简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD Breaks Down to Flash Crash Lows on Brexit Showdown

Abstract:GBP/USD Breaks Down to Flash Crash Lows on Brexit Showdown

GBP/USD Analysis and Talking Points

GBP/USD Breaks 1.20 Handle

Snap Election Provides Additional Uncertainty

GBP Implied Volatility Surging

GBP/USD Breaks 1.20 Handle

GBP/USD is once again under pressure as the Brexit showdown between Tory rebels and the government highlights the current constitutional crisis that is weighing on the currency. The pair made a break below the psychological 1.20 handle, hitting a low of 1.1959, which marks the lowest level since the October 2016 Sterling flash crash. Focus today will be on the debate surrounding the Brexit delay bill (looks to delay Brexit till January 31st, 2020), whereby Prime Minister Johnson has threatened to call a general election by October 10th if passed. As a reminder, under the Fixed Term Parliaments Act, for an election to take place, 2/3 of MPs must support this.

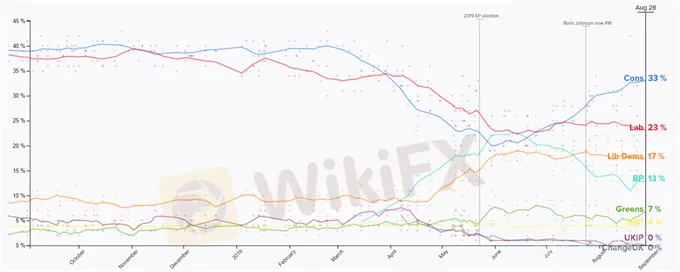

UK Election Opinion Polling

Source: Politico

Snap Election Provides Additional Uncertainty

As it stands, according to opinion polling, the Conservative Party are comfortably ahead of its opposition parties at 33% with Labour at 23%. As such, a snap election in the Autumn is not only going to increase the political uncertainty but also raise the risk of a more pro-Brexit government, which in turn keeps risks firmly titled to the downside for GBP.

GBP Implied Volatility Surging

As the risk of a snap election looms, implied volatility has been on the rise with the 1-week tenor at the highest level since April, while 2-month expiries are nearing the levels seen at the 2016 Brexit referendum as investors continue to price in the risk premium attached to a no-deal Brexit. With that said, Sterling is expected to remain the largest source of volatility across the G10 FX space. Elsewhere, with speculative shorts hovering near extreme levels, there is of course a possibility for a sharp snapback higher, provided the risk of a no-deal Brexit eases slightly. However, as has typically been the case, a sharp move higher tends to provide opportunities to fade.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

All Eye on Today’s NFP

The UK general election 2024 was held on Thursday, and while the results are yet to be finalized, the Labour Party is poised to win a majority, ending the Conservatives' 14-year rule. The UK's equity market index, FTSE 100, edged higher in the last session, while the Pound Sterling remained steady. The Labour Party is expected to focus more on fiscal policy and economic development through expanding the country's sovereign debt, which may strengthen the Pound Sterling.

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator