简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Japanese Yen Strength May Continue, But Will the BoJ Intervene?

Abstract:Japanese Yen strength may fuel speculation that the Bank of Japan could intervene. Amid slowing global growth, a cheaper Yen may do little to support exports while risking trade tensions.

USD/JPY, Bank of Japan, FX intervention - Talking Points

Japanese Yen strength may be fueling speculation of BOJ intervention

However, a weaker Yen may do little for trade amid slowing growth

Currency intervention also risks igniting tensions with Washington

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. Wed love to have you along.

In March 2018, we saw USD/JPY fall through 105.00 as the anti-risk Japanese Yen strengthened alongside a drop in the benchmark Nikkei 225 stock index. This was accompanied by concerns from the Bank of Japan (BOJ) about the impact of a stronger Yen on corporate profits, perhaps fueling speculation of intervention. USD/JPY then rose until October when it topped just under 115. This was also accompanied with a pickup in equities.

Lately, JPY has been facing a similar scenario, falling through 106 after the Nikkei 225 topped in April. While the BOJ could mention the risks of a stronger Yen again, intervention may not be on the table for a couple of reasons. The first is the potentially limited impact on the economy.

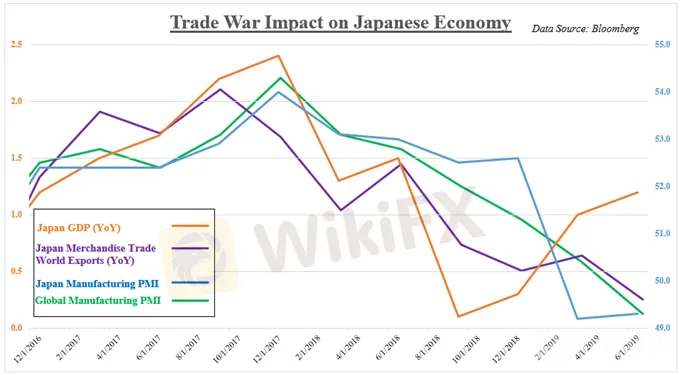

While Japanese economic growth has seen a cautious improvement since last year (1.2% y/y in Q2 2019), it is still far off from the 2.4% rate seen in Q4 2017. Around that time, Japans merchandise trade exports with the rest of the world began tapering off as local manufacturing PMI followed the trend of a global slowdown (see chart below).

If the anti-risk Yen were to fall in value artificially, this would not address the primary fundamental backdrop weighing against global trading activity that is also plaguing Japan. The CPB‘s Merchandise World Trade Volume Index peaked in October 2018 at 127.2, falling to 123.2 in June which was the lowest since October 2017. In other words, if demand isn’t there, a slightly cheaper JPY probably wont do much to boost exports.

The second issue that may deter the Bank of Japan from intervention is the political risk that the country could be labeled a currency manipulator by the United States. This risks bringing a cloud of uncertainty over the principals of a trade agreement the nation reached with the US at Augusts G7 Summit in France.

This is with the Bank of Japan having already deployed its full armament of stimulus. With negative interest rates and quantitative easing in effect, the central bank has fewer options left in their arsenal to boost inflation should price growth deteriorate ahead. Given the risk of escalating trade tensions with the worlds largest economy, for a potentially negligible boost to export competitiveness, Japan may defer on Yen intervention.

Learn how to trade political risk here

Japanese Yen Trading Resources

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

The week ahead: The Dollar keeps dictating the markets

USD/JPY reverses lower as risk appetite weighs on US yields, bounces at key 112.50 support

USD/JPY fell back to weekly lows in the 112.50 region on Friday though has since bounced as volumes fade. The pair reversed from as high as the 113.50s as risk appetite deteriorated and drove long-term US yields lower.

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

USD/JPY Aims Higher After Japan’s Core CPI Falls Short of Expectations

Japanese Yen largely unchanged on October consumer price index data. Oil trims losses, but traders remain laser-focused on potential inventory releases. USD/JPY rides trendline support higher as gains remain intact for the week.

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Malaysia Pioneers Zakat Payments with Cryptocurrencies

Currency Calculator