简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Braces for ECB and Draghi, US Dollar Eyes CPI Data

Abstract:Global traders will be in for a turbulent day as the ECB prepares to announce its rate decision which may inspire market-wide volatility. This may be amplified by US CPI data.

US Dollar, ECB, Euro – TALKING POINTS

Markets brace for ECB rate decision: will Draghi cool or amplify rate cut bets?

US CPI data may enlarge excessive easing bets if report falls short of forecasts

Fed has reiterated it is using a data-dependent approach. Will markets learn?

Learn how to use political-risk analysis in your trading strategy!

Markets will have a perilous day as the ECB prepares to announce its much-awaited rate decision and whether it will reintroduce unorthodox easing measures. Soon-to-be replaced central bank President Mario Draghi will be holding his last press briefing as head of the European Central Bank. Will he be able to meet the markets lofty expectations and tell them he will do “whatever it takes”, or will he crush easing bets and send traders flailing?

ECB and Draghi: Whatever it Takes, or Just Simply Whatever?

Eurozone inflation has been under pressure amid regional geopolitical shocks against the backdrop of a slowing global economy plagued by the US-China trade war. These factors have pressured price growth and prompted the ECB to shift from considering raising rates to now not only cutting but also possibly reintroducing its quantitative easing program after just having weaned markets off of it in December.

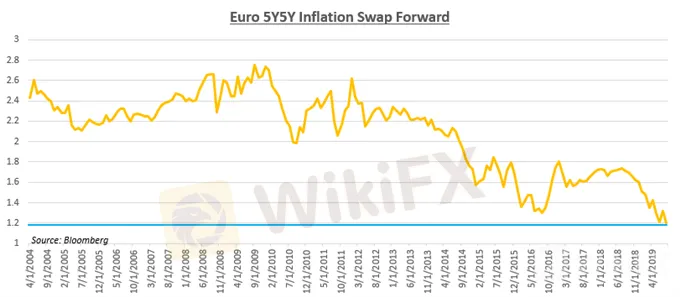

Looking at a monthly chart, the 5Y5Y Euro inflation forward swap is currently at its lowest level ever, hovering at around 1.206. Inflationary prospects are clearly not looking good and deteriorating fundamentals are not inspiring capital inflow into the Euro. German bunds are hovering in negative territory, and the global market for negative-yielding bonds continues to swell beyond $14 trillion as traders anticipate rate cuts ahead.

US CPI Data: Underwhelming Reading May Bloat Unrealistic Easing Expectations

Markets will be closely watching the publication of US CPI data, likely with built-in hopes that the report will underwhelm and provide even more impetus for the Fed to implement accommodative monetary policy. It might also then amplify the market‘s swollen rate cut bets, potentially setting equity markets up for failure when the Fed fails to meet the market’s aggressive expectations.

Such has been the pattern for most of 2019, most notably was during the July FOMC meeting where despite delivering a 25 basis-point cut, the US Dollar rose at the expense of equities. Chairman Jerome Powell cooled market expectations by reiterating his position that the Fed is data-dependent and will adjust policy in accordance to the prevailing economic circumstances that fall under the purview of its mandate.

Chart of the Day: European Inflation is not Looking Too Hot

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator