简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Nine in ten UK consumers struggle with financial literacy - Business Insider

Abstract:Nine in ten UK consumers feel they are undereducated in terms of personal finance – and fintechs should step up efforts to enhance financial clarity.

This story was delivered to Insider Intelligence Fintech Pro subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Nine out of ten consumers in the UK feel that they are undereducated in terms of personal finance, according to a new survey commissioned by Israel-based Bank Leumi's challenger brand Pepper and cited by Finextra.

Business Insider Intelligence

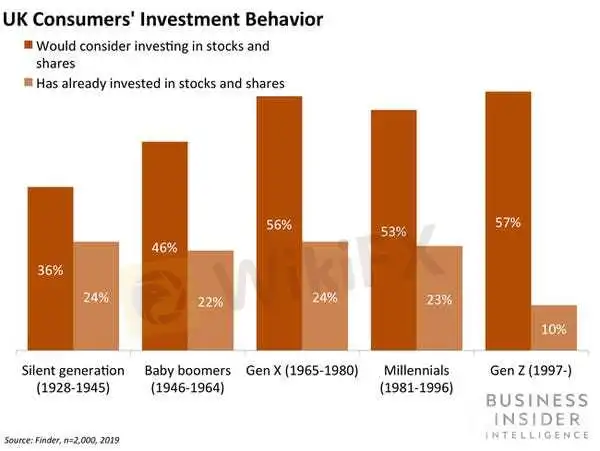

Additionally, nearly half (47%) of respondents said that they think it's their bank's job to help them make better financial decisions, while 24% say they have been misled by banks' financial advice. The survey also found that 72% of consumers currently don't invest in stocks and shares or investment funds, with nearly one-fifth stating that they don't know how to.Fintechs have been busy trying to make financial services more transparent and help consumers better understand their options — but a knowledge gap remains.Some startups in the space are betting on educational features to win over users. For example, US-based commission-free trading platform Robinhood, which recently received its broker authorization from the UK's Financial Conduct Authority (FCA), bought media company MarketSnacks last year to offer its users financial newsletters and news podcasts to help them better understand finance. And UK-based competitor eToro offers educational functions via its platform to help users better understand the investment space.Others focus their whole business models on helping consumers make better financial decisions. Fintechs like UK-based personal finance management (PFM) platforms Cleo and Plum aim to help consumers keep track of their everyday spending and provide them with suggestions on where they can save money. With such services, fintechs are hoping to stand out from conventional financial services companies that aren't as focused on improving consumers' financial literacy.While these efforts can help consumers make better financial decisions, awareness for such apps is still low. Consumers using a budgeting function are able to significantly reduce their spending, per Marcel Lukas, researcher and assistant professor of finance at Edinburgh's Heriot-Watt University. However, these functions are still not being used by the majority of consumers: Cleo, for example had 2 million users across the UK and US as of October 2019, while Plum had just 400,000 as of May 2019.To truly help increase financial literacy, fintechs need to build awareness, but the role of regulators in this matter shouldn't be underestimated. Fintechs looking to help consumers make better financial decisions should focus on marketing their products in order to raise consumers' awareness of them.One way to do so would be to make their educational PFM products available via the platforms of legacy players. Regulators should also take an interest in consumers' financial literacy and ensure that financial services are presented in a transparent manner via regulations that make it easier for consumers to understand different products.The FCA recently took a step in this direction by introducing rules to crack down on unarranged overdrafts — banks made over £2.4 billion ($3.2 billion) in overdraft fees in 2017 alone — but more needs to be done in terms of regulations. Regulators should especially look to ensure that companies present consumers with a complete overview of their options for financial services, including those offered by competitors, such as when it comes to savings accounts and credit cards.Want to read more stories like this one? Here's how to get access: Sign up for Fintech Pro, Insider Intelligence's expert product suite tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedJoin thousands of top companies worldwide who trust Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator