balance Sheet Index as a hunting ground for these names, and noted that the index has outperformed the Russell 2000 over time.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

February 23, 2024- US Stocks Hit Record Highs, Tech Sector Fuels Rally

Nvidia Soars, European Markets Gain, and Key Forex Trends

Market Resurgence: Stocks Rally, Cryptos Surge, and Forex Fluctuations - February 15, 2024 Update

Key Insights into Today's Market Dynamics and Profitable Trading Strategies

EBC Research Institute Hotspot Analysis | China Unleashes Major Moves, Stock Market Brews a Violent Reversal

The Chinese government has taken measures to boost the stock market, yet the market still faces challenges, and investors should proceed with caution.

Market Wrap: Stocks, Bonds, Commodities

U.S. Stocks Rebound, Yen Surges on BoJ Policy Hints

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator