简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

THB exchange rate reached a 6-year high in Asia

Abstract:Thai Baht has strong performance against US Dollar in forex market, reaching a highest level of 1:30.315 since June 2013. This year THB/USD exchange rate has increased by 7%, becoming the best performer in Asia.

Thai Baht has strong performance against US Dollar in forex market, reaching a highest level of 1:30.315 since June 2013. This year THB/USD exchange rate has increased by 7%, becoming the best performer in Asia.

Compared with South-Korean Won and Chinese Yuan heavily influenced by the Sino-US trade war, the uptrend of strong Thai Baht is expected to continue due to two reasons: firstly, Thai Baht is the preferred safe-haven currency in Asia. and it was not influenced heavily during the tense period of Sino-US trade war. Among the eight major currencies in Asia, Baht is the second currency least affected by Chinese Yuan; secondly, Thailand has stable society and economy.

With the Thai government‘s ongoing efforts in recent years to introduce advanced technologies, issue favorable polices, step-up urban planing and boost tourism, the country has seen its cities thrive and economy soars, while the number of tourists totaled 38 million in 2018. Thailand’s Treasury Department estimates the country to achieve a 4.2%-4.3% annual growth, with 5% growth in exports, indicating that the country is steadily becoming a major economy of Southeast Asia. The International Monetary Fund (IMF) has ranked Thailand as the ASEAN economy with the second-largest GDP, right after the Champion Indonesia and followed by Malaysia.

From 2017 to 2018, the number of tourists coming to Thailand increased by 7.54% to nearly 40 million. Besides being a global tourist attraction, the country is also becoming a great investment destination for foreign investors.

As China deepens the Belt and Road Initiative, Thailand actively responds by launching the “Eastern Economic Corridor (EEC)” strategic project, which holds tremendous promise for the country‘s development. Paiboon Nalinthrangkurn, Chairman of the Federation of Thai Capital Market Organizations, notes that the EEC project as well as Thailand’s upcoming election will benefit the countrys economy overall, and with an influx of foreign capital, the Baht is expected to rise over a relatively long period.

Thailand‘s Minister of Finance Uttama Savanayana recently said the central bank will make sure the Baht’s trend is in line with the countrys fundamental economic indicators, as the currency continues to rise against US dollar. The central bank kept the benchmark interest rate unchanged in September after cutting it by 1.5% in August.

The surge of the Baht has been quite a headache for Thailands economy recently. The government has released financial stimulus worth of US$ 10 billion in order to stabilize the economy against the rising Baht.

The Bank of Thailand thinks that the country‘s economy is becoming more sensitive to Baht’s appreciation in the context of weakening export-related sectors, like manufacturing and service industry, as this can post even greater stress on domestic demand. The central banks committee notes the need to closely observe the exchange rate, capital flow and the possible implication on economy, saying that further approaches may be taken when necessary.

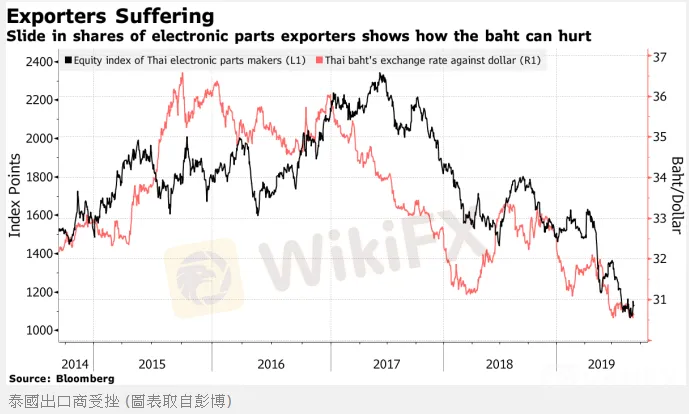

If the Baht continues to go up, it‘s going to post serious challenges to Thailand’s tourism, which is crucial for the country‘s economic growth. Thailand’s growth in the last quarter slowed down to 2.3%, partly due to the recession in the travel industry. Exports of electronic components has also been hit by the Bahts surge, as SET Index of electronic components has been down by 23% year to date.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Watch out! PlatformsFx Robbed Me of US$76,878

A few months ago, a person from the trading solution provider company “PlatformsFx” contacted the victim for forex trading. According to the victim, the scammer and his so-called well-known gold trading platform took US$76,878 from her and put it into a presumably real forex account.

How to choose the best leverage level

Archimendes said: “Give me a fulcrum, I can lift the whole earth”. This is the earliest appearance of the concept of leverage. The word leverage dates from 1724 and was originally used to describe the action of a lever. By 1824, by which time the Industrial Revolution was fully underway, the scope of the word had expanded to include the power of a lever and therefore the obtaining of a mechanical advantage. It is simple to say that if you want to invest $10,000 in the forex market, you can to it by leverage with small investment. Leverage is a financial tool, which can magnify the result of your investment, including gain or loss at a fixed ratio.

Oil Prices Hit Fresh High on Uncertain Outlook

WikiFX News (6 Aug) - WTI crude oil embraced a steep rise in prices, up 4.5% to the high level of $43.68, compared to its low level of $41.76. It has recorded a fresh five-month high since March 6. Nevertheless, the outlook of oil remains uncertain because of the insufficient upward momentum in future oil prices resulted from the sluggish job growth in the United States.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Quadcode Markets: Trustworthy or Risky?

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator