简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Outlook: AUD/USD & AUD/JPY Eye RBA Meeting

Abstract:The September RBA meeting is now 1-week away which sets AUDUSD and AUDJPY back in the spotlight. Where might the Australian Dollar head next?

AUSTRALIAN DOLLAR PRICE SET TO SWING AHEAD OF SEPTEMBER RBA MEETING

AUDUSD and AUDJPY remain bogged down by broad-based risk aversion in light of lingering trade war uncertainty and elevated recession fears

The Australian Dollar will likely gyrate within its August trading range as forex traders await the September RBA meeting a week away

Sharpen your skills as a forex trader with this free educational guide on Building Confidence in Trading

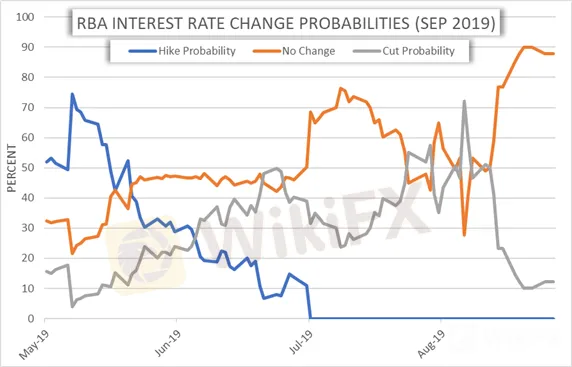

RESERVE BANK OF AUSTRALIA INTEREST RATE CUT PROBABILITY (SEPTEMBER 2019)

That said, overnight swaps are currently pricing an 87.8% probability that the RBA leaves rates unchanged at the central banks next interest rate decision but placing the odds of another RBA rate cut by year-end at 88.0%. A surprise RBA interest rate cut stands to send the Australian Dollar plunging, but this scenario is not likely considering recent commentary from RBA Governor Lowe who hinted at the limitations of monetary policy at the Jackson Hole Economic Symposium last weekend.

AUSTRALIAN DOLLAR 25D RISK REVERSALS (1-WEEK)

Nevertheless, the currency markets bias remains tilted to the downside judging by the 1-week risk reversal metrics for AUDUSD and AUDJPY. Yet, the recent influx of market risk appetite following the supposed trade war de-escalation could be contributing to the marginal bump in Australian Dollar risk reversals measures.

AUDUSD PRICE CHART: DAILY TIME FRAME (APRIL 01, 2019 TO AUGUST 27, 2019)

Spot AUDUSD is expected to trade between 0.6691-0.6815 with a 68% statistical probability as calculated using the currency pair‘s 1-week implied volatility reading of 7.82%. The 1-standard deviation option implied trading range just so happens to measure up closely with spot AUDUSD’s year-to-date low and 23.6% Fibonacci retracement of its April swing high, which reiterates the major confluence levels as technical support and resistance. We have previously highlighted resistance posed by the 0.6800 handle in our most recent AUDUSD price outlook where we stated that the Australian Dollar could be primed for a breakdown – a view we still hold which may materialize on dovish commentary revealed during the September RBA meeting.

AUDJPY PRICE CHART: DAILY TIME FRAME (APRIL 01, 2019 TO AUGUST 27, 2019)

Judging by AUDJPYs 1-week implied volatility reading of 12.56%, the currency pair is estimated to trade between 70.343-72.443 with a 68% statistical probability. The technical backdrop of AUDJPY is quite similar to that of AUDUSD. Spot AUDJPY has also struggled due to major technical resistance around the 72.000 handle which has served as a major headwind for Australian Dollar bulls.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

Japanese Yen Technical Analysis: USD/JPY, AUD/JPY. Are They Establishing Ranges?

JAPANESE YEN, USD/JPY, AUD/JPY - TALKING POINTS

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

US Dollar Holds Gains as Japan Boosts and China PMI Weighs. USD Volatility Ahead?

US DOLLAR, JAPAN ELECTION, USD/JPY, CHINA PMI, AUD/USD - TALKING POINTS

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator