简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Rate Reverses Ahead of Monthly-Low Following Fed Symposium

Abstract:EURUSD reverses course following the Fed Economic Symposium, with the failed attempt to test the August-low (1.1027) raising the scope for a larger rebound.

EUR/USD Rate Talking Points

EURUSD retraces the decline from earlier this month even as Federal Reserve officials tame speculation for a rate easing cycle, and the exchange rate may continue to consolidate over the remainder of the month amid the failed attempt to test the August-low (1.1027).

EURUSD Rate Reverses Ahead of Monthly-Low Following Fed Symposium

EURUSD catches a bid following the Fed Economic Symposium in Jackson Hole, Wyoming even though Chairman Jerome Powellwarns monetary policy “cannot provide a settled rulebook for international trade.”

The comments suggest the Federal Open Market Committee (FOMC) is in no rush to implement lower interest rates, and it remains to be seen if the central bank will reverse the four rate hikes from 2018 as the US economy shows little indications of an imminent recession.

In fact, recent remarks from Kansas City Fed President Esther George, a 2019-voting member on the FOMC, indicate that the central bank will revert back to a wait-and-see approach as the policymaker insist that “were in a good place as long as the consumer can continue to pull the economy forward.”

In turn, Fed officials may closely watch the fresh updates to the Durable Goods Orders report as demand for large-ticket items is expected to increase 1.2% in July after expanding 1.0% the month prior.

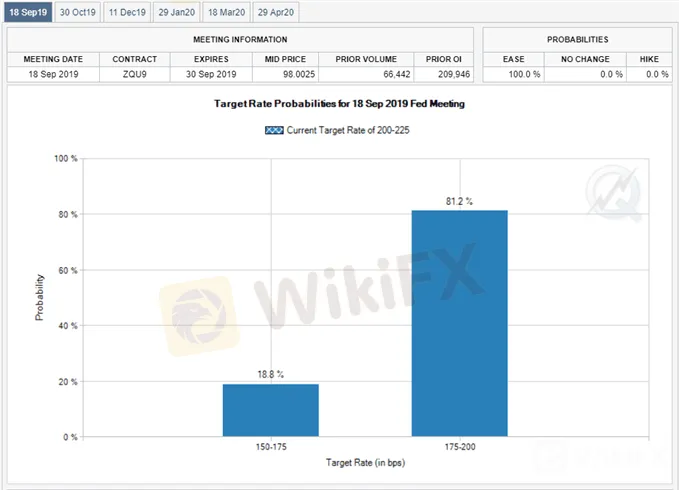

A positive development may encourage the FOMC to buy more time after delivering a rate cut in July, but signs of a slowing economy may produce headwinds for the US Dollar as Fed Fund futures now reflect expectations for at least a 25bp reduction on September 18.

As a result, the FOMC may have little choice but to insulate the economy from the shift in trade policy, and the central bank may continue to adjust the forward guidance as Fed officials are slated to update the Summary of Economic Projections (SEP) in September.

With that said, the monthly opening range sits on the radar for EURUSD, and recent price action raises the risk for a larger rebound in the exchange rate amid the failed attempt to test the August-low (1.1027).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

Source: Trading View

The broader outlook for EURUSD is clouded with mixed signals as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

Will keep a close eye on the Relative Strength Index (RSI) as the oscillator comes up against trendline support, with a break of the bearish structure raising the risk a larger rebound in EURUSD.

The failed attempt to test the August-low (1.1027) has pushed EURUSD back above the 1.1140 (78.6% expansion) pivot, with the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) now on the radar.

Next area of interest comes in around 1.1270 (50% expansion) to 1.1290 (61.8% expansion) followed by the 1.1340 (38.2% expansion) region.

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator